Fool Britannia

Interest-Rates / UK Debt May 23, 2012 - 10:17 AM GMTBy: Jan_Skoyles

So, we started last week with the news that the great British pound, one of the world’s oldest currencies is increasingly being seen as a safe haven. This is alongside the US dollar and the Japanese yen.

So, we started last week with the news that the great British pound, one of the world’s oldest currencies is increasingly being seen as a safe haven. This is alongside the US dollar and the Japanese yen.

Some seem to be surprised by the pound’s climb to safe-haven status, but it may not be that surprising.

So far, since the election in 2010, our conservative-liberal coalition has fed the electorate and the international markets with austerity flavoured medicine; telling us that they know it tastes bitter, but things that are good for us rarely taste it as well.

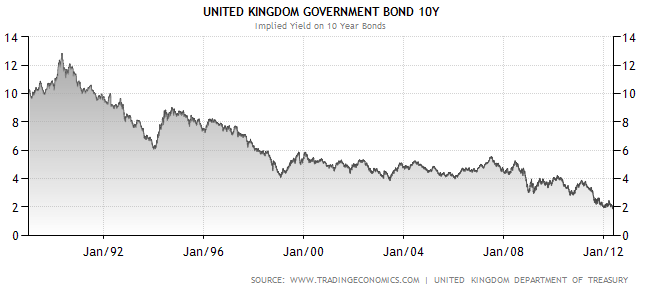

This in turn, seems to have had two effects: one is dire local election results for the coalition parties on account of dislike towards austerity measures; the second is that UK government bonds are now at all-time lows as the markets flock to the apparently austere and secure country.

As Dr Tim Morgan writes in a recent report, the ‘reality of fiscal austerity’ is something which all political parties seem to agree. According to the shadow Chancellor, the coalition’s austerity cuts are too harsh and coming too quickly.

The coalition defends these accusations, keen to state that the strict austerity plans are vital to maintaining the UK’s triple-A safe-haven status.

But all of this is somewhat a mirage. Because when you get up close and look at the figures there is no way that Great Britain is an oasis for the bond markets or experiencing austerity. It seems we have been fed an inert pill in the hope of a placebo effect.

Just this week, Mervyn King, Governor of the Bank of England, was forced to announce that we would be rocked by the oncoming Euro onslaught, despite David Cameron’s efforts to avoid the hangover.

The idea that we could reasonably hope to sail serenely through this [crisis] with growth close to the long run average and inflation at 2% strikes me as wholly unrealistic. We’re bound to be buffeted by this and affected by it.

But did the markets react? Well, not by much. The pound dropped slightly against the dollar, but not enough to send us into a panic.

This all goes to show that the UK has done a superb job in ‘trying to placate (for which read “dupe”) the bond markets by combining maximum spin with minimum substance,’ as Dr Tim Morgan so delicately put in his report.

Sovereigns use the bond market for the long-term funding of public expenditures.

The UK Government likes to think of the record lows to which gilt yields have sunk to be a vote of confidence by international investors in its plans for fiscal consolidation… – Jeremy Warner

However its ‘plans for fiscal consolidation’ are just that, ‘plans’ very few of them have been implemented.

The ‘austerity campaign’ being spearheaded by the government, is anything but. The reality is that there has been very little decrease in public spending (just 1.1%). Public expenditure was in fact up by 3.4% in 2011-2012 compared to 2008-2009. In truth, the British government are merely hoping to use the increased levels of taxation to fund the deficit. As Dr Morgan writes, ‘the tale of ‘big’ cuts in public spending is a bare-faced deception.’

The current government came to power 2 years ago, as Dr Tim Morgan writes, it is easy to spot the coalition’s ‘Big Lie’ when it comes to their austerity measures:

- ‘At £123bn, the deficit remains higher than it was in 2008-09 (£100bn), the year which preceded the Labour government’s £31bn pre-election hike in spending.

- Of the £38bn fiscal consolidation achieved since 2009-10, three-quarters has resulted from higher taxes and only one quarter (£8bn) from spending cuts.

- At constant (2010-11) values, taxes have increased by £30bn since 2009-10, absorbing three quarters of the entire increase in real GDP (£40bn) over that period.

- Far from driving down indebtedness, public debt (on the Maastricht Treaty definition) has increased from £1,032bn in March 2010 to £1,250bn in March 2012, and the ratio of debt to GDP has risen from 71% to 84%.

We are now in a double-dip recession, our first since 1975. Jonathan Portes has long predicted that this would be a longer and tougher period of depression than that seen in the Great Depression. It seems that now economists on both sides of the pond are agreeing. But still the markets remain confident with the UK pound, UK government bonds and the UK government, and for the moment are happy to dance along to the ‘austerity’ music. In the past two years the government have done little to rein in spending, they have assumed three-quarters of GDP increase for themselves and they have increased the debt further. All whilst maintaining an air of fiscal austerity.

By mid-May, the pound had appreciated by 3.6% since the beginning of the year. As Chris Gaffney pointed out earlier this week; this all a bit odd considering the enthusiasm with which the Bank of England has been flooding the market with pounds, one would have not expected an appreciation after all this liquidity.

Best looking horse in the glue factory

Markets continually move money from one place to another. Given the deepening crisis in the Eurozone it’s not surprising money is moving into countries outside of the contagion zone. Goodness, after Thor displayed his dislike of France’s new President, there is little surprise that the markets have lost confidence in the disastrous single currency.

What Britain needs to remember is the Euro Crash on the other side of the channel is just buying us time. Compared to the Euro zone we seem significantly better prepared; we are yet to vote in an extreme political party (but support for non-centric non-status quo politicians is growing) and we are not as interlinked into the Euro as we could have been.

But one must not be fooled into thinking that this mean Great Britain is in a stronger position than its Western counterparts. Unemployment is at a 16 year high and our GDP is 4% lower than its peak in 2008. (Real) inflation remains high above the Monetary Policy Committee’s target, yet Governor King is in denial about the need to increase interest rates. Elsewhere, households are feeling the pinch. In May the decline in household economic activity continued to decline, reportedly dragged down due to low public confidence in the government’s management of the downturn.

External influences

The Bank of England, in their recent quarterly inflation report, stated that the outlook for growth is weaker than they have previously expected. They expect inflation pressures to ‘fall back as external influences fade’. But which external influences are they hoping will ‘fade’?

As we know the Eurozone crisis is showing no signs of cooling down just yet. In the last week alone we have seen disastrous elections, bailouts of banks and further credit rating downgrades. Greece’s long term credit rating has been downgraded from B- to CCC by Fitch’s whilst sixteen Spanish banks and 4 Spanish regions have been downgraded by Moody’s. Last week, the Spanish bond yield rose to 6.31%, a rise of nearly 60bp since early May.

Meanwhile in the US, the FOMC have indicated that they are prepared to consider new actions (read: money printing) should the slowdown worsen. Manufacturing figures in the US have also proved to be ‘disappointing’, with the Philly Manufacturing Index dropping to -5.8% in April, compared to a median of 10.

And China’s gold buying activity (an increase of 10% in Q1) was justified even more when we saw their industrial production figures. May’s year-over-year results show just a 9.3% increase, the first single figure increase since 2009.

As the numbers show, across the major economies there is little chance of this crisis easing off in the foreseeable future. Market participants look to allocate their capital, but currently face sub-optimal choices as financial oppression continues as the central bankers’ modus operandi.

Chris Gaffney is in no doubt that further rounds of QE will be announced in the OECD countries, if they don’t stimulate like this then the governments are admitting defeat for the Western banking system. ‘This time I am expecting a coordinated central bank action that will involve most or all of the major central banks of the OECD: Japan, UK, US, and Europe…One day, we will wake up to find some global message about the need for a coordinated response to a major crisis, and each of the central banks will be issuing some massive new amount of thin-air money.’

He believes the next coordinated action between the central banks will truly, for the first time, raise genuine concerns about the ‘wide scale debasement we are witnessing across the world’s major fiat currencies.’

And then where will the markets find their safe-haven? In a better store of value; gold.

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals.

The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2012 Copyright Jan Skoyles - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.