Stock Market Friday – Be Thankful for Small Bounces

Stock-Markets / Stock Markets 2012 Nov 24, 2012 - 03:57 AM GMTBy: PhilStockWorld

Are we going to have a "V"?

Are we going to have a "V"?

We haven't had a good V bounce-pattern in a while – one where the entire drop is entirely reversed on the other side – as if it were some mistake that's correcting itself as quickly as possible. According to ThePatternSite:

"Price at the bottom of the V will form a one-day reversal, island reversal, or tail, usually on heavy volume, perhaps gapping upward. Price trends up, usually at the mirror angle of the downtrend. If price dropped by 30 degrees, price will rise following a similar angle. The price trend tends to be a straight-line run with few or no pauses, often fitting inside a channel."

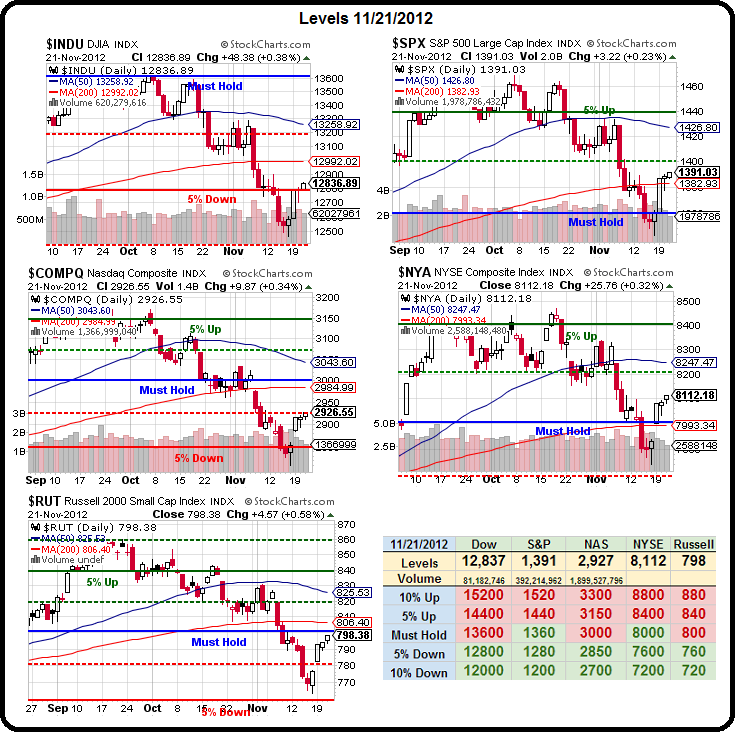

Of course, we don't have a V yet, we just have a bounce off a hard floor that we expected – it's the next 7 days that will be critical but so far, so good on our bottom call. The NYSE is already over our strong bounce line (8,100) and we wait for the rest of the indexes to confirm a recovery at Dow 12,950, S&P 1,400, Nasdaq 3,000 and Russell 805 with less than a 1% move between our indices and their goals – other than the Nasdaq, which needs 2.5% and has been dragging along.

We'd better be up this morning as the Dollar is way down at 80.59 as the Euro climbs back over $1.29 with the Pound at $1.59 and the Yen as weak as it's been in ages at 82.20 to the Dollar. That has been thrilling the Nikkei, which touched 9,450 overnight, up almost 10% from the 8,600 line we liked for a long just 8 sessions ago! While the US doesn't tend to get as excited about a weak Dollar as Japan does about a weak Yen – failing that 80.50 line today should be a fairly bullish indicator for US Equities.

We had some good manufacturing reports from Europe and Asia with Chinese PMI at 50.4, the first growth in 13 months and Manufacturing Output rising to 51.3 in November from 48.2. "The economic recovery continues to gain momentum," says HSBC's Qu Hongbin. "However, it is still the early stage of recovery and global economic growth remains fragile."

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.