Stock Market Falls Over Fiscal Cliff

Stock-Markets / Stock Markets 2012 Nov 08, 2012 - 01:37 PM GMTBy: PhilStockWorld

Down 312 points yesterday.

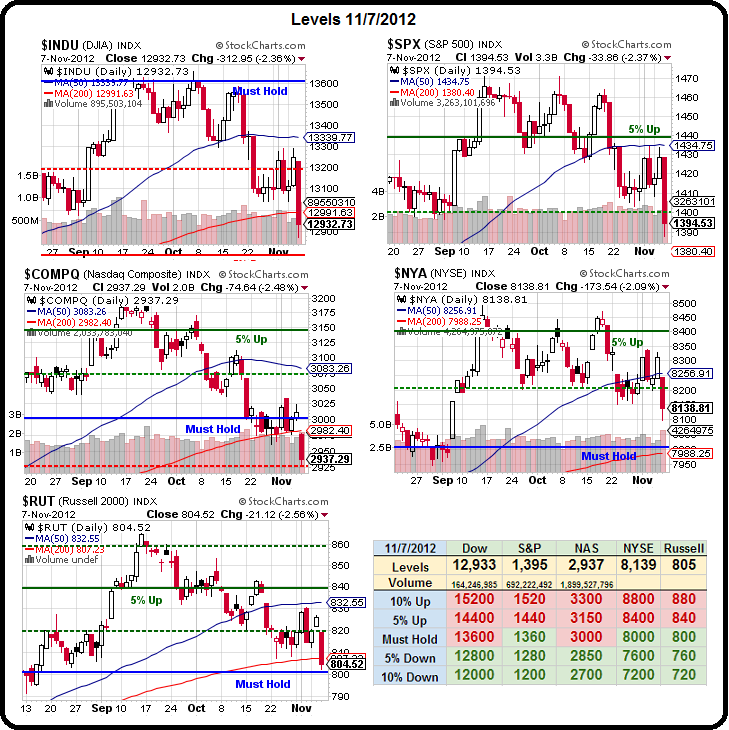

That's a hefty sell-off and we'll see if we get some follow-through but we pretty much hit our downside targets on the head in a single day as I said to Members in yesterday's Morning Alert:

About 13,000 on the Dow. 1,400 on S&P, 2,980 on the Nas, 7,950 on NYSE and 800 on the RUT are about the lows we have to hold – all seem like good spots to go long to me with tight stops if we break below but let's look at this as a head fake except with a bit more conviction as 50% of the population sincerely believes they have to flee the markets before 4 more years of Socialism take us up another 100%.

As I mentioned in the morning post, this is mainly sour grapes selling by Romney fans but there are also legitimate reasons to take some of this year's massive stock profits off the table ahead of possible large increases in capital gains and dividend taxes. Still, we knew this was coming on Tuesday, when the market rallied massively on thoughts of QInfinity and ZIRP as far as the eye could see.

We didn't quite hold our targets so we couldn't get too bullish at the lows but we remain hopeful that there was a bit of over-reaction in yesterday's sell-off and that the truth will lie somewhere in between Tuesday's ephoria and yesterday's panic – let's call it 13,100 on the Dow and 1,410 on the S&P as our goals for Friday and then we can all take a deep breath and think about things over the weekend.

Despite once-again rising bond yeilds, Draghi says whether or not Spain gets an OMT bail-out is entirely up to them and the ECB cannot/will not force them to do so. That's keeping the Euro depressed ($1.274) and the Dollar strong (80.94) and that's keeping a lot of downward pressure on stocks and commodities.

As we expected, oil had a huge build yesterday but we played it long in the futures (/CL) off the $84 line and we're sitting back at $85 this morning after a brief visit to $85.75. Clearly the build in petroleum products was due to the storm but now we have another storm in the Northeast grounding planes and slowing traffic so not too much immediate improvement in oil's…

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.