U.S. Stock Market Indexes Break Support

Stock-Markets / Stock Markets 2012 May 16, 2012 - 01:56 AM GMTBy: Donald_W_Dony

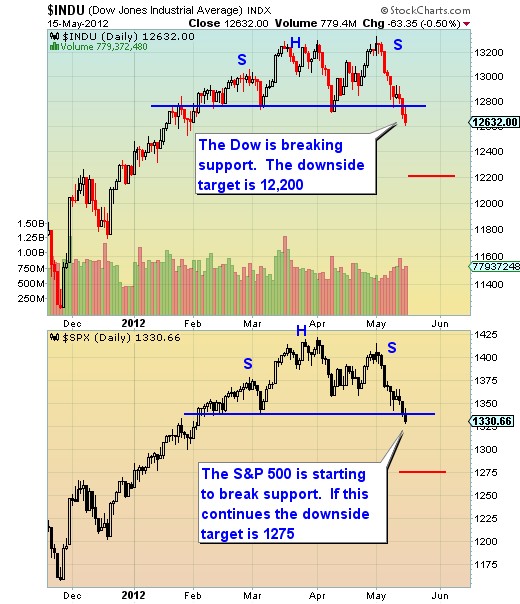

Following the May 9th 2012 Market Minute titled " Downward trend starts", the Dow Jones Industrial Average and the S&P 500 have both broken their key support levels and now appear to be moving lower. The US indexes were one of the few world equity markets that had not started to decline in April or early May.

The broad topping pattern for the Dow and S&P is similar to most other world indexes. The formation is called a Head-and-Shoulders reversal.

The minimum downside target is 12,250 and 1275 respectively.

Bottom line: The US indexes are now expected to trade lower over the next four weeks with a minimum decline of about 4%.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2012 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.