Can the Stock Market Avoid the Election Year Dip?

Stock-Markets / Stock Markets 2012 Sep 01, 2012 - 03:37 AM GMTBy: Sy_Harding

If the last three election years are any indication, the history of the three-month period of August, September and October usually being a downer doesn’t go away just because it’s an election year.

If the last three election years are any indication, the history of the three-month period of August, September and October usually being a downer doesn’t go away just because it’s an election year.

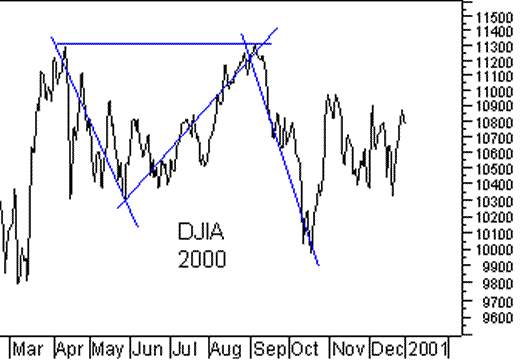

Perhaps ominously, this year the market is following a similar pattern to the election year of 2000, the year of the bitter George Bush Jr./Al Gore election. There was a sell-off from April to an early June low. That was followed by a similar summer rally that carried the market all the way back to the April high by the end of August. The Dow then plunged 15% to its October low. The Nasdaq plunged 27% to its October low, and 38% to another low in November.

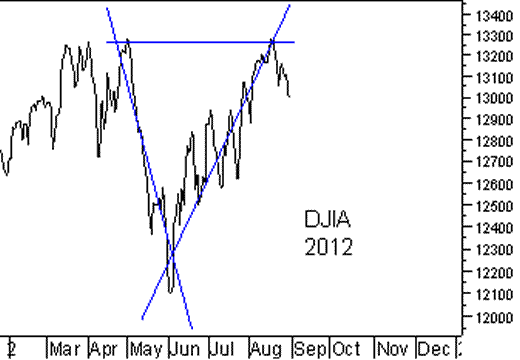

This year so far it’s a similar pattern.

In 2004, as the George Bush Jr./John Kerry election approached, the Dow fell only 4.5% from its August high to its October low.

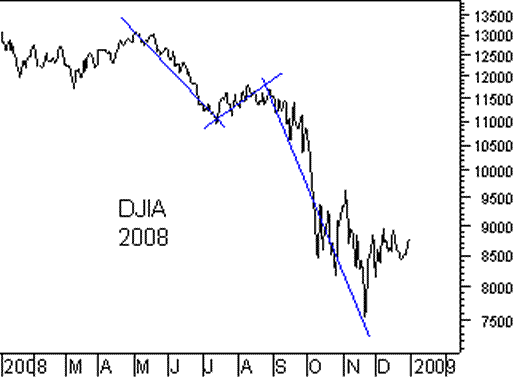

But in 2008, as the contentious Obama/McCain election year played out, the market again topped out in late April to a June low. Its summer rally again ended in late August, and the Dow plunged 35% to its low in November, while the Nasdaq plunged 46%.

The pattern this year is also similar to last year, a non-election year but a year when markets also awaited a hoped for rescue by the Fed and ECB.

There is another similarity this year to elections since 2000.

Neither side shows any indication of meeting in the middle after the election to try to resolve the serious problems the nation faces, including the ‘fiscal cliff’ that looms early next year.

The old-fashioned idea of democracy meaning that elections are held, the majority wins, and then both sides pretty much pull together and work for the good of the country until the next election, went away in the late 1990’s, replaced by the pre-election differences continuing and becoming even more bitter and divisive in the years after elections.

I don’t know if that’s why the pattern of election years usually being positive for markets changed so dramatically with the 2000 election, but I think the widening political divide between left and right accounts for much of the going-nowhere difficulty the country has had since.

That’s particularly troublesome given that the Federal Reserve has been saying this year that it can only do so much from the monetary side, that Congress must now step up from the fiscal side, a view Fed Chairman Bernanke reiterated in his Jackson Hole speech Friday morning.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2012 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.