Are we to Bame Nixon for Fed Money Printing Market Trends?

Stock-Markets / Stock Markets 2012 May 27, 2012 - 08:33 AM GMTBy: Darah_Bazargan

The Fundamental forces driving this market higher for the short term is partly due to the expectation of QE3. Ben Bernanke will ultimately prime the printing pump again, but only after we see the selling pressure intensify.

The Fundamental forces driving this market higher for the short term is partly due to the expectation of QE3. Ben Bernanke will ultimately prime the printing pump again, but only after we see the selling pressure intensify.

There is still plenty more downside left of this market, which is why I'm telling you not to believe this current rally. It is simply a contra-trend within a larger decline, but only for the intermediate term.

What do I mean by that? While there are those per-ma bears who feel we are doomed for a deflationary environment, and on this basis, prices will likely head south to retest the march 09' lows. Folks, there is still plenty of evidence that suggests this is only a mild correction within a larger bull market.

Here are several things to consider....

Ever since President Richard Nixon eliminated the gold standard, the value of money is determined by a basket of currencies. This means the value of our dollar is at the mercy of central banks, and believe me, their priorities are to pay back sovereign nations with cheaper money. This will alleviate them from their enormous debt obligation, but also achieving something much worse- destroy the purchasing power of your bottom line wealth.

The Federal Reserve has made it clear that they will do whatever it takes to avoid another 08' collapse, and now more than ever are firewalls in place to prevent such from happening.

Think about it. For the past year the Market has been masking several dramatic developments that could have, and should have led to catastrophic consequences. They were- the bankruptcy of M.F. Global, J.P. Morgan's announcement of a $2 billion dollar loss on risky credit derivative bets, and the growing magnitude of Europe's economic contraction. Yet the market shrugged it off like a bad case of flees.

And I should also mention that only a handful of Market Indices in the entire world have managed to decisively clear above their previous 2011 highs. I'll give you a hint, they all trade in the United States. Why do you think that is?

You see, The U.S. dollar still holds the World Reserve Currency status, and by default, is considered a safe haven to other international currencies. For this reason, citizens of Europe have been taking money out their home land (real estate, banks, European stock market, etc.) only to re-allocate these funds where the return on investment has a more promising outlook.

We are beginning to see the early stages of this process come into fruition. However, the question that remains is where exactly will all this money go? It can't all go into the Dollar, nor can it all go into gold. It will spread throughout every asset class of the Stock Market , and consequently, re-inflate stocks and commodities to new all time highs.

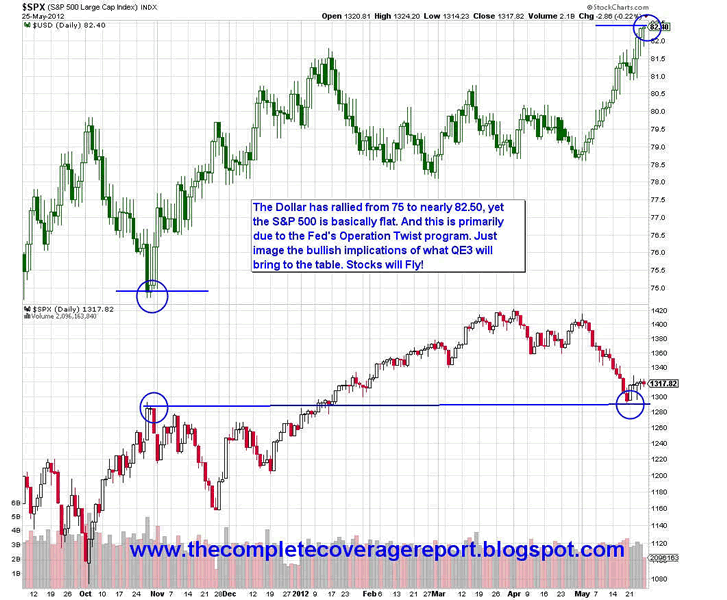

S&P 500 v. U.S. Dollar

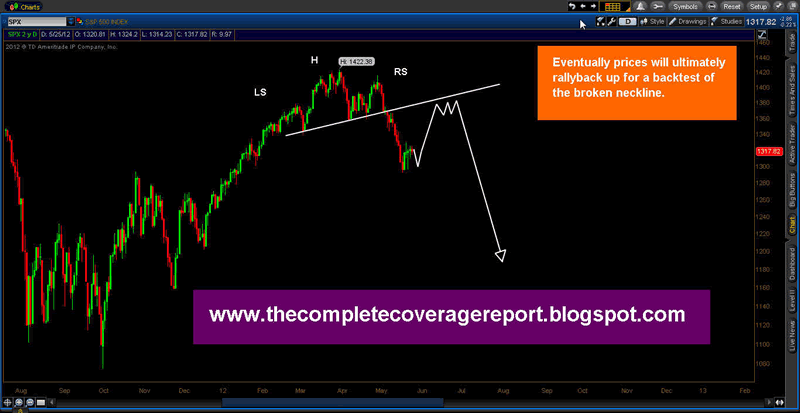

S&P 500- Daily Chart

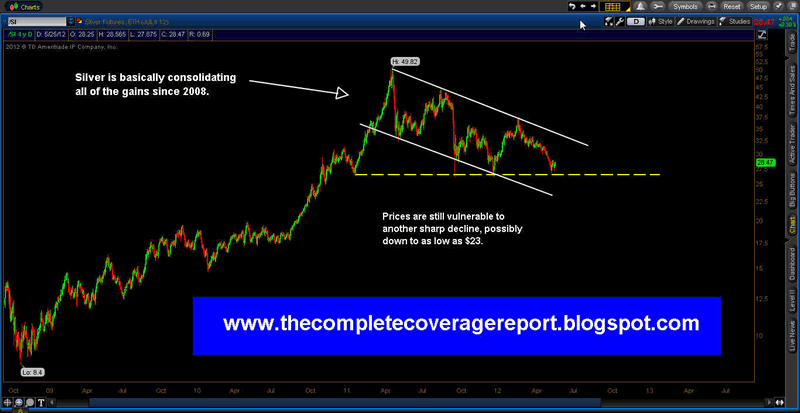

Silver- Daily Chart

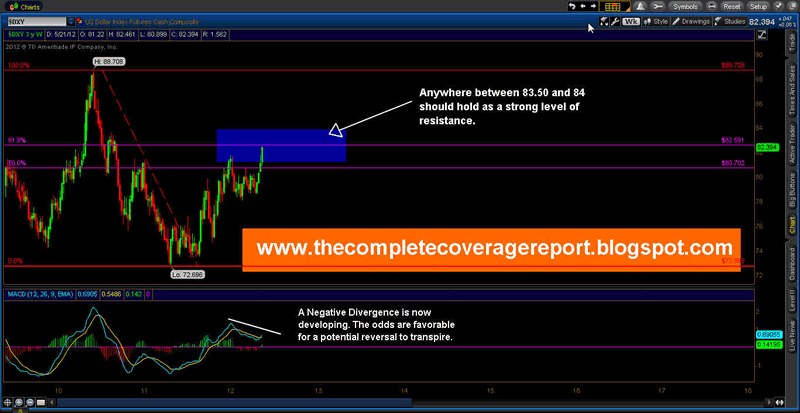

The U.S. Dollar- Daily Chart

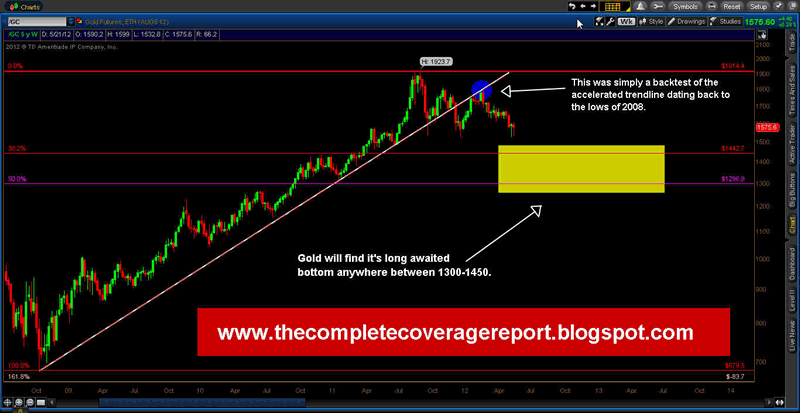

Gold- Weekly Chart

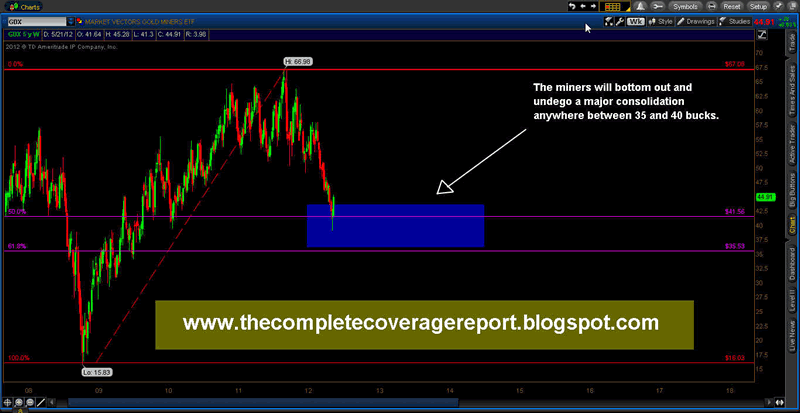

GDX- Weekly Chart

www.thecompletecoveragereport.blogspot.com

© 2012 Copyright Darah Bazargan - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.