Stock Market Kiss of Death, Get Out the Popcorn, The Show is About to Begin

Stock-Markets / Stock Markets 2012 Aug 15, 2012 - 12:21 PM GMT Friends, you are looking at the game changer for the world markets. There are several reasons why.

Friends, you are looking at the game changer for the world markets. There are several reasons why.

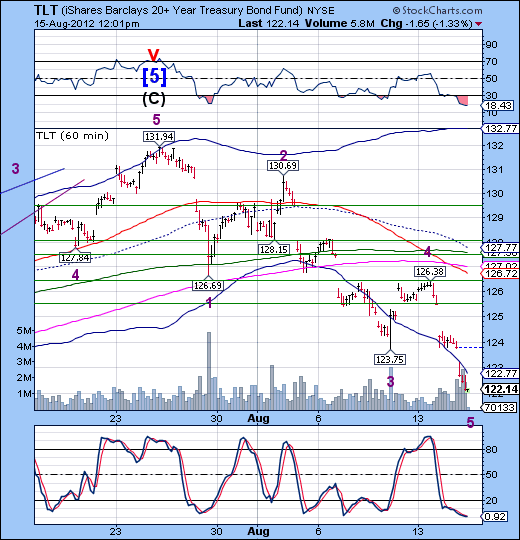

The first is that this tolls the death knell for the bond carry trade that has sustained the banks for so long. In essence, they could borrow from the Fed at .25% and invest in notes and bonds at 1.8% (notes) to 2.8% (bonds) and profit from the “carry” or spread. Naturally, as notes yielded less and less, banks switched to bonds for the higher yield.

That practice could continue only as long as yields were dropping and NAV was rising. That has now changed. Today the long bond NAV has dropped 7.5% in one month. That would take three years to earn back at today’s yields!

Not only that, but many banks were leveraged in the bond carry at 30- or 50-to-1. Man bank portfolios are now under water. Treasury bonds and notes are the last AAA-rated assets that may be used for collateral. That means Bank of America and several others may, in fact, be insolvent by these standards.

What we are witnessing is the tipping point toward debt aversion, as major banks may no longer be able to see their margins being pressured, much less gutted by this move in TLT.

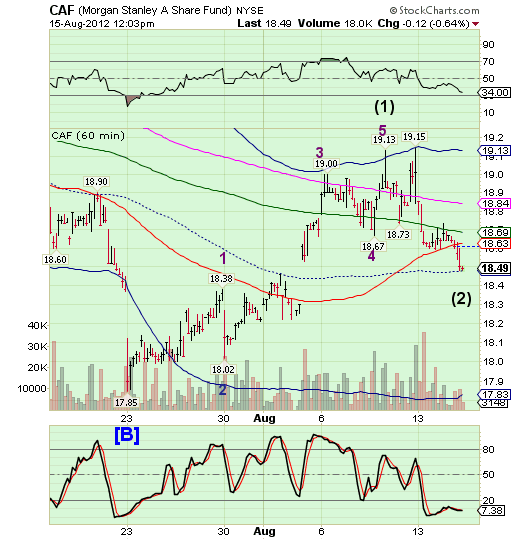

Meanwhile, CAF has now retraced to its 50% level, as I had expected. Unfortunately, it took a few twists and turns to arrive here, but this is the sweet spot to go long CAF.

Several observers have told me that SPY/SPX isn’t doing anything. Well, it has. It has broken its diagonal trendline and may be performing the “kiss of death” against it. Like ill-fated lovers, SPY must part with its uptrend. After all, it was only a fling.

VIX has made its reversal pattern and is prepared to rocket higher. The Cycles Model strongly suggests that VIX will go quite far by August 29-31. Day 17 of the new cycle is August 30. Get out the popcorn and soft drinks and enjoy the show!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.