The Smell of Market Fear: Stocks Typically Fall Faster than they Rise

Stock-Markets / Stock Markets 2012 Jun 12, 2012 - 01:50 PM GMTBy: EWI

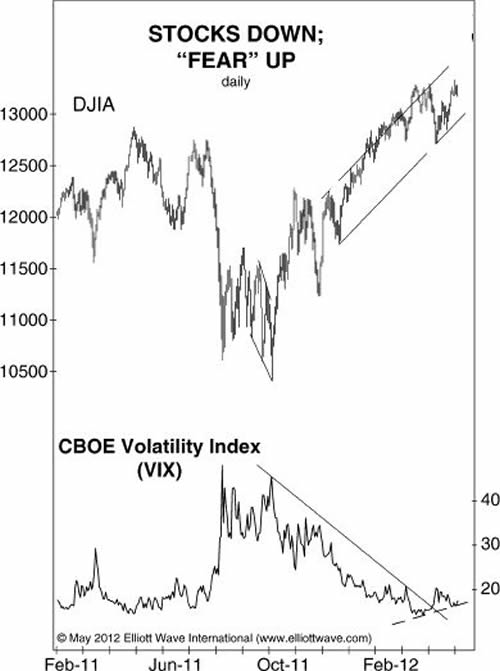

Rising stock prices vs. investor fear: When one is present, the other is usually absent.

Rising stock prices vs. investor fear: When one is present, the other is usually absent.

Yet the two were actually in each other's company around the time of the most recent high in the Dow Industrials (May 1):

This week the Dow carried to a new recovery high without generating a corresponding new low in the VIX. This suggests a sudden hesitancy compared with the all-out, risk-on stance registered by the VIX's behavior in March. The NASDAQ's non-confirmation against the Dow's new high also suggests a sudden reticence to ramp up portfolio risk. Last year, EWFF used a similar hiccup in the VIX to help identify the May 2011 high. With the Dow at or near the end of its rally, the odds favor a similar outcome now. Elliott Wave Financial Forecast, May 3, 2012

Here's the accompanying chart from that issue (wave labels removed):

When the markets were still going up at the beginning of 2012, were you warned that they would soon go down?

Read the full May issue of the Elliott Wave Financial Forecast FREE for a limited time (a $29 value)

Read the full May issue of the Elliott Wave Financial Forecast FREE for a limited time (a $29 value)

No one should invest a dime in U.S. or European markets until they read this 10-page report at least 3 times. Get up to speed and ahead of the markets now. Read the May 2012 Elliott Wave Financial Forecast from Elliott Wave International and get the complete big-picture forecast for U.S. and Europe -- financially, economically and socially.

Download your free 10-page report now >>

This article was syndicated by Elliott Wave International and was originally published under the headline The Smell of Fear: Detecting the Dow's Scent. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.