US Housing Market Cracks Extend to Major Banks

Housing-Market / Analysis & Strategy Feb 24, 2007 - 12:35 AM GMTBy: Jim_Willie_CB

Words from older European sage economists are as welcome to the mainstream financial circles as welcome as leisure suits and hot pants are to the fashion set, as eight track tape sets are to the home music systems, as old Model T Fords are to the classic car vogue (see the Chevy Powerglide).

Yet the wisdom of economist teachings from Old Europe has never lost its meaning. Almost half a century ago, Rothbard warned of booms and busts, noting the inevitability of a dissipated bubble whose occurrence is assured like night follows day. Advising against bubbles is so passé these years. Try telling a PhD Economist from a top US university of the dangers from excessive monetary inflation, the attendant risks for making asset bubbles, and (s)he will think you are crazy. On a couple of occasions, such has been my pleasure and disconcerting experience.

While a depression is hardly likely for the US Economy, given the astounding tendency of the primary central bankers to flood the world with phony money (otherwise called liquidity), the most likely outcome is massive stagflation. Such a condition would be great for gold, since the policymakers will seem like they are pumping water into a heavily leaking vessel. The next threat to the USS America flagship is the current housing bust, early in its pathogenesis, denied every step of the way, its tentacles reaching far into the banking system. The icebergs have already been hit by the flagship, as water has entered the lower chambers.

Despite proclamations by the compromised talents on Wall Street and untalented hack front men in the USGovt, the chambers have absolutely no insulation from the general working top decks and bridge helm. We can rest assured that the offloaded risk has been taken control of by those at the helm, in the hands of first officer fat hogs Freddie Mac and Fannie Mac. Unfortunately their health record reads like a clipboard off an AIDS clinic.

Where a crisis looms near is the banking sector, from widening cracks in the housing foundation hitting bank balance sheets. So far those cracks have been hidden, like with private sales of discounted mortgage bonds to hedge funds, all under the radar. But evidence finally has surfaced of the housing decline extending to the mortgage industry. The Rothbard words as so relevant today, as the housing bust unfolds. Perceived as a harmless correction, the downturn will simply not go away, and will morph into an uglier form. Beware of ripple effects, momentum, and feedback loops. The January issue to the Hat Trick Letter includes his quotes, along with those from Thomas Jefferson (on central bank threats), from Charles Lindberg Sr (on dangers of US Federal Reserve creation), from Friedrich Hayek (on havoc of floating currencys), and Mahatma Gandhi (on ethics)

“As a boom begins to peter out from an injection of credit expansion, the banks inject a further dose. In short, the only way to avert the onset of the depression adjustment process is to continue inflating money and credit. For only continual doses of new money on the credit market will keep the boom going and the new stages profitable. Furthermore, only ever increasing doses can step up the boom, can lower interest rates further, and expand the production structure, for as prices rise, more money and more money will be needed to perform the same amount of work… But it is clear that prolonging the boom by ever larger doses of credit expansion will have only one result: to make the inevitably ensuing depression longer and more grueling. The larger the scope of malinvestment and error in the boom, the greater and longer the task of readjustment in the depression. The way to prevent a depression, then, is simple: avoid starting a boom.”

--- Murray Rothbard (1970).

FALLING & FALLEN SUBPRIME IDIOTS

Any serious analysis of the USEconomy must begin with an update on housing. In a nutshell, both housing starts and permits have fallen significantly, new home construction remains at high levels, inventories persist at near record levels, and consumer expenditures are overdue for a grand plunge. The banking distress has begun, let it be known. To call a housing bottom here is perilous, absurd, and probably highly inaccurate. Regard any such bottom proclamation as extremely biased, replete with vested interest, and probably intentionally falsified with a clear bias. Check the person's employer. In my view, the housing bust has at least two and three more years of bleeding damage to go.

Nothing has changed on the imminent risk from the housing decline to the US banking system and USEconomy. Among the various corners of the banking system, losses have been finally felt with mortgage portfolios and their bonds. The big banks, which serve both as creditors and counter parties to hedge funds, have unloaded substantial amounts of mortgage bonds at a discount to their clients in secret deals to elude public detection, otherwise seen as the initial writedowns. They wish to avert a public panic. With 40% of banking system assets tied either to MBS bonds or to home loan portfolios, the regional banks will suffer huge losses. Home valuation at a national level cannot be reduced by a few trillion$ without corresponding asset loss in the mortgage bonds. Expect at least one regional bank to go bankrupt. Certain large bank subsidiaries might go bust, absorbed by the parent with huge losses incurred. Others will be gobbled up in convenient acquisition mergers to hide the effect. We are perhaps only several months away from banking systemic distress from the housing bust. Deep public concern is still at least one or two years away, which will reach a peak when their certificates of deposit are deemed at risk or seized. Gold will love that. Imagine millions of people in doubt, seeking real safety no longer perceived available in banks!

The most recent high profile mortgage distress signal came from HSBC, the world's third largest bank in marketcap size behind Citigroup and Bank of America. What an unmitigated disaster their acquisition was in 2003 of Household International, a lender to subprime borrowers. HSBC increased their loan loss reserves to $1.38 billion in Q3 from $1.25 billion in Q2, and reported a 3.99% delinquent rate (over two months past due) for mortgages, car loans, and credit cards. They admit not to doing their homework before the acquisition of Household, a financial firm specializing in deadly adjustable mortgages.

Concern over an infectious spread from the mortgage divisions of banks to the unsecured loan portfolio is acute. The word ‘implosion' fits very appropriately to describe what has begun in the mortgage finance sector, worthy of the photo from a website ( http://ml-implode.com ) which tracks the littered dead within the industry.

The KILLING FIELD list in the mortgage industry grows like a Who's Not Who: OwnIt, Harbourton Mortgage Investment, Mortgage Lenders Network, Secured Funding, Origen Wholesale Lending, and more (see my report). Add several others like the subsidiary at H&R Block which has taken huge losses. Others will fall without any doubt whatsoever. The only question is the location, impact, and time required to spread the acidic damage. What is striking about the list is not the lack of recognition of their names, but rather the prominence of some of their creditor broker counter parties, big Wall Street names. Lenders relaxed standards in order to sustain business and their own jobs, not to mention bonuses and origination fees per loan. The inside word is that a credit crunch approaches quickly. The crisis will undoubtedly become a massive fraudulent enterprise where aggressive lenders will be accused of having pushing reckless home loans to people who were totally uncreditworthy. The issue was also fees for bond market underwriters, who rushed to convert loan packages into mortgage bonds, quickly offloaded to the unsuspecting public or foolish Wall Street firms. Watch more pushback by savvy Wall Street, and lawsuits like the one filed last summer by Bear Stearns to reject defective bonds.

The Center for Responsible Lending estimates that 2.2 million American homeowners will likely lose their homes via foreclosure. Default rates are terrible in many regions of the nation, not confined in any way since a systemic problem. One in five subprime mortgage customers who purchased homes in the last two years is likely to enter foreclosure, amounting to 1.1 million people. The most alarming conclusion made from the study, after analysis of more than six million mortgages since 1998, is that the risk of default is independent of the credit score of the borrower. The failures are occurring regardless of income and past credit history. In 1994, only 5% of mortgages underwritten were risky subprimes. Now the subprimes comprise over 25% of the mortgage industry, totaling over $600 billion in 2005. Abuses of negative amortization, piggyback loans to cover down payments, and other stretched deals are discussed in the January Hat Trick Letter report, as are the key specific factors tipping homeowners over the edge into foreclosure. The most dangerous bank system risk might not be the failures so much as the skewed internal underwriter risk controls, and policy for loan loss reserves. Piggyback loans are insane since they directly enabled loans which would not have been approved. They are called “silent seconds” since their loan-to-value lenders only report the first mortgage. Mortgage industry data is thus skewed and biased. Shocks are next.

MORTGAGES EARN DEBT DOWNGRADES

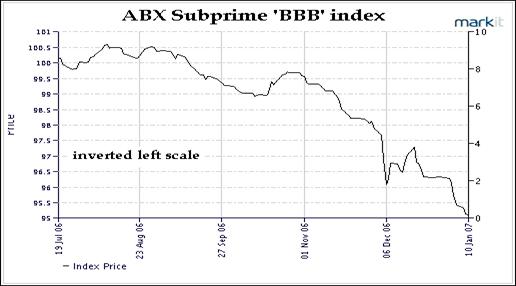

Early damage has finally begun to grip the ABX index for “BBB” credit insurance. The credit default swaps (CDS) market concerns standard insurance for the vast collection of bonds, including many types of mortgages. Foreclosures mean deceased returns on investment within mortgage portfolios for banks. The BBB type refers to subprime mortgage loans, as measured from a broad basket of size and regional locations. The ABX index has fallen suddenly in the late autumn and continues to fall. Relative to its own market, a drop of over 5% is large indeed. As quasi-insurer having invested in CDS contracts, your risk premiums rose and you profited like with a stock held. The index indicates a sudden decline in high risk mortgage conditions.

The mortgage industry is unraveling precisely as my forecasts indicated last year. The concept of the credit default swap contracts is exactly the same as those pertaining to the General Motors bonds collateralized to car loans in summer 2005. As the bonds are damaged, the CDS contracts rise in value. The BBB index below absolutely screams of a widening crack in the mortgage industry, certain to extend into the banking system balance sheets. The scale of the BBB index is inverted to reflect fallen value of the mortgage portfolios.

The ratings agencies are hot on the trail, doing their job. Wall Street might pressure and coerce them on USTreasury risk ratings, but not here. Moodys Rating service last week sounded the alarm on cash flow liquidity concerns generally for the home builders. This has been an anticipated event in my analysis. A couple big names will go bust bankrupt either this year or 2008. The high cancellation rate of almost 40% across the industry greatly interferes with cash flow. It also leads to understated home inventory statistics as a ratio to sales. For instance, writeoffs on land option deals are sure to crimp cash flow in a big way. Stalled home sales add pressure to cash flow. Builders are thus holding properties longer. Moodys expressed concern that bank confidence is at risk, a nice way of saying broad debt downgrades are next for all the builders. The impact will be felt with credit ratings, bond yields paid out to investors, and higher borrowing costs for them collectively. The builders will continue to be the most visible site of horrendous damage, since public companies who must file quarterly statements. The mortgage bonds are more hidden from view, often reported in aggregate from various lending operations in order to conceal the deep blemishes and credit acne.

The list of home builders having announced colossal losses from abandoned land options grows by the week, it seems. Lennar with $500 million, Centex with $400 million, KB Homes with $300 million. More lurk ready to be revealed. That is a lot of money not to matter. Combined, the sum could fund a small Latin American country for an entire year. But in America, the land of the plenty, it is dismissed as a small meaningless sum by the Doom-proof Denial Demagogues.

THE ABSENT HOUSING PIGGY BANK

Over the course of the past five years, much job growth has been claimed, mostly using smoke & mirrors. The official USGovt jobs reports do not even deserve capital letters anymore. Few believe their contents. The data does not jibe with the collection of industry reports filed individually. Expect big job losses from the construction sector before springtime. Some true experts forecast that between 500k and 800k additional construction and related housing jobs will be lost in the next 18 months. Not just builders like carpenters, masons, electricians, roofers, and plumbers are at risk, but also realtors, mortgage lenders, appraisors, title lawyers, and home inspectors. The ripple effect losers might be retailers, small shop owners, pizza joints, and strip mall owners. The following compilation was done by Northern Trust, whose Paul Kasriel is as competent an analyst as they come. Less than one third the job growth has occurred in the more recent period in housing industries.

The economic risk is indescribably great. The investment community has been subjected to blatant nonsense and propaganda, from analysts who claim the housing boom was critically important to the USEconomy on the upside, but that same economy is insulated from housing on the downside. The same umbilical cord is tied from housing to main street, namely home equity loans, refinances, and a general sense of wealth derived from the lifted homestead asset. So the USEconomy is 70% geared to consumer spending, and a grand proportion of funds for spending has been lost from home equity. We are told that as housing falls further, the impact will be muted even as less home equity funds are yanked for real needs and continued frivolity. This is bold deception and patently untrue.

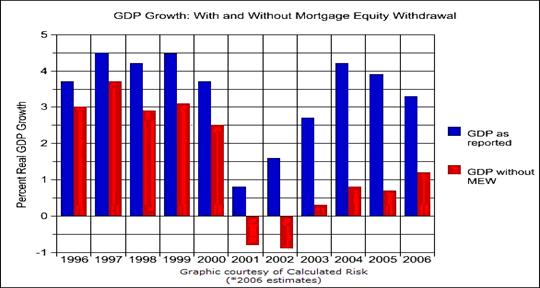

Without the enormous home mortgage equity withdrawals, the USEconomic growth rate might have been a mere 1%, including their exaggerated distortions. The red bars below highlight the meager growth in GDP when the home equity cashouts are factored out. The employed assumption is that 50% of the cash withdrawals is spent, a low estimate probably in the spendthrift American culture.

Most USEconomic growth in this hollow recovery is attributed to equity extractions by an estimated 75%. In fact, it is tied to the major bulk of growth. Since the early 1990 decade, quarterly cashout loans against home equity have jumped by a remarkable 10-fold rise over a 10-year period. To claim its removal will be insulated from the overall USEconomy makes no sense whatsoever. This is the stuff of recessions. Home mortgage equity withdrawal has been sliced by 71% in the most recent four quarters reported up to 3Q2006. The impact will be felt broadly and deeply, especially at a time when adjustable mortgages are reset to higher monthly payment requirements.

Let it be known that banks and brokerage houses are shifting risk to hedge funds en masse, whose managers are traditionally more insane and driven by steroids. Nowhere is the Weimar trait more evident than in global credit and their derivative growth, whose magnitude is permitted to grow unchecked by collusive if not corrupted government agencies without any regulation.

RECOVERY SINCE 2002

The USEconomy depended heavily on two grand forces to lift it out of recession in 2002, the Iraqi War and the Housing Boom (aka bubble & bust). The war machine marches onward, undeterred. The tax cut was extremely minor by comparison, unless you are a pandering party politician. However, one wheel has come off the USEconomic jalopy fueled by debt, on the wrong pathways labeled by consumption road signs. That wheel is housing. Experts and pundits alike can deny all they wish that some insulation protects the mainstream from the housing downturn, but it is almost total disinformation, nonsense, and based upon faulty analysis, if any analysis is used at all.

DO NOT TRY THIS AT HOME !!!

See the January Hat Trick Letter for more complete scorecard on housing starts, housing permits, further expected declines compared to recent history, housing inventory ratio to sales, price deceptions, and the connection to spending. Also analyzed are the recent Gross Domestic Product data and revisions, the meaning of the current account deficit, trade gap information details, and my favorite, the “moron of the month award” for true examples of stupidity in the line of duty.

THE HOME DEPOT SYMBOLIC FIRING

The departure of Home Depot CEO Robert Nardelli is very symbolic. He walked away with a $210 million severance package, sure to incite share holder reaction. He has served as the lightning rod for criticism about the home supply retailer's corporate governance. This is a euphemism for excessive compensation and fraud. My view focuses upon the symbolic footnote. The housing sector is one year into a multi-year decline. Home Depot has been a leading beneficiary in the housing boom (aka bubble). The Nardelli exit punctuates the housing bust, singles out a scapegoat, and points out the largesse within Wall Street at giant corporations. The event echoes the extreme distress felt by home builders. A year ago the Fanny Mae scandals surfaced, almost completely shoved under the rug. The Home Depot events cannot be hidden from view, although absent magnificent scale. The kick in the investor groin was a failure of Home Depot Board members to show up at a May meeting, where activist share holders were entrenched to object to both pay packages and questionable executive stock option grants. Same old same old in the USA financial aristocrat games, but this story has symbolic meaning as a watershed event.

US STEPS TOWARD BANANA REPUBLIC

Many might recall my frequent comments over the past couple years about the United States gradually resembling, if not becoming a Banana Republic. Hats off to Marc Faber, who recently has written ( click here ) in a thorough fashion so as to qualify the issue according to several criteria. The prime identifying characteristics are a spoiled political system, corrupt wealthy elite in power, control exerted by foreign entities, huge wealth inequities and a shrinking middle class, decayed infrastructure, urban wastelands with filthy pockets, primitive segments of the economy, low capital expenditures, capital flight externally, reliance upon foreign capital, heavy monetary inflation, outsized federal budget deficits, excessive import dependence, elite accounts in foreign locations, lowly paid common working class, large police and security forces, enormous prison population, proliferation of gambling casinos, and a weak currency. Some of the last few items are my additions beyond Faber's list. The United States has all of the above with no exception, as few might debate. If not today, then certainly the US has set upon on an unobstructed pathway.

Without doubt, plenty of fine people reside in the United States, plenty of responsible companies operate in the US, and many wonderful organizations exist in the US. It is the home of great colleges, movies, sports, restaurants, stocked supermarkets, entertainment centers, museums, garage sales, national parks, and wide roads. Opportunities remain ripe for personal success through enterprise and social mobility up the class ladder. Warmth and friendliness abounds, especially in the MidWest heartland and many Southern regions. But the trend is clear in backward movement. The foreign sources of power influence reach from Old Europe, mostly exhibited in hidden fashion and concentrated within powerful lobbies. Indirectly, power is exerted upon the US by suppliers of crude oil and finished products, the trade partners who have become quietly credit masters. A sea change began several years ago, which deserves attention.

THE UPCOMING SHOCK

The next couple years should deliver a shock to the economically and financially comatose US citizenry toward the deteriorating condition. The form of delivery might be a combination of a USDollar currency crisis and a profoundly stagnant USEconomy. The pressure is building, the resistance is formidable, but the forces are profound, since the potential for resolution from the imbalance is strong. Add the mortgage finance shock wave to the banking sector as the newest element. In fact, the sheer number of risk factors has grown to alarming levels.

When shocks hit, whether in sequence or together, the US Federal Reserve will be overwhelmed. Accommodation with even more easy money will be of paramount urgency. Global liquidity levels have reached alarming levels. Gold and silver will love the mess to clean up. In fact, clean-up is an American specialty. Ask Greenspan. What is even more alarming is that all the rising risks have failed to sound any alarm whatsoever in the VIX levels, which prices in risk to stock options. The VIX is as quiet as a drunk sleeping it off on a park bench on a summer night. His rhythmic snore is akin to the jagged appearance of the VIX chart itself.

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

The golden jackass is designed to inform and instruct in the complex ways of gold, currencies, bonds, interest rates, stocks, commodities, futures, derivatives, and the world economy, with no respect shown for inept bankers and economists, whose policies and practices contribute toward the slow motion degradation, if not destruction, of the financial world ~ Jim Willie CB, aka "The Golden Jackass" www.GoldenJackass.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.