U.S. August Employment Data Contains Ample Evidence to Justify QE3

Economics / Employment Sep 08, 2012 - 11:01 AM GMTBy: Asha_Bangalore

Before examining the nitty-gritty aspects of the August employment report, the main take away is that the overall tone of the numbers is disappointing. In addition, recent economic reports also cast a long shadow. The three consecutive monthly readings of the factory PMI that are below the critical mark of 50 (which denotes a contraction in factory activity) and the drop in July construction outlays are each sufficiently worrisome signals to win over the skeptics in the FOMC.

Before examining the nitty-gritty aspects of the August employment report, the main take away is that the overall tone of the numbers is disappointing. In addition, recent economic reports also cast a long shadow. The three consecutive monthly readings of the factory PMI that are below the critical mark of 50 (which denotes a contraction in factory activity) and the drop in July construction outlays are each sufficiently worrisome signals to win over the skeptics in the FOMC.

On the positive side, the increase in auto sales during August is noteworthy. But it is important to note that, on balance, economic data have failed to shake off the sluggish performance of the U.S. economy in the second quarter and continue to underscore weak economic fundamentals. Against this backdrop, the reference in the minutes of July/August FOMC meeting that “many members” are willing to put in place additional monetary policy accommodation “fairly soon” and Chairman Bernanke’s Jackson Hole strong remarks about the labor market are useful to bear in mind.

“As we assess the benefits and costs of alternative policy approaches, though, we must not lose sight of the daunting economic challenges that confront our nation. The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years.”

The bottom line is that the odds of monetary policy easing at the September 12-13 FOMC meeting have risen.

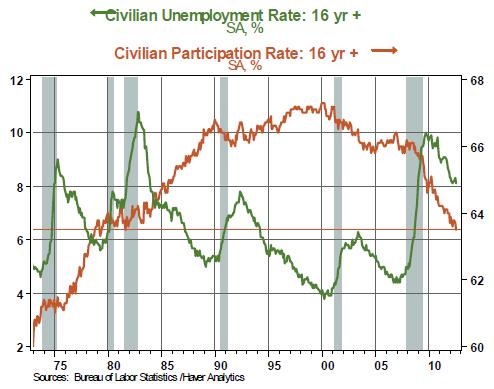

From the details of the household survey, the nation’s unemployment rate fell to 8.1% in August from 8.3% in July. At first blush this is impressive. But, digging deeper, the numbers show indicate that a decline of the labor force (-368,000) resulted in a lower unemployment rate. The unemployment rate has essentially not budged from the narrow range of 8.1% - 8.3% in the first eight months of the year. The labor force participation rate (63.5%) dropped to lowest level since May 1979. Our preliminary research suggests that the decline in labor force participation is a combination of demographic and cyclical forces, implying that monetary policy easing is still suitable to bring about a reduction in the jobless rate.

Chart 1

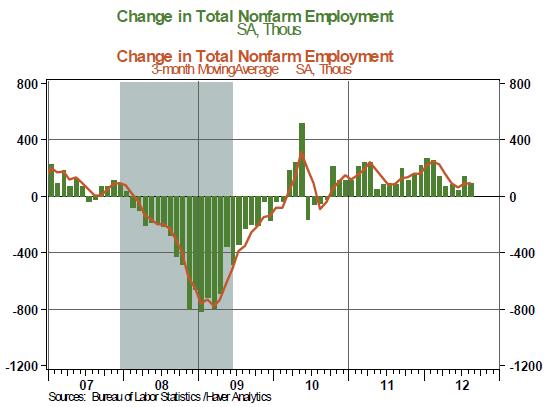

The establishment survey numbers also paint a sluggish hiring picture. Payroll employment advanced only 96,000 in August, following an increase of 141,000 in July. Private sector employment also shows a tepid gain in August (119,000 vs. 139,000). The important point to note is that the job creation is losing not gaining momentum (see Chart 2), which is troubling given the age of the economic recovery (39 months old). Almost all sectors of payroll employment show lackluster gains (details are found here).

Chart 2

The total man-hours index moved up slightly in August (+0.1%); the 0.4% decline of the factory man-hours index bodes poorly for industrial production in August. Both hourly and weekly earnings were virtually unchanged in August and point to a steady reading of the wage and salary component of personal income in August.

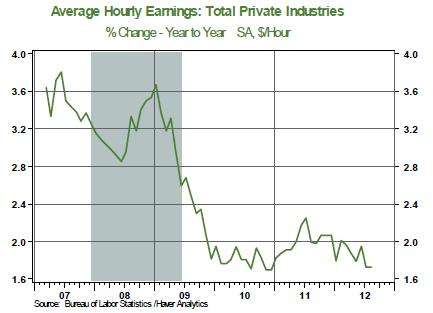

Chart 3

The decelerating trend of earnings is indicative of the absence of inflation pressures from the labor market and allows the Fed to focus on the full employment part of its dual mandate.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.