U.S. Job Creation Just Trying to Keep Up Wth Population Growth

Economics / Employment Apr 08, 2012 - 12:37 PM GMTBy: John_Mauldin

Today's employment numbers were decidedly soft, but the unemployment rate went down anyway, and that is about the best you can say. And this being a holiday weekend, it provides us an opportunity to look deep into the employment numbers, while we put off thinking about Spain for at least a week. And who knew that being an unmarried Asian-American in the US was a risk for unemployment? Plus a few other interesting items will make for an interesting letter.

Today's employment numbers were decidedly soft, but the unemployment rate went down anyway, and that is about the best you can say. And this being a holiday weekend, it provides us an opportunity to look deep into the employment numbers, while we put off thinking about Spain for at least a week. And who knew that being an unmarried Asian-American in the US was a risk for unemployment? Plus a few other interesting items will make for an interesting letter.

Just Trying to Keep Up

March saw "only" 120,000 jobs created. Expectations were for 200,000 new jobs. It wasn't all that long ago that any positive number would have been seen as good, but with the last six months averaging 200,000 jobs, this was disappointing. It gives force to the worry that once again we could see the employment numbers get soft during the spring and summer. And adding to interest in the topic, the employment numbers will take on a decidedly political tone this summer, as every poll shows that jobs and the economy is the #1 thing on voter's minds. This will be underscored only four days before the presidential election on Tuesday, November 6, as the jobs report for October is scheduled to be released on Friday, November 2. Think that one won't be analyzed more than usual? I keep writing that the current release is adjusted so often that it is hard to see more than a trend in the actual monthly releases, but that will not keep pundits from using the release to support their candidate with all the spin they can muster.

There is reason to believe that today's lower number was partially due to the weather being so good in the earlier part of the year, so that what is usually seasonal employment started earlier than is typical; so it might be better to average the last two months, which is still disappointing in that it barely stays ahead of population growth. At this rate it will be another three years before we get back to new employment highs, and that does not factor in any population growth. And it also assumes there is no recession in the meantime. Given that the US must start at some point to get its budget balanced, there is little hope that more government spending (aka stimulus) is on the way.

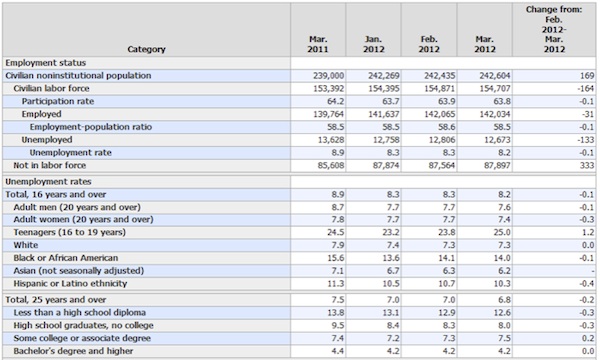

The Bureau of Labor Statistics churns out a massive amount of data each month. Let's look at one table and then discuss what we see. This is Employment Situation Summary Table A of the Household Data report, seasonally adjusted.

First, the unemployment rate fell by 0.1%, to 8.2%. But we see that the number of people who are actually employed dropped by 31,000, so how can the unemployment rate fall? Because the number of people looking for a job dropped by 164,000. If you aren't looking for a job, you are not considered unemployed. Thus the participation rate, or the number of adults either working or looking for work, dropped by 0.1% to 63.8%.

Note that this table shows 133,000 new jobs. This is the HOUSEHOLD report, which is the report created from a survey of households. The 120,000 new jobs number is from the ESTABLISHMENT report, which is a survey of established businesses, plus a guess as to the number of jobs created from new businesses that have been born in the last month, also known as the birth/death ratio. This month the birth/death number added 90,000 new jobs to the total number. The B/D ratio is a very volatile number. It is based on data from the last five years and is projected forward. Again, the unemployment number is taken from the household survey, and the new jobs number is taken from the establishment survey. While you can get a new jobs number from the household survey, it is notoriously volatile and essentially useless as a month to month indicator. As an example, it was 428,000 in February. Variations can run in the high hundreds of thousands month to month.

But over time the household survey gives a pretty good picture and eventually comes quite close to the establishment survey, although there are often some major adjustments after a year or more that help bring the numbers into alignment with the actual numbers that come in from tax data.

Now, let's look at a few other items. You can find employment by age, race, education, and gender. This page has a summary, although you can get very detailed data if you want to. For instance, this month we find that those with a college degree have a 4.2% unemployment rate, while 12.6% of those who did not finish high school did not have a job. Teenagers have a 25% unemployment rate. That number falls with each ten-year increase in age, until we get to those who are over 55, who are down to only 6.2% unemployed. Women have a lower unemployment rate than men at all ages.

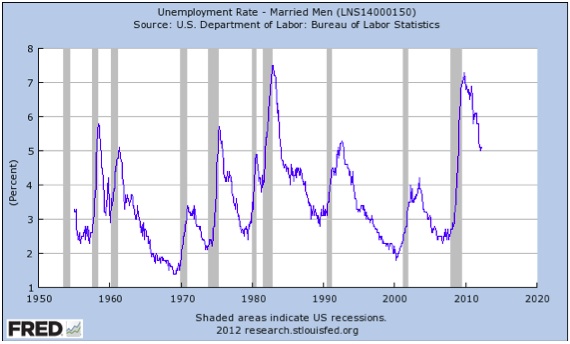

Married men and women (spouse present) seem to fare better, with an average unemployment rate of 5.2%. The graph below shows us that married men tend to lose jobs faster during a recession but also get back to work quicker. I guess it helps you find a job if you have someone reminding you to go to work every morning.

If you had never been married you had a 12.5% chance of being out of work in March. For what it's worth, Asian-Ameroicans seem to do slightly better in most categories than whites, while African-Americans have almost twice the unemployment levels. Hispanics are about halfway between whites and blacks across the board. One odd thing that stuck out was that married white couples have a lower rate (5.3%) than Asian couples (6.2%) while never-married whites are unemployed at 10.5% and Asians at 9.2%. I am sure my readers, both Asian and white will have all sorts of anecdotal reasons for this, but even though I have Asian daughters and black sons (adopted, for those who wonder how), I don't get that one. You can find more data than you want to think about at http://www.bls.gov/web/empsit/cpseea10.htm .

Participating in the Labor Force

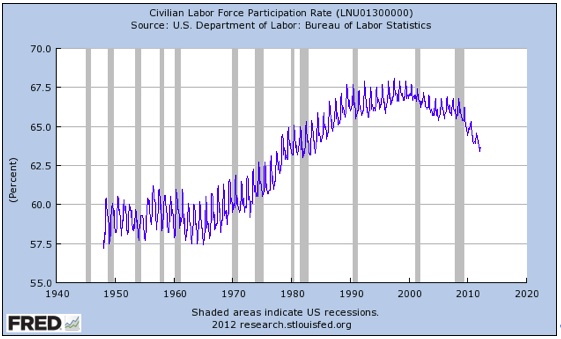

Earlier we talked about the "labor-force participation rate." TThis is the percentage of working-age persons in an economy who are employed or are unemployed but looking for a job. Typically "working-age persons" is defined as people between the ages of 16-64. People in those age groups who are not counted as participating in the labor force are typically students, homemakers, and people under the age of 64 who are retired.

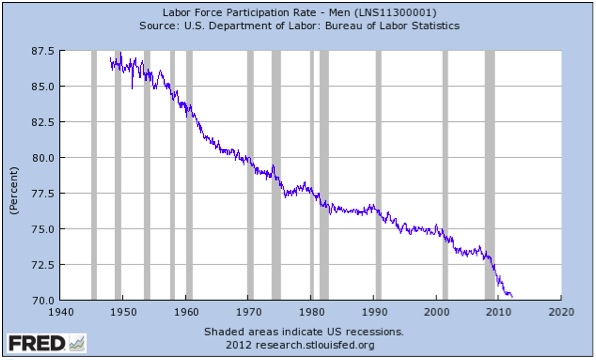

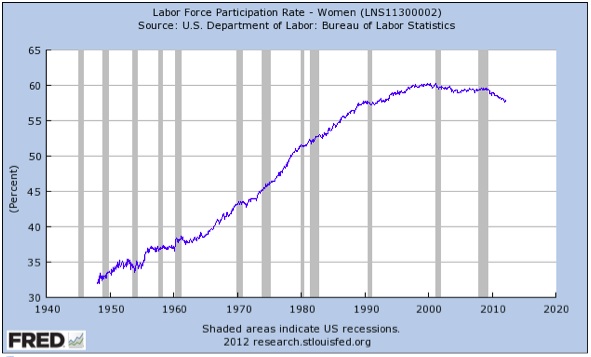

Let's look at three graphs from the St. Louis Fed FRED database. The first is the participation rate of men since the late '40s, and the second is the participation rate of women.

The first graph shows the participation rate of men falling consistently since the 1950s and then plunging since 2007. This is a 20% drop overall. Contrast that with the significant rise of women in the labor force until about 1995 and the gradual decline since 2008. In the United States the average labor-force participation rate was usually around 67% (since 1990) until the recent recession.

Let's look at one last graph of the total participation rate, but this time it will not be seasonally adjusted. Note the very large seasonal volatility in the number. This was especially true when they began collecting the data in the late '40s, but the seasonal variation has lessened with time; and since the recession it has fallen back to where it was in the late '70s. This just demonstrates in yet another way that more people want a job than can find one.

Just as disappointing as the total new jobs this month was the average work week fell, especially in manufacturing. This does not bode well for the next few months. Interestingly, the average wage for manufacturing is now 2% below the wages paid in the service industry.

Some Good News on Employment

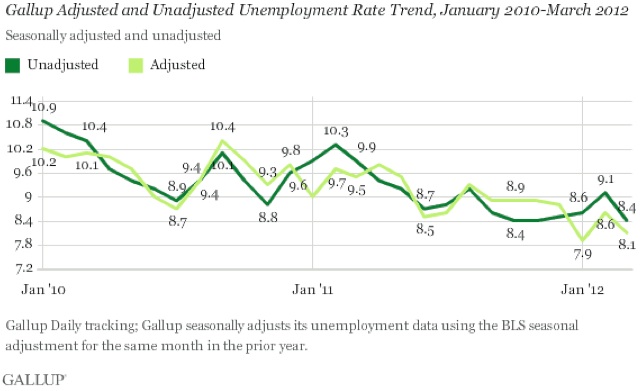

Looking elsewhere, we can find some good news on employment. The polling company Gallup produces its own household survey each month. Gallup does continuous daily polling all through the month, while BLS takes a sample week in the middle of the month. While the Gallup overall unemployment number was at 8.4%, higher than that of the BLS, it did drop sharply in the last half of the month. And if they use the same seasonal adjustment the BLS uses, the number drops to 8.1%. Both are down sharply over the last month, and Gallup noted that most of that drop was in the last two weeks.

Gallup makes the following comments at the end of its release this week ( http://www.gallup.com/poll/153761/Unemployment-Declines-March.aspx?ref=more):

"… The March and January rates are the two lowest since Gallup began monitoring and reporting unemployment in January 2010. They are also consistent with Gallup's other behavioral economic data for March showing a new high in Gallup's Economic Confidence Index and a post-recession high in its Job Creation Index as well as strong consumer spending.

"While the sharp drop in the U.S. unemployment rate during recent months is clearly good news, it raises some significant economic questions. Traditional economic analysis raises the question of why the unemployment rate is falling much more rapidly than can be justified by the modest pace of current economic growth. Answering this question is essential to determining the sustainability of the declining trend in unemployment.

"Federal Reserve Board Chairman Ben Bernanke made this issue the centerpiece of his recent speech to the National Association for Business Economics, noting, 'the better jobs numbers seem somewhat out of sync with the overall pace of economic expansion.' He went on to explain his hypothesis that companies shed many more jobs than necessary during the recession and financial crisis of 2008-2009, and now they are correcting their workforces for this understaffing of the past. The chairman went on to suggest that achieving further declines in the unemployment rate is likely to require a more rapid pace of economic growth going forward.

"If Bernanke is right, then the rapid decline in the unemployment rate might be approaching its end as individual businesses achieve a right-sizing of their workforces. Further, traditional economics also suggest that many people who have been sitting on the sidelines waiting for the economy to improve might decide that now is the time to seek a job, increasing the baseline figure used to calculate unemployment. In turn, this could keep the unemployment rate from decreasing or even send it higher, negatively affecting economic confidence and the overall economy – not good news for political incumbents, including the president.

"On the other hand, the economy might continue to build on the momentum indicated by the current positive trend in Gallup's behavioral economic data, or perhaps the economy is already growing faster than the current economic data suggest. Either way, if true, the unemployment rate could fall below 8.0% in the not-too-distant future – particularly if the workforce does not grow – meaning good things for the economy, incumbents, and the president's re-election effort."

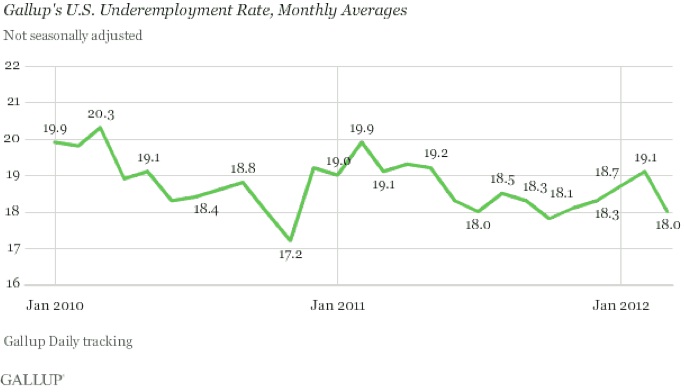

Gallup had one more chart that does not bode as well for political incumbents, although even here they find a bright spot in the direction of the data. We will close with this. Gallup's US underemployment measure combines those unemployed with those working part-time but looking for full-time work. As a result of sharp declines in both of these groups, the underemployment rate, on an unadjusted basis, fell to 18.0% in March from 19.1% in February 2012. The underemployment rate declined to as low as 18.0% last July before reversing course in August; it also increased from November through January. This compares with the BLS U-6 unemployment rate of 14.5%, which is the rate of unemployed plus those who are part-time but want full-time work.

Employment and the economy in the US are getting better, just not as fast as we would like. And the world is still vulnerable to a renewed crisis in Europe, which seems to be coming back around. David Kotok notes that Greece is "in a downward death spiral." He continues:

"The private losses on Greek debt are mostly taken. The government/institutional/official losses are in the hands of politicians and still lie ahead. The Greek economy shrinks as the debt burden grows. This perpetual subsidy from others is on an unsustainable collision course with eventual Greek financial collapse. Meanwhile, 92 members of the Greek parliament have offered amendments to water down the austerity budget (hat tip to Barclays). The Greek prime minister vows to defeat all of them. Next week Greece will announce its bank recapitalization plan. Those banks that are deemed 'viable' will be able to gain financing from the ECB. Those that are not will need to fund liquidity from the Greek central bank under the Emergency Liquidity Assistance (ELA) program (hat tip to Credit Suisse). Note that ELA lending is central bank advances with lower-grade collateral. The Greek tragedy continues.

"We are tracking ELA balances in every euro zone country. It is not easy to do. The central banks of the 17 euro zone nations do not break it out in a single available figure. They also report with a lag. There is little reporting consistency among them. Greece has only revealed its ELA balance through November. We estimate it was about 40 billion euros then, up from about 7 billion in July. We have no idea what the balance is today. The European Central Bank could separately identify each country's ELA balance but chooses not to do so. Why not? Consider this: would you deposit your money in a bank that was in a national system with rising ELA? Not if you are sane. The flip side is that Eurozone folks have to guess. So they move money faster than they otherwise might and cause a bank run and an increase in that country's ELA. It is always better to cut off a small loss and be forthright about it than to maintain a growing loss and try to hide it. But politicians do not know how to learn that lesson."

Indeed. That seems to be the one consistency across nations. Politicians never learn until it is too late, and even then…

San Francisco, Denver, Austin, Philadelphia, Washington DC, Fort Lauderdale, etc.

Yes, all of the above cities are in my next three weeks. I am trying to figure out who exactly is creating my travel schedule. It could not have been me. I swear it has to be an American Airlines accountant, intent on fixing their bankruptcy with my travel! But some of the travel will be fun, with a little off-time thrown in. Details next week.

I was at a Dallas Mavericks game last week with a friend who is also a local investment advisor. I pointed out that while our record is mediocre, we have had a lot of injuries this season. If you factor in all of the players being back for the play-offs, we will have the deepest bench in the NBA. And yes, our team is "old," but that is what everyone said last year, and we won it all. If the old guys can remember the glory days of their youth, we could really make another run at a championship. And if Lamar Odom can forget what Kardashian sideshow he is in, get over not being in LA, and act like the star he is getting paid to be? Then we can just keep running real talent at teams that may have a better starting five but can't compete with our next five, let alone the 12 legitimate NBA players we will have. I will admit to maybe being a little animated. Perhaps I got a little overenthusiastic.

"John, why can't you be this optimistic about the economy when you write on Friday nights?" my friend asked.

But what would be the fun in thinking we'll go out in the first round? Sometimes you just gotta believe.

It's time to hit the send button. It's late and I need my beauty rest. Most of the kids and some friends will be here on Sunday, and we will fire up the grill. I hope you have a great week as well!

Your really an optimist at heart analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.