Stock Market Downtrend to Resume Shortly

Stock-Markets / Stock Markets 2012 Apr 22, 2012 - 06:02 AM GMTBy: Tony_Caldaro

While Europe was trying to rally for most of the week US economic reports were weighing down the US markets. Reports for the week were mostly negative with 10 declining and 4 rising. On the downtick: retail sales, the NY and Philly FED, business inventories, the NAHB, housing starts, existing home sales, leading indciators, the WLEI and jobless claims rose. On the uptick: building permits, capacity utilization, the M1 multiplier and the monetary base. For the week the SPX/DOW gained 1.00%, while the NDX/NAZ lost 0.65%. Asian markets gained 0.5%, European markets gained 0.8%, and the DJ World index gained 0.8%. Next week FOMC meeting on tues/wed, Q1 GDP, and more Housing data.

While Europe was trying to rally for most of the week US economic reports were weighing down the US markets. Reports for the week were mostly negative with 10 declining and 4 rising. On the downtick: retail sales, the NY and Philly FED, business inventories, the NAHB, housing starts, existing home sales, leading indciators, the WLEI and jobless claims rose. On the uptick: building permits, capacity utilization, the M1 multiplier and the monetary base. For the week the SPX/DOW gained 1.00%, while the NDX/NAZ lost 0.65%. Asian markets gained 0.5%, European markets gained 0.8%, and the DJ World index gained 0.8%. Next week FOMC meeting on tues/wed, Q1 GDP, and more Housing data.

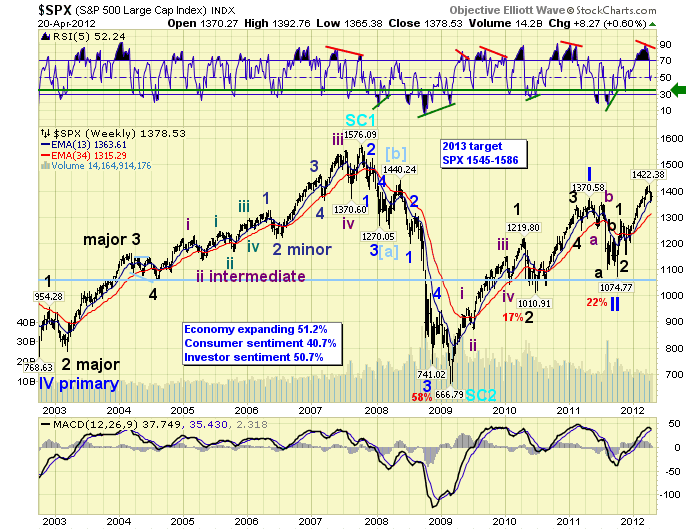

LONG TERM: bull market

The three year bull market has run into some resistance lately as it tried to clear to SPX 1400 level. It ran into the same type of difficulty, to varying degrees, at 1100, 1200 and 1300. This is the normal progression of a bull market. Overall we continue to project a 2013 bull market target high between SPX 1545 and 1586. Since the market has already risen from SPX 667 in March 2009 to SPX 1422 in April 2012, most of the gains would appear to be behind us. Our objective now is to identify the significant waves as the unfold, and label them correctly, so that we can identify the actual high of this bull market.

Longer term we see this bull market as a Cycle wave [1] of a multi-decade Super cycle bull market. The 1932 ‘crash and burn’ event for this deflationary Secular cycle already occurred in 2009. When this bull market does end, however, the market is likely to lose as much as 50% of its value in a few years. This usually occurs during Cycle wave bear markets. Bear markets of a lesser wave degree are, of course, more moderate in terms of overall market loss.

Currently we count the rise from Mar09 at SPX 667 to May11 at SPX 1371 as Primary wave I of the five primary wave bull market. Primary wave II concluded in Oct11 at SPX 1075. Primary wave III has been underway since then. Within Primary III we have identified Major wave 1 at SPX 1293 in Oct11 and Major 2 at SPX 1159 in Nov11. Major wave 3, of the five major wave Primary III, may have concluded at SPX 1422 this month. Only the DOW, of the four major US indices, has confirmed a downtrend thus far. We expect the others to follow shortly. After Major 4 concludes, a rising Major wave 5 should conclude Primary wave III. Then we’ll have a Primary IV correction before ending the bull market with a Primary wave V.

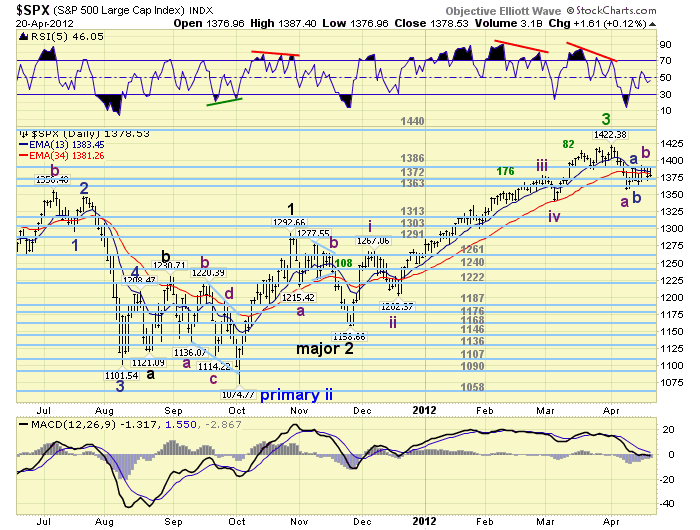

MEDIUM TERM: DOW in confirmed downtrend, SPX likely to follow

The five month uptrend from the Major wave 2 low at SPX 1159 appears to have topped at SPX 1422. We counted five Intermediate waves up during the uptrend: wave 1 SPX 1267, wave 2 SPX 102, wave 3 SPX 1378, wave 4 SPX 1340, and wave 5 SPX 1422. Since Int. wave 5 was the shortest, Int. iv will not likely hold support during this correction.

Thus far we can count Intermediate waves A and potentially B, of a three wave ABC correction, completed. Intermediate wave A ended at SPX 1357, and B appears to have ended at SPX 1393. Intermediate wave C can have one of two fibonacci relationships to Int. wave A. At SPX 1353 Int. C = 0.618 A, and at SPX 1328 Int. C = Int. A. While the SPX 1353 level would be sufficient to form an ABC flat. It would not be sufficient to confirm a downtrend so we’ll put that aside for now. The SPX 1328 level would form an ABC zigzag and fall nicely within the various parameters we have been observing for this correction.

A few weeks ago we pointed out that the mean normal correction during this bull market has been 95-105 points. This projects a correction low around SPX 1317-1327. Also a 38.2% retracement of the entire uptrend occurs at SPX 1322. Therefore, the zigzag C=A pattern at SPX 1328 fits quite nicely into these other technical parameters.

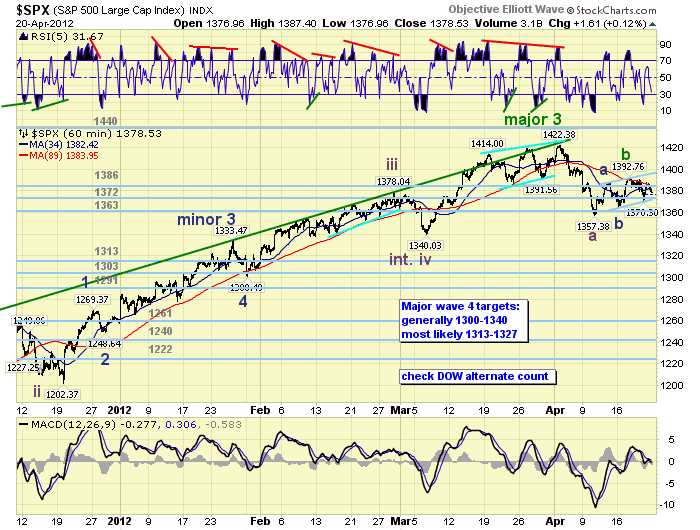

SHORT TERM

After the ending diagonal triangle completed at SPX 1422, the market went into somewhat of a free fall. It declined to SPX 1357 with only three small 8 to 9 point rallies in between. We counted this decline as an ABC, more specifically an abc-x-abc, which apparently ended Intermediate wave A. From that low, the market rose in an abc to SPX 1388, declined in an abc to SPX 1365, then rose to SPX 1393. This should have been sufficient to complete Int. wave B. We do, however, have another one of those symmetrical triangles potentially forming.

During Intermediate wave five of the uptrend we observed a symmetrical triangle forming as the market worked its way higher. The triangle was rising with five point increments between highs and lows: 1414-1387-1419-1392. It then topped at SPX 1422, just two points shy of a perfect 1414-(1387)-1419-(1392)-1424 wedge. Currently we have a potentially similar formation. The rise from the SPX 1357 Int. wave A: 1388-1365-1393-1370. Again this pattern is rising in five point increments between highs and lows. This would project a high for Int. wave B around SPX 1398. If this is to occur it would be the third successive triangle to end a rally. Intermediate wave iii, at SPX 1378, also ended in a diagonal triangle. Interesting market!

Short term support for the SPX remains at the 1372 and then 1363 pivots. Overhead resistance is at the 1386 pivot, and the SPX 1390′s. Short term momentum ended below neutral on friday. The short term OEW charts have been swinging back and forth between positive and negative with each swing above and below the low 1380′s. Best to your trading!

FOREIGN MARKETS

The Asian markets were mostly higher on the week for a net gain of 0.5%. Australia, Indonesia and Singapore are still in uptrends.

The European markets were mostly higher as well for a net gain of 0.8%. Only Switzerland remains in an uptrend.

The Commodity equity sector gained 0.5% on the week. All three; Brazil, Canada and Russia remain in downtrends.

The DJ World index is still downtrending but gained 0.8% on the week. We now have 16 of the 20 world markets we track in confirmed downtrends.

COMMODITIES

Bonds appear to be uptrending but gained only 0.1% on the week.

Crude is trying to establish an uptrend and gained 1.0% on the week.

Gold is also trying to establish an uptrend but lost 1.1% on the week.

The USD is still uptrending but lost 0.9% on the week and remains in a trading range.

NEXT WEEK

The economic week kicks off on tuesday with Case-Shiller, Consumer confidence, New home sales, and the FHFA housing index. On wednesday, Durable goods orders and the FED concludes its FOMC meeting. On thursday, weekly Jobless claims and Pending home sales. Then on friday Q1 GDP, estimates at +2.6%, and Consumer sentiment. Best to your week!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.