Stock Market Quarter End Squaring Before the Damn Bursts

Stock-Markets / Stock Markets 2012 Sep 28, 2012 - 05:54 AM GMT I have repositioned the EW structure to simplify it a bit. Today’s rally overlapped wave (1), so yesterday’s decline can only be another wave 1 of a smaller degree. That by no means suggests that the wave itself must be smaller.

I have repositioned the EW structure to simplify it a bit. Today’s rally overlapped wave (1), so yesterday’s decline can only be another wave 1 of a smaller degree. That by no means suggests that the wave itself must be smaller.

If you get into the 10-minute charts, it begins to look more complex, but I don’t think it is necessary. We often find the shape of the waves changing as we go from a 10-minute to hourly to daily or weekly. That’s OK as long as the waves agree in trend, which they do. The best fit for the end of wave (2) is a truncated wave c (5 waves), held down by the Wedge trendline.

The reluctance to go down now, most likely due to end-of-quarter squaring, is more likely to cause a “dam burst” tomorrow or next week. You can see the blue trading bands tighten up, inferring a very large move once the bands are broken.

Citigroup’s Macro Risk Aversion Model just tested historic lows, suggesting that no one is expecting a big decline. SPX has a good likelihood of one more probe to short-term resistance at 1453.26 before reversing hard back down. The Daily Cycle Top is also at 1464.50, which may be an alternate target.

Today’s action has also caused me to change my view on VIX. Overlap of Minor wave 2 with Intermediate Wave (1) has narrowed down the wave possibilities considerably.

Gold has made a reversal pattern that closed at Cycle Top Resistance at 1780.50, but did not challenge its high at 1790.00. SSEC rose inside the Cycle bands to close at Cycle Bottom support at 2015.23.

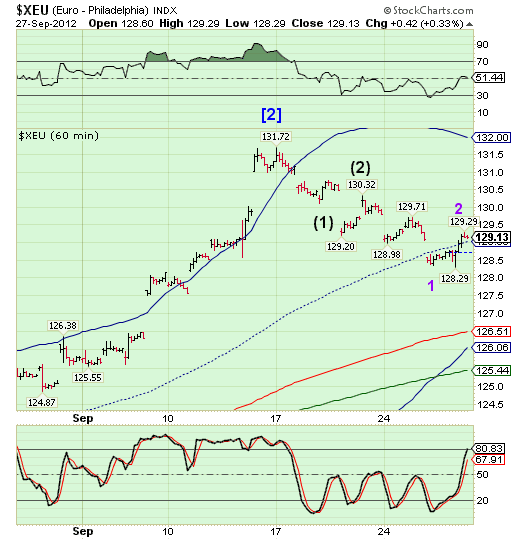

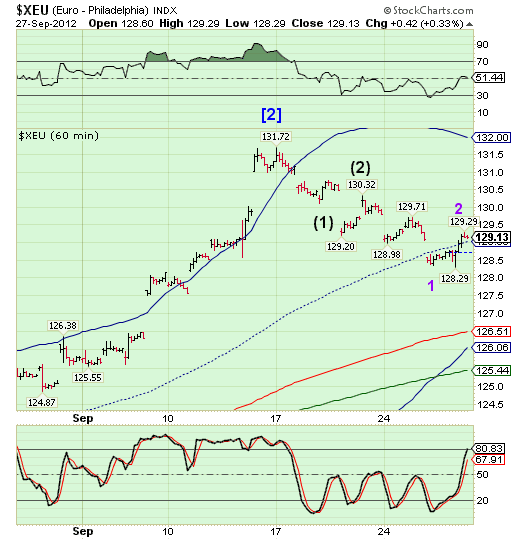

The Euro has made a 1-2 count at 2 degrees and may be finished with its second retracement. I would prepare for the Euro to start dropping in the overnight session.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.