Stock Market SPX Support Cluster is Broken

Stock-Markets / Stock Markets 2012 Dec 28, 2012 - 02:52 AM GMT SPX broke through its cluster of supports this morning, testing Hourly Cycle Bottom at 1400.21. Having completed yet another impulse, it is now retracing back to the 50-day moving average at 1413.17. This level will be attacked, since the loss of the 50-day support is a major breakdown. Once that support is lost for a second time today, selling should resume shortly with a minimum decline to 1344.00. The next model support is the next round number in SPX…1300.00.

SPX broke through its cluster of supports this morning, testing Hourly Cycle Bottom at 1400.21. Having completed yet another impulse, it is now retracing back to the 50-day moving average at 1413.17. This level will be attacked, since the loss of the 50-day support is a major breakdown. Once that support is lost for a second time today, selling should resume shortly with a minimum decline to 1344.00. The next model support is the next round number in SPX…1300.00.

There may be a bounce at 1388, which is the panic trigger and 200-day moving average. The loss of support at the 50-day moving average is now bringing a heightened awareness of how shaky the markets are. Crossing 1388.00 should bring an avalanche of selling, including a potential flash crash.

The Lip of the Cup with Handle is being tested for support. Hourly Cycle Top support is nearby at 19.56, but the VIX may not decline that far. Minor retests of this sort are not to be feared.

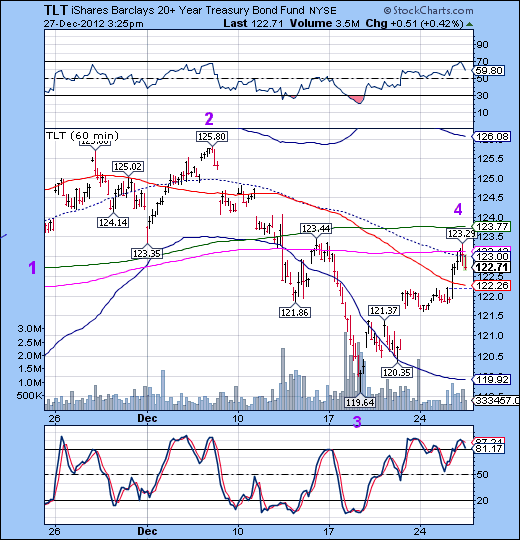

TLT appears to have concluded its retracement at its Hourly mid-Cycle resistance and Intermediate-term resistance at 123.10. This also corresponds with daily mid-Cycle resistance in TLT and USB. Once it crosses the Lip of its Cup with Handle near 119.64, the decline really begins in earnest, contrary to Tyler Durden’s view of a smashing rally in the long bonds.

I’ll be in touch later with more breaking news.

Best wishes to you and yours for the Holiday Season.

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.