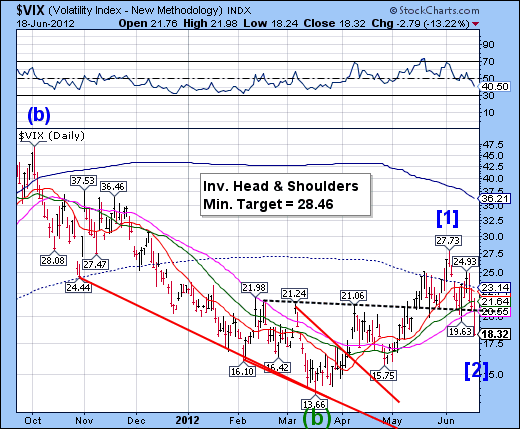

How Can VIX Get So Low When Market Risk is High?

Stock-Markets / Stock Markets 2012 Jun 19, 2012 - 03:58 AM GMTTraders are scratching their heads about the dismal showing in the VIX today. How in the world can the VIX get so low when the market is so much at risk? Well, as the saying goes, the market will do what it wants to do. In this case, it is due, not only for a Primary Wave [2] low, but also a Master Cycle low. In Cycles jargon, tomorrow is a Primary Cycle pivot day, as well.

Tomorrow is also day 235 in the Master Cycle that began at the October 28 low. Granted, it’s a bit early, but I’d rather get it out of the way sooner rather than later, wouldn’t you? The fact is, the October 28 Master Cycle is getting old and the March 16 Master Cycle seems to be dominating the market.

So far, VIX has retraced 67.8% of its rally. It could go to the 76.8% retracement, or 16.92, given that tomorrow is the most likely pivot date. Regardless of the details, this is yet another reason for the markets acting “squirrely” today.

Today appears to be a double pivot Trading Cycle high. You may already know that I follow at least 2 cycles per ETF. Many cycles analysts follow only one (usually the trading) cycle. What I have discovered is that there are multiple cycles at work and tracking more than one cycle gives more valuable information about what is transpiring, since one cycle may dominate the other. In this case, the two cycles coincide perfectly. What they are warning is that there aqppears to be a steep, 17 calendar day decline straight ahead.

GLD also has a double pivot day today. UUP had a double pivot on Saturday, which explains the reversal at the open.

Good luck and good trading!

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.