Has the Fed Boosted the Stock Market?

Stock-Markets / Stock Markets 2012 Apr 04, 2012 - 05:52 AM GMTBy: Paul_L_Kasriel

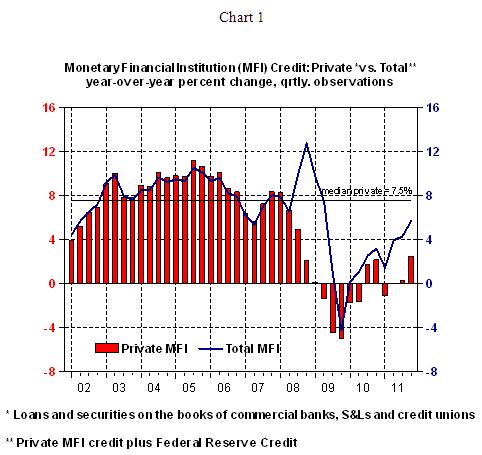

You bet. And aggregate demand for goods and services, too. If the Fed had not expanded its balance sheet in the past few years, the weakest U.S. economic recovery in the post-WWII era would have been even weaker and U.S. stock prices would have suffered. Chart 1 shows the year-over-year percent changes in monetary financial institution (MFI) credit. Private MFI credit is made up of the sum of loans and securities of commercial banks, savings & loan associations and credit unions. Total MFI credit is private MFI credit plus assets on the books of the Federal Reserve, i.e., Fed credit.

You bet. And aggregate demand for goods and services, too. If the Fed had not expanded its balance sheet in the past few years, the weakest U.S. economic recovery in the post-WWII era would have been even weaker and U.S. stock prices would have suffered. Chart 1 shows the year-over-year percent changes in monetary financial institution (MFI) credit. Private MFI credit is made up of the sum of loans and securities of commercial banks, savings & loan associations and credit unions. Total MFI credit is private MFI credit plus assets on the books of the Federal Reserve, i.e., Fed credit.

The median year-over-year change in private MFI credit from Q1:1953 through Q4:2011 was 7.5%. In 2009, private MFI credit began what turned out to be its most severe contraction since the early 1930s. Although private MFI credit resumed growth in the second half of 2010, the rate of growth has been far below its long-run median rate of 7.5%. Even with the Fed's second round of quantitative easing QE) from November 2010 through June 2011, total MFI credit, private plus Fed, has been growing well below the long-run median rate for private MFI credit. But without QE2, credit creation for the U.S. economy would have been even weaker.

So, yes, the Federal Reserve's actions have benefited the stock market as well as aggregate demand for goods and services in the U.S. economy. You got a problem with that? Would you have preferred that the Fed sit idle as it did in the early 1930s, with likely similar results for the stock market and the economy in recent years as occurred at that time? The Fed has simply provided some of the credit to the economy that the private MFI system would have had it not been crippled with loan losses. And even with the Fed's additional credit creation, total MFI credit growth has fallen short of the long-run "normal" credit creation of private MFIs. I understand the frustration of those who argue that the stock market is being boosted "artificially" by the Fed. I, too, get frustrated when my forecasts are incorrect!

We Will Repeat One of the Silliest Market Rites on Wednesday - ADP

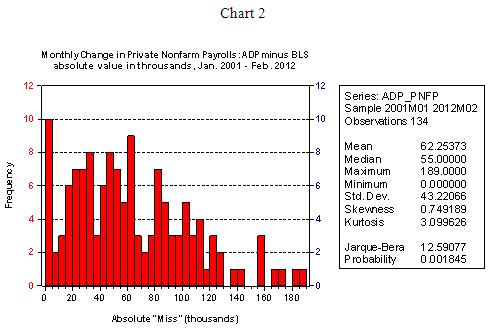

Tomorrow, Wednesday, April 4, the ADP estimate of private nonfarm payrolls will be released. Media will report that private payrolls in March increased/decreased by X thousands. Really? Is the ADP's estimate what the actual change was in private nonfarm payrolls? Suppose you knew on Wednesday what the BLS was going to report as the change in March private nonfarm payrolls on Friday. Which estimate would you trade off of, that of ADP or BLS? Most people would trade off the BLS estimate. But we can't constrain ourselves from trading off the ADP estimate. If the ADP estimates were good predictors of the BLS estimates, I might see the logic of this. Are the ADP estimates very good predictors?

You can decide from the information in Chart 2. Mind you, this history of ADP estimates has been "sanitized." That is, the ADP historical March figures match the BLS historical March figures because ADP figures are benchmarked to BLS levels in March. So the median "miss" of the ADP estimate to the BLS estimate of 55 K in absolute terms would likely have been even larger had not the ADP estimates been revised to comport with past March BLS estimates.

To add to the silliness, the media will report that the ADP change came in above or below "economists" forecast of the ADP change. Why do we economists waste our time even attempting to forecast a number that will quickly fade into oblivion two days later? How much effort do most economists actually put forth in forecasting this number? Actually, I know why. Because the media survey us on this forecast. And we don't have the courage to tell the media that this is an exercise that is a waste of everyone's time.

Post-April 30 email: Econtrarian@gmail.com

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel and Asha Bangalore

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.