US Stock Market Nearing Bull/bear Inflection Point

Stock-Markets / Stock Markets 2012 Dec 02, 2012 - 11:24 AM GMTBy: Tony_Caldaro

The rally from the SPX 1343 low, two weeks ago friday, continued this week as the SPX hit 1420 on thursday. Thus far the advance looks impulsive and is riding a WROC buy signal. Which usually precedes an uptrend confirmation. Which, btw, is not all that far away. For the week the SPX/DOW gained 0.3%, and the NDX/NAZ rose 1.5%. Asian markets gained 1.0% European markets gained 0.3%, and the DJ World index gained 0.9%. On the economic front positive reports marginally outpaced negative reports eight to seven. On the uptick: Q3 GDP, Case-Shiller, consumer confidence, FHFA housing prices, pending home sales, PCE prices, the Chicago PMI and weekly jobless claimed improved. On the downtick: durable goods orders, new homes sales/prices, personal income/spending, the WLEI, and the Monetary base. Next week we will get the Payrolls report, ISM and monthly Auto sales.

The rally from the SPX 1343 low, two weeks ago friday, continued this week as the SPX hit 1420 on thursday. Thus far the advance looks impulsive and is riding a WROC buy signal. Which usually precedes an uptrend confirmation. Which, btw, is not all that far away. For the week the SPX/DOW gained 0.3%, and the NDX/NAZ rose 1.5%. Asian markets gained 1.0% European markets gained 0.3%, and the DJ World index gained 0.9%. On the economic front positive reports marginally outpaced negative reports eight to seven. On the uptick: Q3 GDP, Case-Shiller, consumer confidence, FHFA housing prices, pending home sales, PCE prices, the Chicago PMI and weekly jobless claimed improved. On the downtick: durable goods orders, new homes sales/prices, personal income/spending, the WLEI, and the Monetary base. Next week we will get the Payrolls report, ISM and monthly Auto sales.

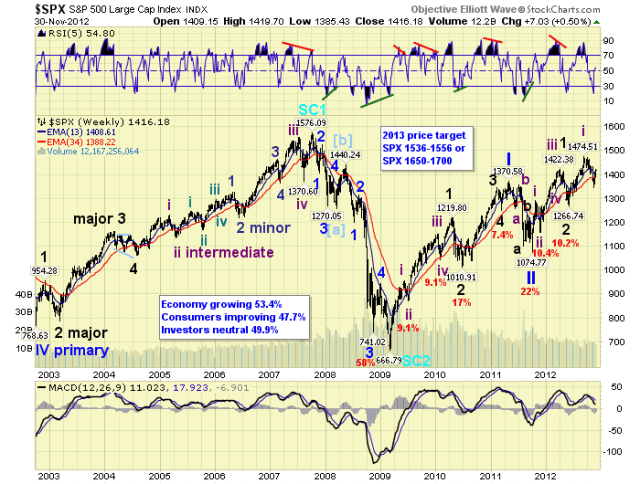

LONG TERM: bull market reaching inflection point

We believe the bull market has a good 70% probability of continuing into 2013. The count we have been tracking continues to display the potential for five Primary waves up from the March 2009 SPX 667 low. Primary waaves I and II completed in 2011, and Primary wave III has been underway since that low. Primary wave I divided into five Major waves with a subdividing Major wave 1. Primary III appears to be following a similar path except that Major wave 3 is also subdividing into five Intermediate waves.

Currently we count Major wave 1 and 2 complete for Primary III, with the subdividing Major wave 3 underway since the SPX 1267 low. Within Major wave 3, Intermediate wave i completed at SPX 1475, Int. wave ii probably completed at SPX 1343, and Int. wave iii, to new highs, is probably underway.

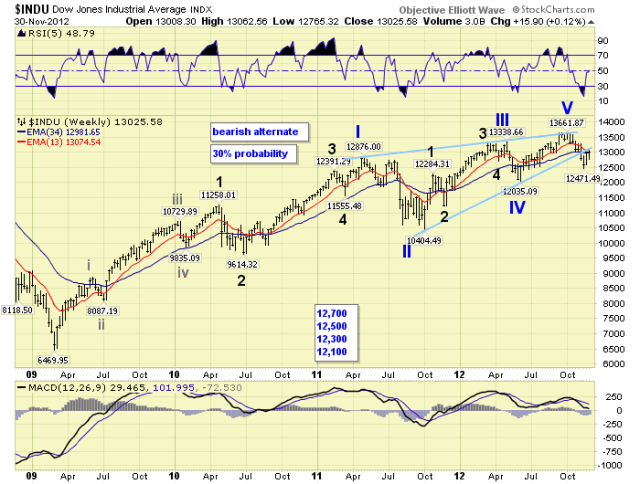

We have been closely monitoring the recent market activity as this market approaches what we have determined is a bull/bear inflection point. For the past few weeks we have noted the 30% probability of an ongoing bear market. This potential negative count was first posted during the last downtrend after the SPX hit 1475. It suggests the bull market ended recently, and the downtrend to SPX 1343 was the first leg down of a new bear market. This would make the current advance a partial retracement rally of the first decline.

After examining the last five bear markets, since 1981, we determined the market loses between 6.9% and 13.8% during the first downtrend. The recent decline generated a market loss of 8.9%. Then the following uptrend retraces between 69% and 90% of the first decline. When we count the first decline from SPX 1475 to SPX 1343, a retracement rally between SPX 1434 and SPX 1462 would be normal for a bear market uptrend. If this uptrend ends within that range we are likely in a bear market. If the uptrend continues to new highs the bull market continues. The rally hit SPX 1420 this week and is quickly approaching the range.

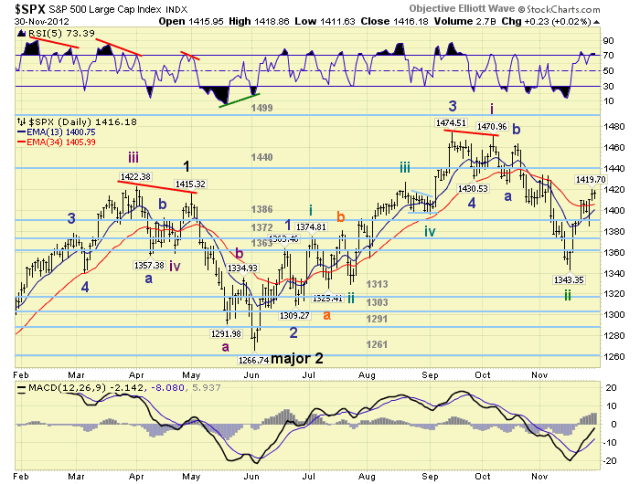

MEDIUM TERM: uptrend probably underway

After the recent June to Sept/Oct uptrend ended at SPX 1475/71 the market entered a downtrend which appears to have bottomed in mid-November at SPX 1343. During the ensuing rally the market generated a WROC buy signal, (96% accurate), which usually precedes uptrend confirmations. As a result there is a high probablity the current rally from SPX 1343 to SPX 1420 will be confirmed as an uptrend/significant wave.

From the low, which was quite oversold on the daily RSI/MACD, the market has rallied impulsively. We are counting the SPX 1343 low as Intermediate wave ii, and the current uptrend Int. wave iii. Thus far the rally looks quite normal for this bull market as the SPX has advanced 5.7% in just two weeks. We would expect the market to get extremely overbought as some point, on the daily charts, and it is barely overbought now. Medium term support is at the 1386 and 1372 pivots, with resistance at the 1440 and 1499 pivots.

SHORT TERM

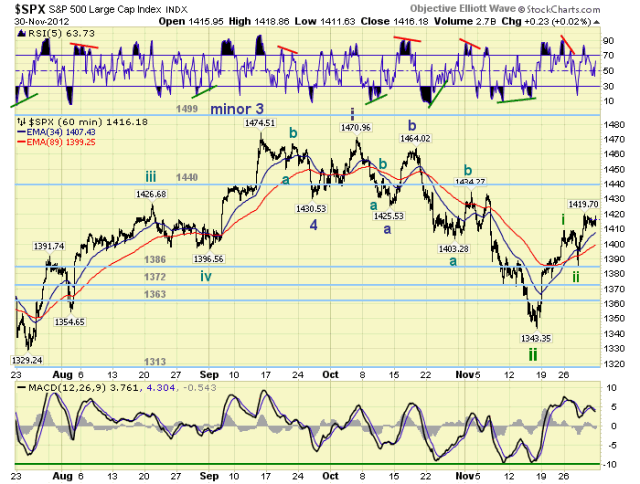

Short term support is at SPX 1413/16 and 1402/03, with resistance at SPX 1422/27 and the 1440 pivot. Short term momentum ended the week just above neutral. The short term OEW charts remain positive with the swing level around SPX 1401. After the close on friday FED governor Steins’s interesting speech was released: http://www.federalreserve.gov/newsevents/speech/stein20121130a.htm.

The rally from SPX 1343 displays a nice five waves up to SPX 1409, with just minor pullbacks of 10 and 13 points along the way. After reaching SPX 1409 the market declined in a more significant pullback to SPX 1385. We are counting this activity as Minute waves i and ii of Minor 1. The recent rally to SPX 1420, and minor pullback to 1409 looks like it is part of Minute wave iii. Or it may be all of Minute waves iii and iv if the market continues to go sideways for a few more days. In either case we are expecting higher highs shortly. There are a couple of other possible counts, but this looks the most probable at this time.

Keep in mind. It is important to observe how this probable uptrend unfolds as it approaches the bull/bear inflection range of SPX 1434-1462. Should it look corrective it may be a bear market rally. Should it look impulsive the bull market continues. If undecided some hedging might be appropriate. Best to your trading!

FOREIGN MARKETS

The Asian markets were mostly higher on the week for a net gain of 1.0%. Hong Kong, India and Japan are in confirmed uptrends.

The European markets were mostly higher for a net gain of 0.3% for the week. France, the Stox and Switzerland are in confirmed uptrends.

The Commodity equity group were mixed on the week and ended unchanged.

The DJ World index is close to an uptrend confirmation and gained 0.9% on the week.

COMMODITIES

Bonds continue to uptrend gaining 0.6% on the week.

Crude is getting close to confirming an uptrend and gained 0.5% on the week.

Gold’s rally from early November has turned into a choppy pattern as it lost 2.0% on the week.

The USD is close to confirming a downtrend, and it lost 0.1% on the week.

NEXT WEEK

Monday kicks off another busy week with ISM manufacturing and Construction spending at 10:00, and monthly Auto sales. Wednesday: the ADP index, Factory orders and ISM services. Thursday: weekly Jobless claims. Friday: the monthly Payrolls report, Consumer sentiment and Consumer credit. As for the FED. The only thing scheduled is a speech from FED governor Tarullo on tuesday at 10:45. Best to your weekend and week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.