The Dogs of the Global Stocks Bull Market

Stock-Markets / Global Stock Markets Aug 30, 2012 - 05:29 AM GMTBy: Donald_W_Dony

The BRIC countries have long been touted by analysis and economists as the 'darlings' of the global economy. China, Brazil, Russia and India have had some of the highest GDP of any countries in the world over the past 5-10 years. These economies have all of the right fundamentals for a thriving equity markets. Yet these four countries have produced some of the worst indexes performances in the last two or three years.

The BRIC countries have long been touted by analysis and economists as the 'darlings' of the global economy. China, Brazil, Russia and India have had some of the highest GDP of any countries in the world over the past 5-10 years. These economies have all of the right fundamentals for a thriving equity markets. Yet these four countries have produced some of the worst indexes performances in the last two or three years.

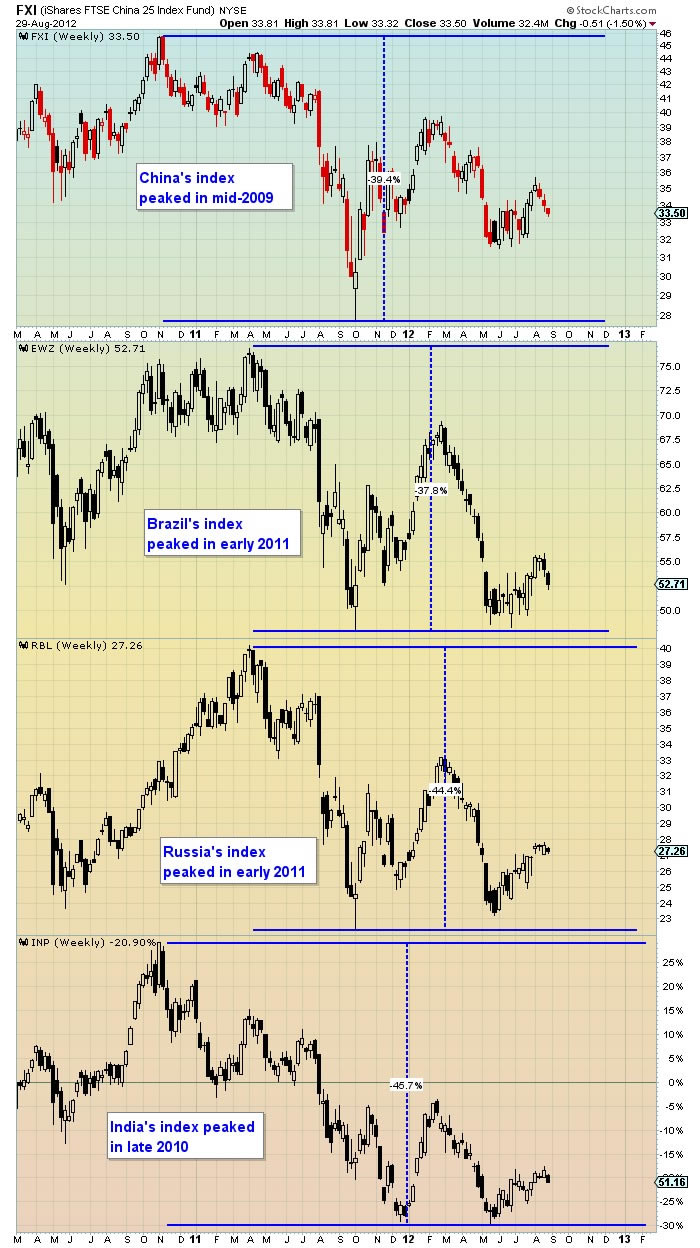

China's index, in particular, was one of the first globally to top out once the world bull market started in early 2009. It did not even have a full year of rising.

Brazil, another strong economic contender, widely recommended as a new emerging powerhouse, has failed to live up to the hype. Their index crested in early 2011.

The markets of Russia and India are no better. Both peaked in early 2011 and late 2010 respectively.

All four equity indexes have plunged over the last two years. Their average decline has been -41.5%.

Bottom line: Bullish economic data does not always produce bullish equity markets. These four economies have been at the forefront of the global recovery but that growth shows no signs of materialize in their stock markets.

Investment approach: Investing on pure economic data does not guarantee a strong performance from the stock market. A visual check is always recommended along with the fundamentals.

In contrast, the US economy is progressing at its slowest level since 2002. The S&P 500 has been the top performer during this bull market.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2012 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.