Is the Japanese Yen FINALLY Ready for a Pullback?

Currencies / Japanese Yen Jan 22, 2013 - 04:17 PM GMTBy: Simit_Patel

Many of us here on InformedTrades have been waiting for a pullback in the Yen, under the belief that the Yen is headed much lower. Our infographic on Japan as well as this video from ShortJapanDebt, explains all the rationale for the belief in a sustained devaluation of the yen; to summarize, here are the key reasons:

1. Debt: Japan's debt/GDP ratio is over 2.2, making it the highest of any G20 economy in the world -- even higher than Greece. Interest payments on debt currently account for 25% of all tax revenue the government generates.

2. Resources: After the shutdown of its nuclear reactors due to the Fukushima crisis, Japan has been forced to become an importer of energy -- leading the country to run twin deficits (budget and trade)

3. Demographics: Japan is an aging civilization whose population is declining in absolute terms. Social security expenses are increasing while the tax base is declining.

4. War: The threat of war with China, one of the largest holders of Japanese Government Bonds (and thus a potential seller that could bring weakness to JGBs and the Yen), over ownership of the Senkaku Islands and the energy resources they contain

5. Monetary Policy: Japan's new Prime Minister, Shinzo Abe, openly seeks an aggressive inflation target as the country's monetary policy

6. Technicals: Price formed a key reversal pattern at the end of May 2012.

The Yen has been falling sharply since the first week of October, declining over 18% against the Australian dollar in that time. Personally, AUD/JPY is the currency pair I'm most focused on, as the Australian dollar has outperformed other currencies relative to the yen, and also provides the largest interest rate differential against the yen of any major currency -- thus allowing speculators to earn interest payments while waiting for the full trend to play out. I think it is in many ways a classic carry trade opportunity.

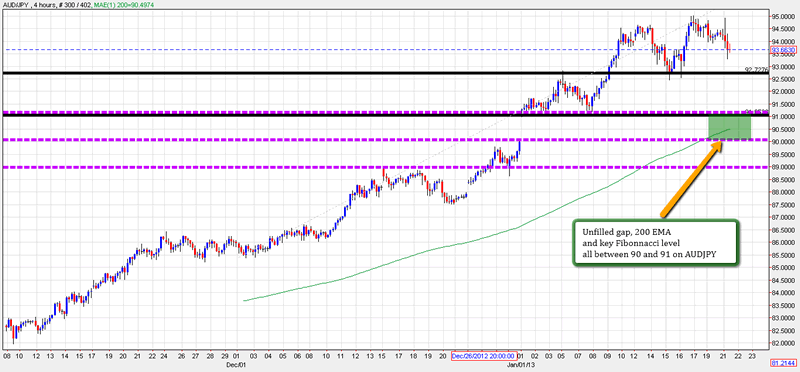

The chart below illustrates my current take on AUDJPY. I think there is confluence in the 90-91 range on the 4 hour timeframe (my preferred timeframe for trading). If price can fall to this level, I think it may be a great opportunity to short the Yen and to employ trend following strategies to get the most out of the opportunity. This is especially true if one considers that today's announcement from Japan's Ministry of Finance confirming their commitment to aggressive inflationary monetary policy is a classic "sell the news" type of trading environment.

By Simit Patel

http://www.informedtrades.com

InformedTrades is an online community dedicated to helping individuals learn to trade the world's financial markets. Members earn prizes for sharing their knowledge, and the best contributions are compiled into InformedTrades University, the largest collection of free organized

learning material for traders on the web.

© 2013 Copyright Simit Patel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.