Stock Market First a Stair-step, Next a Stumble?

Stock-Markets / Stock Markets 2012 Dec 14, 2012 - 03:46 AM GMT The SPX is stair-stepping through its trendline support and closed at its 50-day support. The bounce fell short of a 38.2% retracement and appears to be over. In fact, the after-hours futures continued to fall beneath the 50-day moving average. There is a high risk of an overnight fall beneath the remaining supports to the Cycle Bottom at 1383.39 and 200-day moving average at 1387.00. Should that event take place, we could wake up Monday to a waterfall decline.

The SPX is stair-stepping through its trendline support and closed at its 50-day support. The bounce fell short of a 38.2% retracement and appears to be over. In fact, the after-hours futures continued to fall beneath the 50-day moving average. There is a high risk of an overnight fall beneath the remaining supports to the Cycle Bottom at 1383.39 and 200-day moving average at 1387.00. Should that event take place, we could wake up Monday to a waterfall decline.

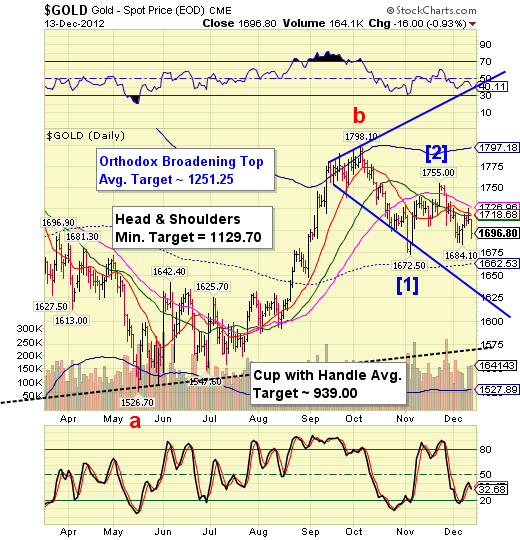

No guarantees. This is how the Orthodox Broadening Top plays out.

The VIX closed above its 50-day moving average at 16.41 today. It also made a small retracement that appears to be over. A breakout above the recent highs at 18.64 would wake up the analysts and put the VIX above its 200-day moving average at 17.54.

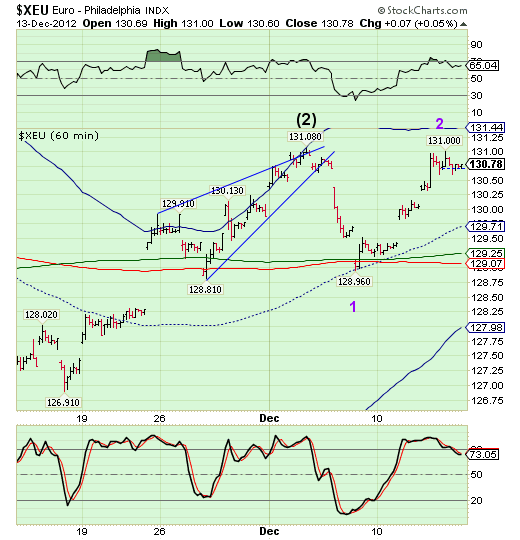

The Euro is high due to the fact that a lot of shorts loaded up this Summer. There seems to be a concerted effort to eliminate those short positions in order to keep the European banks (net long) intact. The hedge funds would walk away with huge profits once the Euro drops below 120.00, but the banks would be wiped out.

Gold resumed its decline toward its crash trigger at 1625.00. Not much more to be said.

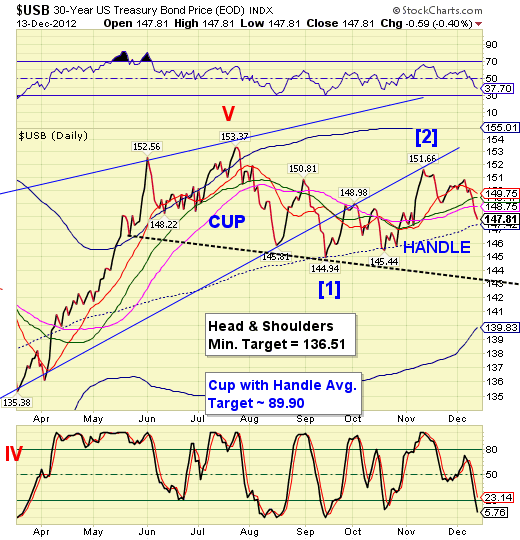

USB lost all but mid-Cycle support at 147.42. The first target appears to be the Head & Shoulders goal near Cycle Bottom support at 139.83.

The long-term trendline, running from September 1981, is at 123.00. The crossing of that trendline will mark the end of era.

Until tomorrow,

Best wishes,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.