Economic Summits, China Trade War, and the Gold Bull Run

Economics / Analysis & Strategy Feb 23, 2007 - 02:05 AM GMTBy: Jim_Willie_CB

Numerous international events took place within the last month. The Economic Summit was held in Davos Switzerland. It convened a large collection of world renown economists, corporate chieftains, and some financial market kingpins. The G8 Meeting of finance ministers was held in Germany. Back home, USFed Chairman Bernanke issued a grave warning to the US Congress on the shattered US financial balance sheets. My commentary on money supply explosion comes next.

Lastly, the Chinese trade disputes have taken a big step toward outright trade war and protectionism. Few see how the trade war will affect gold yet. They will soon enough. Restricted trade flow always results in higher prices. It is always accompanied by a scramble for resources in today's context. This trade war will include a massive bidding war and staggering battles to build stockpiles of all critical commodities.

See the Hat Trick Letter special report entitled “Economic Summits & China” for a deeper analysis and discussion.

The three greatest mega forces behind the gold bull in the next couple years will be:

-

The housing debacle, which will infect the banking sector like a grand contagion.

-

Endless military war instigated by the US, as it desperately secures energy supply.

-

Trade war with China, whose expansion was sponsored by US firms, costing US jobs.

THE UNHEEDED DAVOS WARNING

The Davos Summit provided an opportunity for economists to mingle with central bankers, and frankly to hear an earful of dire warnings, most of which will go in one ear and out the other. This was the annual meeting of the World Economic Forum. The old guard of Europe accentuated the impending risk to global financial markets, the inherent risk to currencys, and increasingly likely financial crises sure to reach global proportions. With Secy of Inflation Greenspan no longer on the scene at the helm, the duty to explain the current situation has fallen on the German kingpin Max Weber. Unlike Greenspan, who relied on justification of inflation and obfuscation to keep a cloud from full open discovery of his actual devices, Weber is reality based from the old reliable German roots. He speaks in plain language without a foot standing in any punch bowl.

European Central Bank council member Axel Weber attempted to sound the alarm. Weber cited the price structure in particular, and focused upon risk. He urged the investor community not to expect central banks to bail them out in the event of what he described as a potential ‘abrupt' fall in financial markets. He spoke of the danger of a ‘rush to the exit' if investors wait too long. Stocks and bonds do not properly price risk in financial assets. Of course one central bank would provide an avalanche of liquidity in the event of a market crisis, that being the US Federal Reserve. When they do, gold will rejoice, and the USDollar will groan in pain.

Weber said the following:

“If you misprice risk, don't come looking to us for liquidity assistance. The longer this goes on and the more risky positions are built up over time, the more luck you need… It is time for financial market to move back to more adequate risk pricing and maybe forego a deal even if it looks tempting… Global liquidity will dry up and when that point comes some of this underpricing of risk will normalize. If there is much less liquidity around, people will not go into such high risk engagements and will unwind them.”

Weber cited a potential catalyst to disturb the financial markets, the Bank of Japan interest rate hikes. They had widely expected to raise their benchmark borrowing costs from the current 0.25% gradually until it reaches 1.0% in the first quarter of 2008. This week the BOJ did just that, hike to 0.50%, but they carefully refrained from offering any forward guidance toward additional rate hikes. So far the impact has been muted. The Japanese yen currency has even risen, evidence of firm controls in place, for which one might credit Goldman Sachs. Compare thiirwith the US Federal Reserve 5.25%, the English 5.25%, and the Euro Central Bank 3.5% official rate. Existing carry trades lie at great risk. The higher BOJ borrowing cost hurts that trade, and higher rates will encourage a runup in the Japanese yen currency, for a second blow to that trade. Carry trade participants borrow cheap Japanese money, which just rose in cost. They carry a yen currency risk, which just move in the wrong direction. They invest in USTreasury Bonds, which are at risk from higher yields and a weaker USDollar. For some unexplained reason, probably toeing the line, Weber expects an orderly adjustment in risk assessment, with a denial of systemic threats to financial stability, deemed to be a different issue.

Recent economic data inside Japan has been mixed, some areas of strength, some ongoing softness in prices. Pressure abounds wherein Tokyo politicians and powerful ministries have exerted influence for the absurdly low rates to continue. Current indications are for Japan to do nothing for as long as possible. Politicians have taken control. Nevertheless, the risk remains for a BOJ rate hike and colossal disruption to what is estimated as between $1000 and $3000 billion in global carry trade volume.

A quick glance at the comatose VIX and VNX verifies the absent price assigned to risk in the past several months. They are at 10-year lows, reflecting almost zero risk within price structures. Some label it the “Paulson Put” as though the “Greenspan Put” has witnessed a handoff. As Secy of Treasury, Paulson's other job is to maintain the stock bull market, ensure purchasing power to the citizenry, and along the way continue to line Wall Street pockets with fantastic profits. He has done a riproaring great job. One must ask about the moral hazard, which begs the questions “Do markets seek trouble in their managed upward paths?” and “Do economic displacements perpetuate to cause different worse problems?” and “Does structural political damage result when the next crises occur?”

Other measures signaling dangerous low assessed risk are the tiny spreads in the credit market, covered in more detail in the report. When distress returns, control is lost, and things unravel, the solution is always the same: print more money, flood the system, rescue the aristocratic positions. Gold shines in such a climate, as the meter on money.

G8 MEETING IN GERMANY

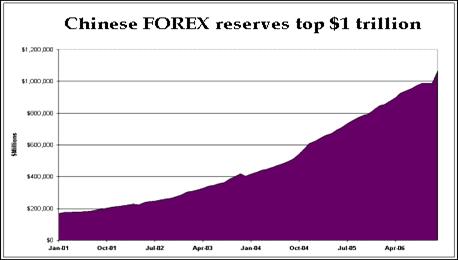

The G8 Meeting of finance ministers convened in Essen, Germany in early February. Finally, China was invited with some respect shown, but they kept the G7 title which is not used in my section heading, since the eighth member was indeed present. The host nation showed respect, and urged the group to invite China and other nations into the fold. Or did they, since China might have been invited in order to be clubbed over the head concerning its $1 trillion FOREX savings account? It has been obtained from tight yuan control, massive industrial expansion, blockage of free trade with competition, and continued allowance of intellectual property theft. And yes, NEVER overlook the huge universal labor cost advantage, which in my view will never be rectified.

The official statements from the meeting issued soft soap commentary on the robust nature of the USEconomy and the newfound strength of the European Union economy. The ministers refused to follow the European lead to attack policy in Tokyo, on the matter of interest rates kept so low as to put the EU at a competitive disadvantage. A quick gloss was given to Japan. “Japan's recovery is on track and is expected to continue. We are confident that the implications of these developments will be recognized by market participants and will be incorporated in their assessment of risks.” What nonsense! They claim the Bank of Japan will properly assess the risks of an essentially 0% official interest rate! The US, London, and Swiss bankers want the BOJ to continue the open wellspring of near zero cost money in order to perpetuate the giant carry trades which require borrowing yen money. Even at an official 0.50% rate, the potential remains considerable for ongoing carry trade, provided long stretches of time pass between their rate hikes. My view is steadfast, that the economists from the leading perpetrators of global monetary inflation (United States, England) are a compromised bunch beyond any remedy. The system cannot be fixed when they are the system. It is like asking Congress to reform itself, or for Major League Baseball to reform itself, or the Mafia to install a code of behavior.

Euro Central Bank president Trichet delivered his own warning to yen carry trade players. “We want the markets to be aware of the risks of one-way bets, in particular on the foreign exchange market. One-way bets in the present circumstances would not be, it seems to us, appropriate. We want the markets to be aware of the risks they contains.” Trichet kept his comments general enough to encompass the euro carry trade, which borrows cheaper euro and invests in higher yielding USTBonds. Such a strategy allows the for US financial masters to keep down the rising euro currency by means of bond speculation. No reference was made to the Swiss carry trade, which exploits the artificially low Swiss National Bank official rate, which stands at half the Euro Central Bank rate. The Swiss do love to make money at big banks without work, their national sport behind ski racing.

Instead of permitting a European bashing of the Japanese, who have marched obediently to the orders doled out by their American masters, the ministers focused on the US agenda, dictated by US Treasury Secy Paulson. As a group, the ministers urged China to relax control on their yuan currency, and to pursue more flexibility. Have we heard the Paulson statements include the word “flexibility” at least 1000 times? Methinks yes. “In emerging economies with large and growing current account surpluses, especially China , it is desirable that their effective exchange rates move so that necessary adjustments will occur… [Nations are committed to policies that] support the orderly adjustment of global imbalances.” They refer to the outsized USEconomic trade deficits. Curiously, not a peep was mentioned to address any internal policies enacted by the USGovt which render it permanent. In this respect, the G8 Meeting has become a forum to perpetuate and rescue the system, never to fix it. China is the great change agent. Japan is the great sustenance agent. The US is the great offender.

Paulson made individual comments of his own, a clear revelation of US priorities. “Greater flexibility in China's exchange regime is also needed as part of C hina's rebalancing of its economy… It is one of my responsibilities to encourage them to move more quickly because it is in their own interest and in the global economy's interest for them to do so… As Treasury Secretary, as a general principle, I do not like to comment on currencies that trade in competitive marketplaces.” That was his dodge of the Japanese yen problem, sort of a thumbed nose to Europe. He hid between the MARKETPLACE of all places. Wow! This was a show hosted in Europe, but one surely to be dominated by an American agenda which Paulson would enforce and steer.

My personal opinion is that the USGovt intends to utilize the G8 forum to justify upcoming trade sanctions in protectionist measures aimed at China. The USGovt does not want to proceed alone, without international blessing. The US exploits the Japanese market interference, but wants to be seen as being victimized by the Chinese interference. After all, they are the change agent, not in any way shape or form emerging from the US-Western Europe banker cabal. The Japanese financial market is open to US exploit in the highly lucrative ultimately important bond speculation arena. The Chinese financial market is virtually closed, and as such is not susceptible to US financial exploit.

In reply to a veritable barrage of criticism and urgent pleading, the Chinese Jin replied “We continue to strengthen macroeconomic adjustments.” They are laconic people when they need to be, saying little, but with great power and broad impact from chosen words. Beijing leaders will proceed at their own pace, stated repeatedly. Reform will be slow, conducted in a manner to their advantage. It seems nowhere is the United States rebuked for dispatching its manufacturing base to Asia, then running a consumption based economy which produces gigantic trade deficits, only to finally place blame on China. A flexible yuan currency would do little to alleviate the US trade gap with China , since the labor cost differential is the real crux of the problem. As the USGovt suffers erosion of its political base, China stands as an easy mark for constant harping, shallow scapegoating, and probably new legislation. It is all a grand distraction from the real problem. The Chinese leaders actually have spoken publicly about the scapegoating. They are not only aware, but increasingly angry by this Chinese stick being used.

Closing topics were intriguing. Among them, British Prime Minister Tony Blair supported the G8 expansion, identifying a “hopeless mismatch” between global challenges and institutions which can address them. He urges reform of the United Nations, the International Monetary Fund, World Bank, and the G8. Attempts to include the “outreach” countries such as Brazil, China, India, Mexico, and South Africa will surely be watered down, delayed, and agreed to grudgingly. To do so would relinquish coordinated banker policy. The advantages of the emerging East are manufacturing, expansion, cheap labor, no unions, no retiree pensions, and colossal savings in FOREX accounts. The advantages of the West are banking, intellectual property, and military (fully utilized). The contrast motivates strains, greater imbalances, and more geopolitical conflict.

With each passing year, the current USGovt tag team of oil men, defense titans, and banksters have created more strain, more imbalance, and more conflict. Gold has loved this corrupt inept group of leaders. No evidence whatsoever indicates a shift toward progress in lieu of battle. So gold will continue to love this team. Without any doubt, voters are no longer in control, as corporations and military are. In history, populist breakdown usually means more war, more corruption, more geopolitical crises. My view is plain, to save the empire, all semblance of democracy will be foregone and sacrificed. Gold almost always prevails in such a climate.

BERNANKE WARNS TO FISCAL IDIOTS

USFed Chairman Bernanke spoke to the US Congress, more like delivered a severe warning. The Bernanke message pertained to federal spending, entitlement programs, debt burden, and associated borrowing costs. “Dealing with the resulting fiscal strains will pose difficult choices for the Congress, the Administration, and the American people. However, if early and meaningful action is not taken, the USEconomy could be seriously weakened, with future generations bearing much of the cost. Thus, a vicious cycle may develop in which large deficits lead to rapid growth in debt and interest payments, which in turn adds to subsequent deficits.” Who is he kidding? It is already too late. The USGovt spending has gone totally out of control. The move from $5 trillion in debt to $8 trillion has been swift since 2001, a legacy of irresponsible spending masked by constant war footing is clear. The federal debt is expected to slam up against the $8.965 trillion limit this autumn! Isn't it amazing how the federal debt rises toward limits even though the budget deficit is supposedly getting smaller? Pure deception. As exited Treasury Secy O'Neill said, “pure show business.”

Medicare obligations are staggering. Social Security obligations are catastrophic. Military spending is haywire. Bernanke was essentially saying that Congress must renege on entitlement programs. What he failed to address was how the USGovt has morphed into a military state, whose budget requests are never even challenged. What he failed to address was how the US Federal Reserve has aided & abetted the process with easy money, bubble after bubble, which has contributed to the structural disintegration of the USEconomy. This whole speech smelled bad, like standing over a city sewage center and claiming never to have had a bowel movement or aimed a urinary stream. In 18 months, with a run on the USDollar, Little Ben can claim he warned the US Congress. A humorous criticism bounced around in the press. How could Congressional members possibly understand what was said, when their pay scales were not high enough?

In other statements before Congress, Bernanke admitted to being on constant watch for problems in the banking sector. We have the early signs finally of the USFed detected a bank crisis unfolding, no denial. Wait until phase #2 with the negative amortization mortgages blowing up. No wonder hedge funds want to buy them on discount from beleaguered banks. Their purchase enables amplified fees for fund managers on income never received on the negative-am's, due to accounting niceties. Next after that will be the prime mortgages. Let us not forget that $800 billion in adjustable mortgages reset in price in calendar 2007. And clowns think the housing market has bottomed? Nonsense!

My view has been steadfast for several months. The gold community will benefit from the upcoming, ongoing, broadening, and deepening banking sector crisis born out of mortgage industry. The gold community has yet to appreciate this giant tailwind, not yet. The US Federal Reserve is subservient to the banking sector. Their claim of the USFed serving the USEconomy for the purpose of maintaining full employment and low price inflation is pure rubbish. They serve bankers, period. See the LTCM bailout in 1998. While the Bernanke warnings did not address the bank crisis in progress, his comments in coming months will do just that.

The Special Report covers the credit explosion, some causes, some details. The USGovt fiscal house is in worse shape than the hurricane damage zone in the ew Orleans and Gulf Coast region. That relentless flow of red ink is the impetus behind the undermine of USTreasurys. Gold, which is in competition with USTBonds like a dog & cat, like an ant & termite, will enjoy the distress to USTBonds.

CHINA TRADE WAR FESTERS

The trade war with China remains a favorite topic of mine, probably because it was so easy to foresee, inevitable in its basis, and denied as it approached. My eyes saw an end of the seeming symbiosis between the United States and China after two to three years of smiles, hugs, and kisses were the order of the day. My forecast of open hostile inevitable trade war led to personal ridicule when jobs were being shed, gigantic investments were being made, and cheaper Chinese labor was being exploit. They racked up trade surpluses as the US racked up job losses. The low-cost solution mantra is no longer stated. Instead we hear of unfair trade.

Focus upon the Chinese subsidies in World Trade Org disputes and deliberations is a small part of the overall universal labor advantage enjoyed by China. Despite this diversion and focus on subsidies, one can conclude the trade war between the US and China has taken a notable step worse. The failed mission in late November (Strategic Dialog with China) might have been regarded as a last ditch effort to avert trade war. It failed, my immediate assessment proven correct. Well, a success if IPO bank stock issuance by Wall Streeters is the objective, replete with hefty fees. Ratcheted trade sanctions and protectionist measures are next. Look for the Chinese to deal in a constructive fashion for a while, until they realize the motives behind US actions are more political than business.

At the time Beijing officials realize the duplicity and ulterior motive to capture voter attention and seize upon their angst based on job insecurity, look for Chinese leaders to deliver harmful retaliatory salvos in the currency and bond market, to remind the USGovt and US Congress of their power. They will sell USTBonds, purchase more gold, issue statements about diversification of FOREX reserves, and perhaps emphasize new strategies of stockpiling commodities. They might even discuss openly the expansion of their military divisions. Ongoing support by China for USTBonds has been motivated by their wish to avert protectionist measures such as trade tariffs. If the US Congress pursues the WTO complaint route, China will refrain from USTBond purchases.

The enforced Chinese yuan currency peg was in effect for five years, which served as a blood draining conduit into the Beijing FOREX coffers. They now boast $1 trillion in reserves. The new National Foreign Exchange Investment company will manage the fund initially. A grand metamorphosis is underway in Beijing, wherein power is next to be shared for management of the colossal $1 trillion. No longer will the State Administration of Foreign Exchange (SAFE) dominate solely. The internal power shift is fully covered in the February report.

The potential for investments is broad and wide open, sure to include gold, perhaps the entire Chinese precious metals mining output (like Russia), surely additions to their crude oil stockpiles. My conjecture is that Beijing leaders will embark on a buying spree of world class mining and energy companies, engage in large scale joint projects on a global scope, and probably widen their stockpiles to include strategic metals for both industrial and military supply chains. Gold, silver, oil, natural gas, they will all love it. Let's not forget copper, nickel, tin, aluminum, cobalt, and uranium. The strategic metals like titanium, strontium, and vanadium will not be overlooked. The trade war will invite retaliatory strikes by Beijing on the USDollar and USTreasury Bonds. But the undercurrent not yet recognized is to be directed upon important commodities, principally gold and crude oil, the true currencies today.

By

Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

The golden jackass is designed to inform and instruct in the complex ways of gold, currencies, bonds, interest rates, stocks, commodities, futures, derivatives, and the world economy, with no respect shown for inept bankers and economists, whose policies and practices contribute toward the slow motion degradation, if not destruction, of the financial world ~ Jim Willie CB, aka "The Golden Jackass" www.GoldenJackass.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.