Minefields That Can Blow-Up Global Stock Markets in 2012

Stock-Markets / Stock Markets 2012 Apr 12, 2012 - 06:50 AM GMTBy: Gary_Dorsch

Gerald Loeb was most of the most respected analysts on Wall Street, during the Great Depression years and through the following decades. He wrote an epic book, titled "The Battle for Investment Survival," last published in 1965. Many of his pearls of wisdom, concerning the financial markets and rules of investing, have withstood the test of time. Yet one has to wonder though, if Loeb's long held truths about the markets would stand up to the erratic behavior of today's world of high frequency trading (HFT). There is also the heavy hand of the world's top central banks that are actively manipulating and distorting market values, and in turn, upbraiding many of the traditional rules of the game of investing.

Gerald Loeb was most of the most respected analysts on Wall Street, during the Great Depression years and through the following decades. He wrote an epic book, titled "The Battle for Investment Survival," last published in 1965. Many of his pearls of wisdom, concerning the financial markets and rules of investing, have withstood the test of time. Yet one has to wonder though, if Loeb's long held truths about the markets would stand up to the erratic behavior of today's world of high frequency trading (HFT). There is also the heavy hand of the world's top central banks that are actively manipulating and distorting market values, and in turn, upbraiding many of the traditional rules of the game of investing.

Still, one of Loeb's axioms that still rings true today, says, "There is no such thing as a final answer to security values. A dozen experts will arrive at 12 different conclusions. It often happens that a few moments later each would alter his verdict if given a chance to reconsider because of a changed condition. Even the price of a stock at a given moment is a potent influence in fixing its subsequent market value. Thus, a low price might frighten holders into selling, deter prospective buyers, or attract bargain seekers. A high figure has equally varying effects on subsequent quotations," Loeb wrote.

Nowadays, it seems as though the market is always teetering on the knife's edge. Depending upon which way the wind is blowing on any given day, or what chatter is coming across the newswires, markets around the globe are moving at lightning fast speed. Sentiment can change instantly, with the release of unexpected economic data, market movements, or surprising actions of central bankers. The effect of high frequency trading (HFT) has turned the decades old profession of investing into a high stakes gambling operation, and more characteristic of commodity trading. Such erratic behavior on a daily basis makes it difficult, if not impossible, for analysts to formulate a long-term view, and for investors to maintain a long-term, "Buy and hold" position. "As soon as you think you've got the key to the stock market, they change the lock," said long-time market guru, Joe Granville.

It takes a long time for the entrenched "conventional wisdom" to lose its power of persuasion. "A trend in motion will stay in motion, until some major outside force knocks it off its course." Along the way, there are sudden and nasty shakeouts in the markets that cause many traders to quickly lose their nerve and close their bets, fearing big losses. However, the true skill of the Macro Trader is to distinguish between daily price swings, and instead, to anticipate and correctly time, the major changes in market sentiment, that can lead to violent price moves in the opposite direction and quickly wipe-out the market's excesses.

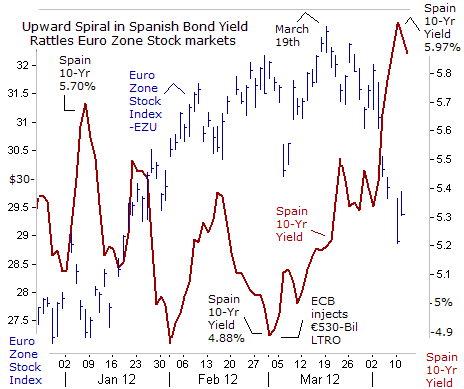

For example, even as Wall Street was celebrating the third anniversary of one of the most powerful Bull markets in history on March 9th, - big trouble was brewing across the other side of the Atlantic Ocean, in the sovereign bond market located in Madrid, Spain. There, the mood is very different, - it's a market filled with fear of default, and once again, beset by upward spiraling bond yields and plunging equity values. Rising concerns over Spain's economy and its ability to handle its €935-billion debts lifted its 10-year cost of borrowing towards 6-percent, sparking fears that Europe's debt crisis is flaring up again after a brief respite.

Uncertainty over Election politics and Taxes in US, It's also an Election year in the United States, that's adding an extra layer of volatility in the global marketplace. If re-elected, President Obama might allow the Bush tax cuts to expire, and therefore allow the long-term capital-gains tax rate to increase to 20%, plus a 3.8% investment surtax to finance Obama-Care. That 23.8% rate amounts to a nearly 60% increase from the 15% rate in effect since 2003. And that's without his new "Buffett rule," which would take the rate to 30% for many taxpayers.Taxes on short-term capital gains would increase by 3% across the board,and dividends will once again be taxed as regular income, plus a 3.8% tax on investment income as part of the health-care overhaul passed in 2009. For the highest earners, tax rates on most dividends, currently 15% is set to jump to a whopping 43.4% next year.

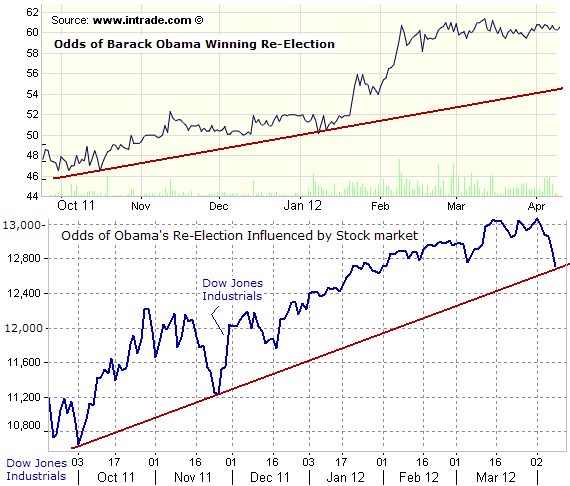

The great irony is, the post October 4th stock market rally, that's lifted the Dow Jones Industrials to above the 13,000-level, a four high year, has also boosted Obama's odds of winning re-election. On-line bettors at Intrade.com, give Mr Obama a 60% chance of winning re-election today. That's up from as low as 46% six months ago, when the Dow Industrials briefly plunged below the 10,800-level. The stock market's recovery rally has created the illusion among the gullible masses of the US-public that a sustainable and healthy economic recovery is underway. That notion was dealt a blow however, when US Labor apparatchiks reported that 164,000 discouraged Americans gave-up looking for work in the month of March, - and more than the net 121,000-workers that found jobs.

During the Obama administration there's been an huge widening of the wealth divide between the rich and poor. That's because 80% of all the stocks listed on the NYSE and Nasdaq, now reaching four-year and 10-year highs respectively, are owned by the top-10% of the richest Americans. Thus, the top-10% has reaped the lion's share of the wealth creation on Wall Street since March 2009, while the remaining 90% of Americans are stuck paying higher prices for gasoline, and are still saddled with chronically weak home prices.

Traders on Wall Street are convinced that the Federal Reserve would come to the rescue of the stock market, with huge waves of money printing, whenever there is a nasty decline that might threat Obama's polling numbers. According to the latest Washington Post-ABC News poll, released April 10th, it finds that if the election was held today, 51% of registered US-voters would pull the lever for Obama, while only 44% favor ex-Massachusetts governor, Mitt Romney. This is actually good news for the Romney camp, since the Republican is still within a close striking distance of the incumbent, even after a brutal primary campaign.

Furthermore, the latest Washington Post-ABC News poll was published by news organizations that are aligned the extreme far left of the political spectrum. As such, the polling data was skewed for political propaganda purposes. The poll was notably tilted to Democratic respondents - the breakdown in the poll was 34% Democrat, 23% Republican, and 34% Independent. Thus, Democrats had an 11% advantage in the poll, even though Democrats only hold a 3% advantage over Republicans among nationally registered voters. The added 8% advantage is what gives Obama his lead in the poll. Otherwise, if measured according to the actual party affiliations, the race for the presidency is about dead even.

History shows that the underdog, Mr Romney can still pull-off an upset victory in November. For instance, in March 1980, President Jimmy Carter led Ronald Reagan by 18% and 25% in some polls. Reagan went onto win the November election by wide 51% to 41% margin. In June 1992, Bill Clinton was running third in opinion polls. Ross Perot had 39%, President George HW Bush 31%, and Clinton just 25-percent. Clinton went onto win the November election by 43% to Bush's 39-percent. All of these candidacies rode the waves of historical events (Oil Shock in 1980, recession in 1992) that unfolded in the months preceding the election, and had a notable impact on the final tally for the presidency.

For Mr Obama, a 7% cushion in the far left skewed opinion polls, might not be enough to ride out the upcoming storm of historical events that could derail his re-election bid. Only a true prophet can predict the future with certainty. However, gazing into our crystal ball, there are renewed signs of extreme turmoil in the Italian and Spanish bond markets, leading to sharply higher interest rates, and threatening to push the Euro-zone's #3 and #4 economies into a deeper recession. Spain is widely considered too big to bail out: It makes up about 11% of the economic output of the Euro-zone economy. Greece makes up about 2-percent.

Despite the best efforts of the European Central Bank (ECB) to calm the sovereign debt crisis and drive bond yields lower, just the opposite has occurred since the ECB's last €530-billion LTRO injection on February 29th. The yield on Spain's 10-year note has turned upward, climbing +110-basis points higher, to as high as 6% this week. Likewise, in a bout of contagion, the yield on Italy's 10-year note jumped óbps higher since March 19th, to as high as 5.66%. That's important, because Italy's bond market is the third largest in the world with roughly 2-trillion Euros of debt outstanding, double the size of Spain's sovereign debts. Italy and Spain are too big to bail-out, and would require a massive ECB rescue operation.

Since peaking on March 19th, the exchange traded fund for the broader Euro-zone stock market index, ticker symbol EZU.N, has declined by -12% to as low as $29 /share, and surrendering most of its gains from the first quarter. The sharp slide of EZU, if sustained, could be the earliest warning signal of a deeper recession that's unfolding in the Euro-zone. On April 4th, the ECB chief Mario Draghi warned, "Downside risks to the economic outlook prevail." He warned that the central bank has done as much as it can to fight the bond crisis, and put the onus for stabilizing the bond markets on the shoulders of the politicians that rule the Euro zone's periphery. "Markets are asking these governments to deliver," their austerity packages of spending cuts and tax increases," Draghi said.

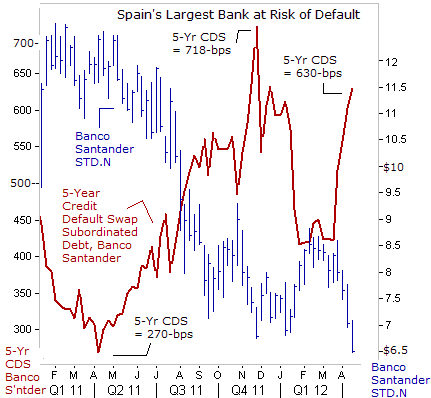

The biggest threat to the global economy has quickly shifted to Spain. The Madrid stock market and Spanish banking stocks continue to tumble. The benchmark IBEX-35 index is down -10% so far this year, and is -30% lower from a year ago.Spain's biggest bank, Banco Santander STD.N) has fallen -18% over the past four weeks, and has dropped more than -45% over the past year. Credit Default Swaps, used to measure the cost to insure the debt of Banco Santander's subordinated debt, for a period of five years, jumped +220-bps higher in the past two weeks to around 630-bps today, meaning it takes €630,000 to insure €10-million of STD's debt against the risk of default.

Shares of Banco Santander skidded to $6.52 on April 10th - a 3-year low. With a stated annual dividend of 92-cents, STD is yielding 13-percent. Traders expect STD to cut its dividend by as much as half, in order to preserve badly needed cash. Whenever a company is forced to cut its dividend in half to conserve cash, there's usually a knee-jerk reaction to sell the company's subordinated debt, sending its borrowing costs higher. The viability of Spain's top-3 banks, Banco Santander, #2 bank, BBVA and #3 bank, La Caixa, is very important, since they collectively hold customer assets worth about $2.7-trillion. That's nearly double the size of Spain's $1.4-trillion economy. In other words: Spain's three biggest banks are too big to fail. Spain's banks may need more capital if the economy deteriorates, Bank of Spain chief Miguel Angel Fernandez Ordonez warned on April 10th, reflecting fresh concerns that some might not survive a severe recession made worse by the government's fiscal austerity drive.

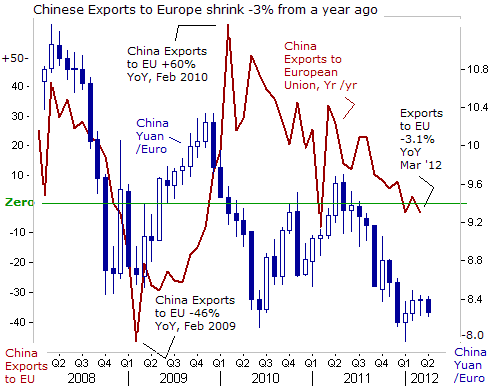

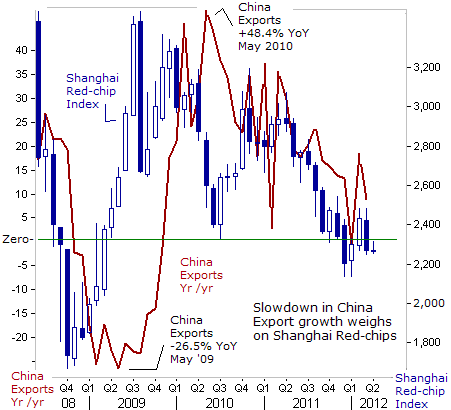

The Deepening Recession in Europe is Spilling over into the Asian sphere, and slowing down the world's economic locomotive - China. Chinese exports ranged between $475-billion to $518-billion in the last three quarters of 2011. However,in the first quarter of 2012, China's exports fell to $430-billion. Factory activity in China shrank for a fifth straight month in March, hit by declining order books, disappointing exports, and new hiring hitting a two-year low, according to the HSBC purchasing managers index. Most worrisome, the new orders sub-index fell to a four-month low of 46.1, from 48.5 in February.

China accounts for 16% of the world's gross domestic product, and is also the world's largest trading nation. However, it remains highly dependent on its export-oriented manufacturing sector, which provides most of the country's jobs. Exports to Europe, its single largest trading partner, were -3.1% lower in March compared with a year earlier, and this declining trend is of great concern to Beijing, which is already trying to engineer a gradual slowdown to +7.5% economic growth this year. Making matters worse, the Euro has lost a third of its purchasing power of Chinese yuan compared with four years ago, making China's exports to Europe more expensive and in a vicious cycle, weakening China's economy further. Meanwhile, an uptick in China's inflation rate to +3.6% in March might restrict Beijing's ability to blunt a sharp slowdown by easing monetary policy in the months ahead.

China's benchmark stock index, the Shanghai Composite, ended March with a -6.8% decline, continuing a long and brutal slide that began in the second quarter of 2009. The National Bureau of Statistics reported that the profits of China's large industrial companies dropped by -5.2% in the first two months of 2012, compared with the same period a year earlier, and marking its first decline in more than two years. The steady drip of negative news has also generated talk of the prospect of a hard-landing for China's economy.

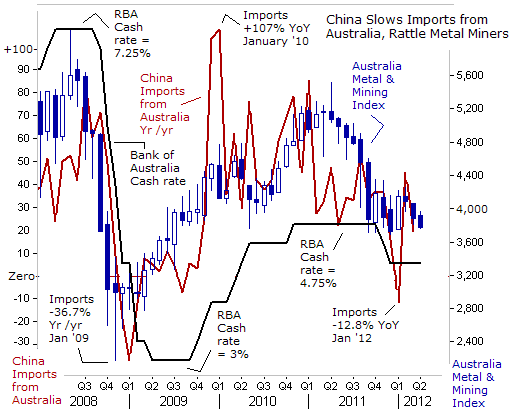

China's voracious thirst for commodities raises the possibility that slumping Chinese demand might exact a heavy toll on commodity exporter nations around the world. Fears of a deeper-than-expected downturn have already knocked the Australian dollar as much as -5.6% lower over the past five weeks, to as low as $1.0225. Australia's currency is a symbol of global risk taking, and has also emerged as a key barometer of Chinese growth trajectory. Because of renewed worries about European debt risks, the Aussie dollar has also dropped by -5% against the Euro since early February, partly reflecting ideas of further rate cuts by the central bank of Australia, to cushion the Aussie economy from a downturn in global trade.

Signs of Economic Cracks in Australia, Australia's economic integration with Asia began in earnest under the Hawke Government in the mid-1980's, has positioned itself brilliantly to benefit from the industrialization and urbanization that's underway in China, India, and other Asian countries. In 2011, Australia's economy expanded +2.3%, andmarked its 20th straight year of expansion, - testimony to its open economy and a flexible currency to absorb external shocks, and to the skills of the Reserve Bank of Australia (RBA).

Much of Australia's good fortune rests on the relentless Chinese demand for commodities. Australia's exports to China increased 25-fold in real terms since 1990. Exports to China climbed +24% to A$72-billion in 2011, from 2010, taking it further ahead of Japan, South Korea and India as Australia's biggest customer.About 26% of all of Australia's exports are shipped to China, with bilateral trade worth $105-billion.Australia's trade surplus for 2011 as a whole hit A$19.3-billion, an increase of +27% on 2010 and the highest on record.

China's demand for iron ore, coal and natural gas, drove Australia's terms of trade, or export prices relative to import prices, to a record high last year. But Australia unexpectedly posted back-to-back trade deficits in January and February, the first consecutive shortfalls in two years, as coal and metal prices slumped, sending the Aussie dollar lower and intensifying pressure on the Reserve Bank of Australia (RBA) to resume cutting interest rates, at the May 1 policy meeting, because overseas shipments account for about a quarter of gross domestic product. Exports fell in February to A$24.4-billion, the lowest level in a year. The value of coal exports, the nation's second-biggest commodity export after iron ore, plunged -21% to A$3.4-billion, the least since March 2011. Overseas sales of goods and services to India, Japan and Korea, which buy about 25% of Australian exports, all declined, it showed.

Australia's metal miners are still stuck in a year long Bear market, with the ASX's natural resource index tumbling towards the 3,800-level, or -27% below its 2011 high. Australia's parliament passed laws for a 30% tax on the profits of iron ore and coal miners on March 14th, after a bruising two-year battle with mining companies, in a major victory for Prime Minister Julia Gillard and her struggling minority government. The tax will affect about 30 miners, including global miners BHP Billiton BHP.N, Rio Tinto RIO.N, and Xstrata XTA.L. The tax aims to raise about A$10.6-billion in government revenue in its first three years.

Traders are pricing in an 87% chance the RBA will lower the cash rate by -25-bps at the next policy meeting. The RBA lowered the overnight cash rate target -50-bps last year to 4.25%, but paused for three straight meetings, while signaling it might resume cutting rates as soon as May, if weaker-than-expected growth slows inflation.

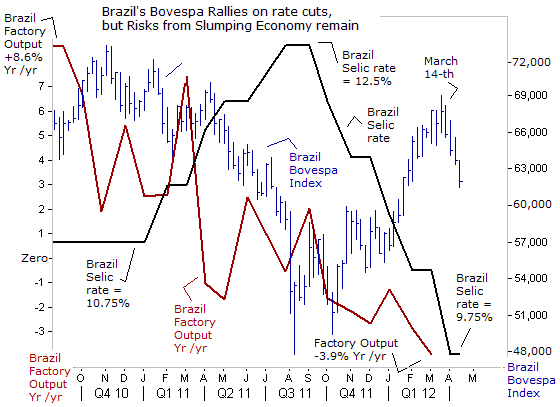

Latin America's Top Economy Stalls at Zero growth, Since 2003, Brazil has steadily improved its macro-economic prowess, building up foreign currency reserves, and reducing its debt profile by shifting toward real denominated debentures. In 2008, Brazil became a net external creditor and two ratings agencies awarded investment grade status to its debt. Large capital inflows over the past year have contributed to the rapid appreciation of its currency, the Real, attracted to Brazil's strong growth and high interest rates.

Brazil has been enjoying an economic boom based on soaring prices for its natural resources including crude oil, agricultural products, such as soybeans, corn, and cattle, and metals such as iron ore and bauxite-aluminum. Brazil now accounts for approximately two-thirds of the output of all of Latin America. Last year Brazil overtook Britain as the world's sixth biggest economy.But while the rest of the world is trying to deal with so many other problems, Brazil's first and foremost issue is the high level of exchange rate of its currency, - the Real, which is hurting its manufacturers, at a time when a slowdown in China and weaker job growth in the US has fueled speculation that global growth is stalling.

Brazil's economy stalled out in the past two quarters, showing near zero growth in Q'3 of 2011 and Q'4 of 2012. Factory output in February was -3.9% lower than a year ago. Yet slower growth was necessary in order to quell the inflation rate, which was quite high, north of +7% in August 2011. For all of 2011, Brazil's economy grew +2.7%, after expanding at a record +7.5% in 2010. "One of our economic difficulties with competing is the exchange rate," said Finance chide Guido Mantega on April 10th. "If needed, we'll take measures so there's not an appreciation of the currency," he warned.

Brazil's President Dilma Rousseff slammed the European Central Bank, the Bank of Japan, the Bank of England, and the Federal Reserve, for unleashing a "tsunami of cheap money that threatened to cannibalize emerging countries," such as Brazil, and forcing them to act to protect struggling local industries. "Quantitative easing" (QE) has damaged Emerging-market nations such as Brazil by unleashing a wave of capital inflows, that has made our currencies overvalued and exports more expensive. We have a currency war that is based on an expansionary monetary policy that creates unequal conditions for competition," said Rousseff.

Brazil's Bovespa stock index has fallen -12% since March 14th, when Beijing said it would lower its growth target to +7.5% for 2012, down from a target of +8% annually over the past seven years. Brazil's stock market was the fourth-worst performer over the past four weeks, as foreign investors sought to avoid losses from adverse currency depreciation. Brazil's central bank chief Alexandre Tombini repeated on April 10th, that he would lower the benchmark Selic rate reaches about 9%, in order to help weaken the Real. The Bank of Brazil has already slashed the Selic rate -275-bps since August, bringing it to 9.75-percent.

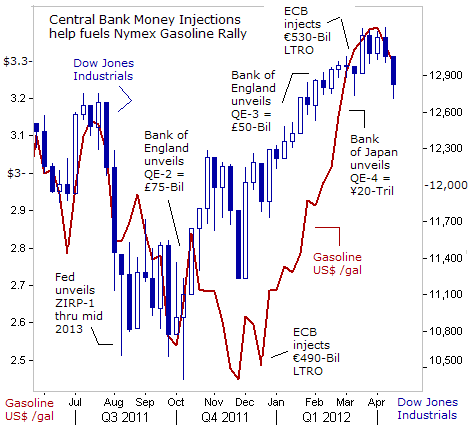

"Gasoline Shock" Threatens Stock market Rally, The tsunami of global liquidity, injected in recent months by the ECB, the BoJ, and the Bank of England, combined with the Fed's Zero Interest Rate Policy (ZIRP), has proven to be a very powerful cocktail that helped to fuel the spectacular surge in the price of crude oil, and its derivative product, - unleaded gasoline. In the US, motorists are now faced with a price of $4 per gallon, on average, and according to opinions polls. In Europe, the price of North Sea Brent hit €96 /barrel last month, nearly +10% above last year's high of €88-barrel. That's significant, because US-oil companies are closing some refineries this summer, and will import the more expensive Brent crude from Europe, in order to produce gasoline for motorists on the East Coast.

For global macro-traders, the question is whether record high oil prices would weaken the world economy, like previous "Oil Shocks" that tipped global economies into recession and triggered Bear markets in equities. Most Americans say higher gasoline prices are already taking a toll on family finances, and nearly half say they think that prices will continue to rise, and stay high. Nearly 2/3's of Americans say they disapprove of the way the president Obama is handling the spike in gasoline prices, according to a left leaning Washington Post-ABC News poll. Sharply higher petrol prices increases the cost of transportation, and are usually passed along by the middleman to the final consumer, thus leading to inflation shock.

Adding to the list of worries, Labor apparatchiks said the US-job market slowed in March as companies hit the brakes on hiring amid uncertainty about the economy's growth prospects. Employers added 120,000-jobs in March, down from more than 200,000 in each of the previous three months. Factoring in those discouraged adults and others working part time for lack of full time opportunities, the jobless rate is 14.5 percent. However, 70% of all job gains in the past six months were concentrated in lower wage sectors, such as restaurants and hotels, retail trade, and temporary employment agencies. Among the economy's better-paying sectors, the jobless rate is closer to 17-percent.

The Dow Jones Industrials dropped than 500-points, for a cumulative loss of -3.8%, from its April 2nd high. The CBOE Volatility Index jumped +8.4% to 20.39, and was up for the eighth straight day, its longest streak of consecutive gains in nearly nine years.Still stock market pullbacks of -5% are as common as the common cold, occurring about four times a year. But price dips still fray nerves of traders because of the fear that small declines will morph into bigger corrections of -10% or more. That's already happened in emerging markets, such as Brazil's Bovespa and European stock markets in Italy and Spain. The Toronto stock index is unchanged from the beginning of the year. Stock markets in Australia and China remain chronically weak, and haven't recovered much from their 2008 meltdowns.

In today's world of lightning fast - high frequency trading, perhaps, the strategy of "Sell in May and Go Away," that worked so well in the past two years has already begun in April, in order to beat the crowd. As always, the key focus is on Wall Street, where 57% of the world's trading in equities happens, and where monies from offshore find a speculative haven. Weak earnings growth, weak jobs growth, recession in Europe, a slowdown in China, the global gasoline shock, higher capital gains taxes in 2013, and bubbles in G-7 government bond markets, are just a few of the risks that investors must consider in the months ahead.

What could prevent a normal pullback from morphing into a larger S&P-500 index correction? Traders haven't given up hope that Fed chief Bernanke would ride to the rescue with another big juicy blast of QE, in order to keep the stock market addicts sedated at artificial highs. Yet Bernanke's dilemma is, another big round of QE could also catapult Brent crude oil to $150 /barrel, and topple the world economy into a synchronized recession. "Oh what a tangled web we weave when first we practice to deceive," -- Sir Walter Scott.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2012 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.