Greece May Trigger Bearish Stock Market Pattern

Stock-Markets / Stock Markets 2012 May 14, 2012 - 05:31 AM GMTBy: Chris_Ciovacco

Over the weekend, there was little in the way of good news coming from Greece. According to Bloomberg:

Greece’s biggest anti-bailout party, Syriza, said for the second time in as many days that it won’t join a unity government, pushing the country closer to new elections that have sparked concerns about a euro-area exit.

Nine-MSN, in a story dated May 14, also gives little encouragement relative to progress in Greece:

Emergency Greek cabinet talks have yielded no clear progress, raising the prospect of new elections that could scupper reforms and drive the country out of the eurozone. If a cabinet cannot be formed by Thursday, when parliament convenes, new elections will have to be called in June.

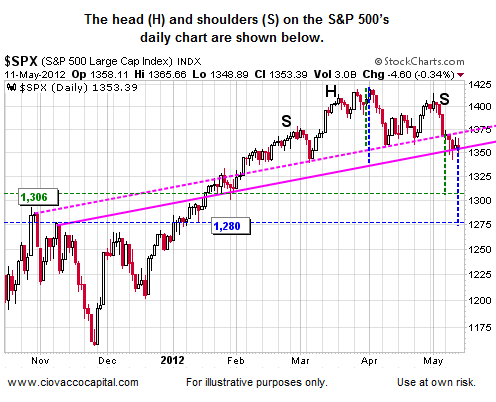

The S&P 500 finished last week firmly in neutral territory and near support. Unless a breakthrough comes in the Greek political stalemate or central bankers step in, the S&P 500 may break below the neckline of a potentially bearish head-and-shoulders chart pattern (see below).

Should the pattern come into play, the video below describes how the possible downside targets of 1,306 and 1,280 were derived. The video also provides updates on the CCM Market Models, DeMark targets, and valuations of blue-chip dividend-paying stocks.

If the S&P 500 futures make a clean break below 1,350 and the CCM Risk Model retreats below 50, we may take another incremental step away from risk. The bulls could get a jump start if a new Greek cabinet can be formed sometime before Thursday.

-

Copyright (C) 2012 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.