Stock Market Forecast and Outlook for March 2008

Stock-Markets / US Stock Markets Mar 07, 2008 - 12:43 AM GMTBy: Hans_Wagner

If you want to beat the market, you need to invest with the trend. In looking at the trend, I believe it is best to begin with the big picture in mind and then work our way down to weekly and then daily views of the charts. You will notice that the chart and the value of the indicators change as we move from a monthly to a weekly and then a daily chart. This is a normal part of the technical analysis.

If you want to beat the market, you need to invest with the trend. In looking at the trend, I believe it is best to begin with the big picture in mind and then work our way down to weekly and then daily views of the charts. You will notice that the chart and the value of the indicators change as we move from a monthly to a weekly and then a daily chart. This is a normal part of the technical analysis.

Let's start with the long term view of the S&P 500. The Relative Strength Index (RSI) seems to be a good indicator of the cyclical bull and bear markets. In addition, the 78 week Exponential Moving Average (EMA) acts as support in a bull market and resistance in a bear market.

In January we fell into a bear market as the RSI dropped below 50, the index fell through the rising trend line and the 78 week exponential moving average and MACD crossed below zero. This is consistent with the fundamentals of a weakening economy, and a recession. It is best to remain nimble during times like this.

The first support level looks to be just above the 1200 level. However, we can expect to retest the 78-week exponential moving average at some time in the future.

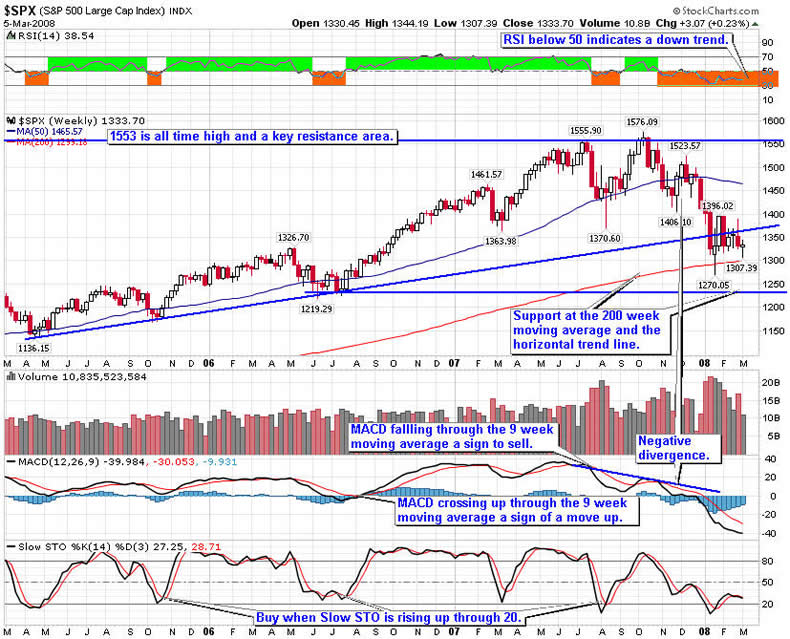

The weekly S&P 500 below was in a bullish ascending triangle that broke to the down side. Support is now at the 200-day moving average. If this holds then we can expect a move up. If it does not hold then look for the S&P 500 to fall to the 1220 level.

RSI below 50 indicates a downtrend. MACD broke down through the 9 week moving average, a sell sign. Also, we see negative divergence on the MACD where the indicator shows a down trend and the price has not yet fallen. This was another sign that we are likely to see more weaknesses in the market in the near future. As a result, we should expect more market volatility over the next couple of months.

High volatility is normally a sign of further weaknesses, so be careful with your longs and be sure to put on protection.

The daily S&P 500 chart below shows lower highs as the index is unable to move higher, which is a sign of a market top, indicating we are in a bear market.

RSI is below 50 indicating down trend. The MACD gave a buy signal but is now turning down. For now, it is best to be ready to go long if support holds or go short if it fails. In the mean time patience is the best way to go, unless you are a day trader.

Given this perspective, it is important to be patient looking for good opportunities to enter longs that are able to overcome the downward bias in the market. It will be important to add down side protection to your long positions either through stops, protective put options and/or covered calls. On any rises to resistance level, look to go short through selected stocks or the ultra shorts ETFs SDS and QID.

If you are interested in investing with the trend you might want to read Ahead of the Curve: A Commonsense Guide to Forecasting Business and Market Cycles by Joe Ellis is an excellent book on how to predict macro moves of the market. It focuses more on the fundamental reasons for economic cycles. For those that want to learn from one of the founders of technical analysis, the I suggest you read Stan Weinstein's Secrets For Profiting in Bull and Bear Markets is one of the best books on "reading the market". It is easy to read and an excellent description of how traders and investors use technical analysis.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.