Will Fiscal Cliff Uncertainty Defeat Stock Market’s Favorable Seasonality?

Stock-Markets / Stock Markets 2012 Dec 07, 2012 - 12:42 PM GMTBy: Sy_Harding

It’s no secret that the stock market makes most of its gains in the winter months, and if it’s going to have problems they usually take place in the summer months.

It’s no secret that the stock market makes most of its gains in the winter months, and if it’s going to have problems they usually take place in the summer months.

The pattern is so consistent that academic studies prove that over the long-term betting on the pattern even with a strategy as simplistic as the venerable old ‘Sell in May and Go Away’ dictum, outperforms the benchmark S&P 500 by a wide margin, while taking only 50% of market risk.

However, it doesn’t happen every single year. So by far the majority of investors remain skeptics, and in spite of their performance history believe there must be a way to be right 100% of the time.

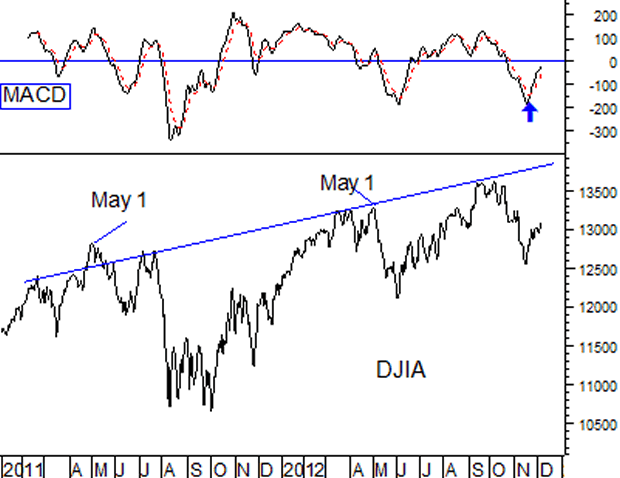

Last year (2011) the market followed the seasonal pattern in classic fashion. The rally in the winter months of 2010-1011 topped out May 1, followed by a double-digit summer correction. The summer correction ended in October, and a typical winter months rally began.

This year followed a similar pattern – until June. A strong winter rally topped out in late April into a summer correction. But the correction ended at the June low, with a rally that carried the market up to a level fractionally higher than the seasonal May exit. At that point, exiting May 1 had not paid off.

But then the market pulled back again to a level lower than the May 1 peak.

The question for seasonal investors now, fractionally ahead of the market if they followed the spring exit and recent re-entry signal of my Seasonal Timing Strategy, is whether the rally that began in November was the beginning of a typical favorable season rally into next spring.

It’s been a nervous attempt to rally so far as uncertainties over the fiscal cliff negotiations continue.

That uncertainty is not being helped by the way several months of positive economic reports that indicated the U.S. economic recovery is back on track, have been replaced by some reports for October and November that are less supportive of that conclusion.

As I wrote last week, durable goods orders were flat in October after an encouraging increase in September, new home sales fell 0.3% in October, and consumer spending declined in October for the first time in five months.

On Friday this week it was reported that the University of Michigan-Thomson Reuters Consumer Sentiment Index fell sharply in early December, from 82.7 in November to 74.5 so far this month, much worse than the consensus forecast of 82.0

The Labor Department also reported on Friday that 146,000 new jobs were created in November, much better than the consensus forecast of 95,000. But previous reports for September and October were revised down by 49,000 jobs total.

But don’t count seasonality for the winter months out yet.

The wait and see attitude of business and consumers regarding the fiscal cliff, which has been creating the recent weakness in economic reports, would likely take a decided turn for the better again if a reasonable compromise is reached to avoid the cliff, or at least kick it down the road again.

And nothing in the typically slow negotiation process so far has disabused me of expecting that outcome.

By the way if that happens, although it would a positive for a few months, down the road the remnants could provide the catalyst for the seasonal pattern to continue next summer.

So I continue to be watchfully optimistic that a typical ‘favorable season’ rally will continue to come out of the rubble of the current uncertainties.

But it is still not a time for over-confidence, or to adopt a buy and hold approach.

Until there is more clarity regarding the cliff, I favor conservative holdings like the SPDR DJIA etf, symbol DIA, and the Utilities Sector, via etf’s like the Select SPDR Utilities, symbol XLU, while holding an ample supply of cash ready to pounce on more aggressive opportunities.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2012 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.