U.S. Debt, Deficit, Economy and Financial NO SPIN Zone

Economics / US Debt Mar 30, 2012 - 02:29 AM GMTBy: Ty_Andros

As leviathan government, Central Bankers and the welfare states battle Mother Nature and Darwin, the stakes for the global banksters and elites could not be higher. Governments in the US and Europe are striving to place debt and legal shackles on those they pretend to serve and working for the interests of banksters, power-hungry public servants and entrenched government bureaucrats against that of their own constituents.

As leviathan government, Central Bankers and the welfare states battle Mother Nature and Darwin, the stakes for the global banksters and elites could not be higher. Governments in the US and Europe are striving to place debt and legal shackles on those they pretend to serve and working for the interests of banksters, power-hungry public servants and entrenched government bureaucrats against that of their own constituents.

Welfare states on both sides of the Atlantic are creating legions of government dependents to justify their TAKINGS of the private sector. Having already spent the money they have collected and borrowed since Bretton Woods II, credit markets are REJECTING their requests for further lending. New sources of REVENUES must be found since they have effectively DESTROYED wealth and income creation in their economies. So it's off to the printing press and PROGRESSIVE, rubber-stamp legislatures they go.

Using FEAR, FORCE and runaway legislation/regulation to achieve their goals of domination, unaccountable socialists in Washington and Brussels are working overtime with their mainstream media to dupe and subjugate their constituents. The public misunderstands socialism. They think socialism is the government transferring wealth from the rich to the poor. NO, it is the transfer of wealth from the poor and confiscating the fruits of the private sector for government to spread as thin gruel for all. It is misery spread widely for all.

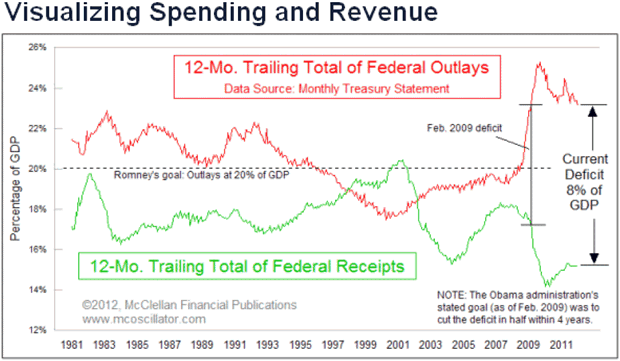

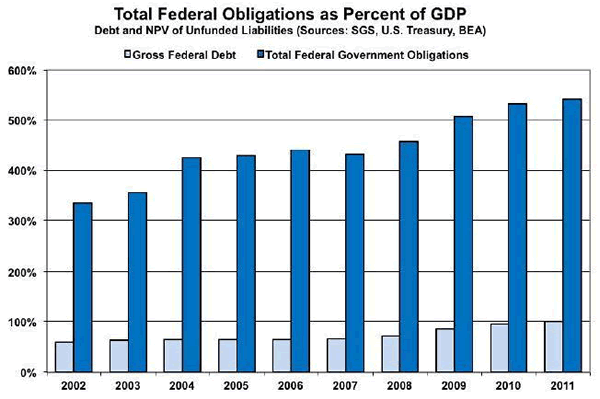

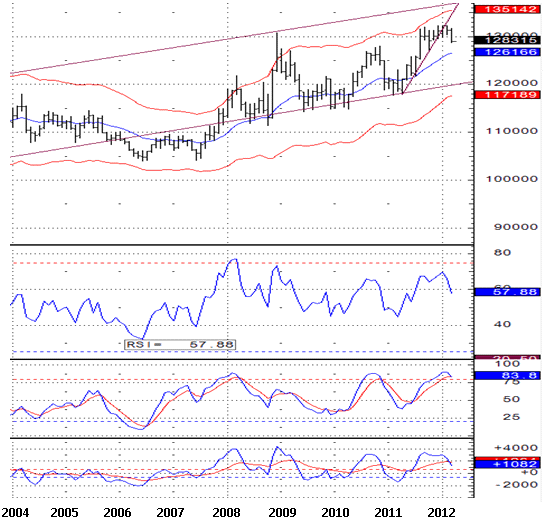

The Jaws of DEATH spell doom for the dollar over the long term. This is the mother and father of dozens of BLACK SWANS throughout the financial systems of the world. What are the Jaws of Death you ask? Take a look:

See that YAWNING gap on the right side of that chart? That is the Jaws of DEATH. It is signaling the UNFOLDING demise of the US dollar and ultimately the financial systems of the WORLD. Keep in mind this DOES NOT include the Social Security holiday, the extension of unemployment insurance or the theft of Social Security, Medicare or Highway Trust funds which would add another 5% to the GAP. This is the demise of the world's financial systems on the HORIZON.

In a fiat currency world everything is a DERIVATIVE of the dollar. Why? Because between 60 and 70% of most of the major central banks' RESERVES are dollar denominated. They and US treasuries are the FOUNDATIONS of the world's major currencies. When they become worthless the foundations of all the major central banks will COLLAPSE. It is inevitable. It has happened to every fiat currency in HISTORY, and this time will be NO DIFFERENT.

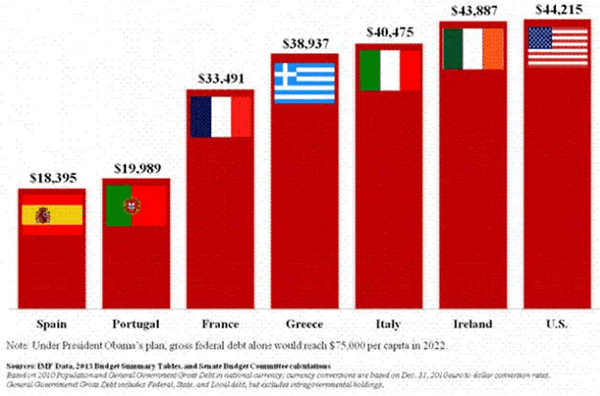

Just how much more in new obligations to pay runaway entitlement spending can US citizens ABSORB? Let's take a look at this SHOCKING table showing how much is already absorbed by each citizen:

My guess, not much more. Of course this does not include STATE and Municipal debt, but that is a debacle yet to come. But the plans have been hatched to tie them up in more un-payable debt and lash them to the debt to pay bankster creditors . In the first two months of 2012 US banks bought more treasury securities than all last year COMBINED. In other words, these are injections of un-payable TOXIC promises into the US financial system to spend on CONSUMPTION!

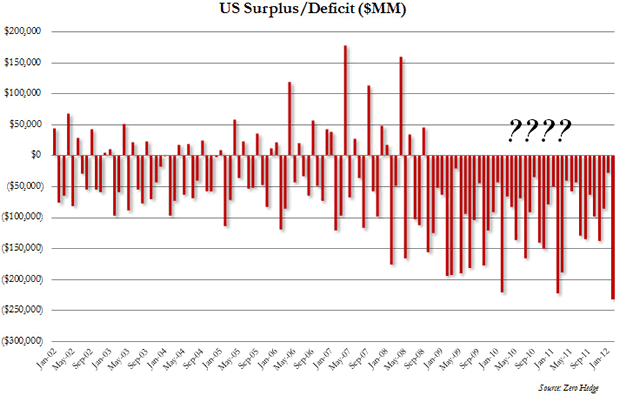

Currently the United States is BORROWING more than 41 cents of every dollar they spend. The deficit in February was the worst in HISTORY at $231 BILLION plus, and the trade deficit exploded to $50 billion plus. That's $281 billion in RED INK in 1 month. Take a look at this MONTHLY deficit chart (courtesy of www.zerohedge.com ) and look at the beginning of the Ob@ma Administration and its uber-corrupt socialist supermajority in congress:

Monthly surpluses have become EXTINCT under the current administration and CONGRESS. When was the last year the US or European governments ran a SURPLUS? Don't say Clinton; that surplus did not include the money borrowed from Social Security and Medicare. How can the US and European governments pay any previous borrowing when they NEVER take in more than they spend? I would say anyone doing this may be criminally insane. This is a recipe for a COLLAPSE.... And Bernanke says things are on the mend. He hints at no more Quantitative Easing. HA HA. What is he thinking? He is trying to keep a straight face as he FOOLS the useful idiots into believing his paper money will hold its value.

The biggest OBSCENITY is that the deficit spending is counted as GROWTH in the GDP numbers. The US is currently running a 9% deficit (the latest $150 billion Social Security suspension and unemployment extensions are not shown). This is the BLACK SWAN of the MORAL and FISCAL Bankruptcy of the US federal government WRIT LARGE.

FEBRUARY was the BIGGEST DEFICIT month EVER. Keep in mind this is a government that has operated WITHOUT A BUDGET since the chosen one was elected, with a legislature which REFUSES to cut spending or the rate of growth in spending. A government which has NEVER paid off a dime of principle in 50 year, only rolled the notes and BORROWED more. When will the global holders of dollars and treasuries WAKE UP? Do you really think you can store wealth in the IOU's (Junk Bonds) of this borrower? Those are the questions. Now let's look at how many promises to pay are on the HORIZON for the world's biggest debtor and the foundations of the world financial system:

The US is hemorrhaging cash. Why hasn't it crashed already? Because the United States Dollar is the only currency in the world in which the shorts and the longs do not want it to move. The shorts are the groups printing it endlessly -- The US government, banksters and the Federal Reserve. This is runaway confiscation of wealth. The longs are those trying to STORE WEALTH IN IT, which is a fool's errand. Keep in mind the Fed hinted that QEIII is off the table. HA HA. It is an April fool's joke. And YOU are the FOOL! IT IS ONLY A MATTER OF TIME. PERIOD.

These numbers DO NOT include mortgage giants Fannie and Freddie or the guarantees on student debt which topped $1 trillion TODAY -- new graduates are debt slaves to the government; 27% are in functional default, the 2005 bankruptcy reform prohibits discharge through bankruptcy and there are no jobs to pay it back due to government policies.

Governments here and in the Euro zone (The EFSF - European Financial Security Fund, European Development Bank, etc.) ALWAYS issue guarantees with the idea they will never have to PAY. These are endless obligations Of MORALLY and FISCALLY bankrupt public servants and their governments. When the bill come due it is the duty of the private sector and public at large to pay. Ask the Greeks how that works? It's coming to you...

The SQUANDERING of WEALTH and CAPITAL is BREATHTAKING in its immensity throughout the developed world. In no place is capital investment taking place except in windmills and solar power. All capital is going to CONSUMPTION, not self-liquidating capital investments. Rewards that go to the savers and private sectors for virtuous behavior, job creation and wealth creation are PUNISHED. So there will be LESS of it. Would someone please show me where government spending is going into something PRODUCTIVE and produces more than it costs?

We are at the Von Havenstein moment: it is easier to PRINT the money rather than curtail the benefits. Von Havenstein was the central banker to the Weimar republic. HA!

The other currencies that central banks hold as RESERVES: Yen, UK Pounds, Euros, Aussie Dollars and Swiss Francs are all hopelessly in debt, have little or no REAL growth in income and wealth generation and have debts which are compounding at 4 to 8% annually. These are called a debt spirals and all the world's major economies are hopelessly caught in them. These economies DO NOT GROW! How are they going to pay for new borrowing and maturing debt?

The truth is they never planned on paying maturing debt, only rolling it over. They declared their debt risk free and believed their own lies. If sovereign debt was marked to market, then these financial systems would be INSTANTLY INSOLVENT. The structure of the Long Term Financing Operations (LTRO) guarantee's the smart money will exit while the getting is good, as now EVERYBODY is subordinated to the European Central Bank (ECB) and the sovereign central bank holders! Mayhem dead ahead?

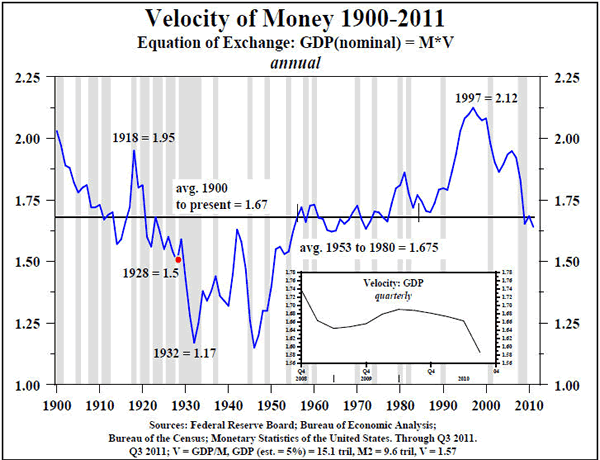

Now let's look at the winds of deflation versus inflation as they Wind Sheer each other. First let's look at the velocity of money and its CRASH, signifying how terrorized the private sector has become of the unpredictability of developed-world governments and the lack of capital opportunities that can PAY OFF after taxes and runaway regulations:

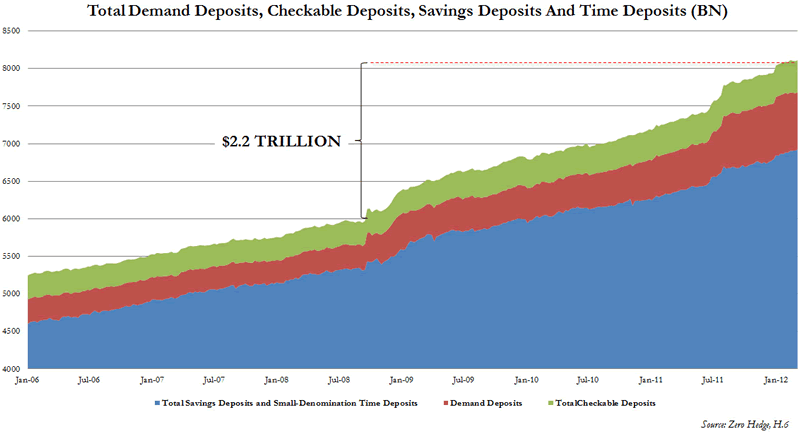

Don't forget the ZOMBIE banks that are unwilling to lend except to governments (which they still think is risk free). The money keeps piling up, because if velocity does not pick up, the FED must keep printing to fill the hole caused by the lack of monetary blood flow. Just as FEAR has caused the collapse, FEAR will cause it to turn up at some point, fear of money printing and uncontrolled socialism. Look at these mountains of worthless paper money PILING up (courtesy of www.zerohedge.com ):

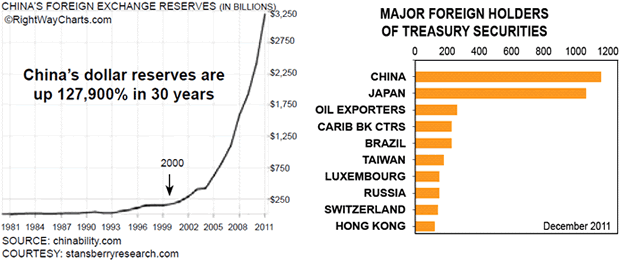

That is $2.2 trillion of purchasing power subtracted from bank accounts around the world. It's as simple as the Principle of Double-Entry Bookkeeping. That is a domestic measure now let's looks at some INTERNATIONAL numbers:

These small illustrations MASSIVELY understate the amount of worthless, paper IOU's, aka money, that are sitting in banks around the world. When will these PILES of cash turn in fright from the printing press? At that point VELOCITY will turn viscously HIGHER and the LOSS of purchasing power will go exponential as it FLIES off the sidelines seeking shelter. Are you waiting for this? Do you think it might be INFLATIONARY? The velocity of money is a testament to the amount of FEAR of the policies of government past and present, public servants and inferior financial products (guaranteed to return less than you deposited) of the big brokers and banks.

UNFORTUNATELY most people don't know they are holding IOU's rather than REAL money. Dodd Frank is KILLING the nimble competitors who actually provide a REAL return and it is LEGISLATING you into the poor offerings of the banksters, whose offerings have NO chance of making a REAL return after inflation! DO YOU STORE YOUR WEALTH IN THESE RISK-FREE investments?

US Bonds have given SELL signals on the weekly and monthly charts (German Bunds and UK Gilts have as well and they echo the chart below). Make no mistake, CREDIT is expanding and so is the US economy; without it GROWTH disappears. Take a look at this MONTHLY chart of the 10-year Note (trend lines back to the 80's), a decline to the lower trend line leaves the multi-decade BULL market INTACT. Notice the mini violations going back years? That is where the interventions were taking place by the central banks. Just how powerful will the intervention have to be to counter this UNFOLDING LONG-TERM pullback? Bigger than EVER.

Notice the active MONTHLY SELL signals on the slow stochastics and MACD indicators at the bottom of the chart? Just returning to the lower channel of the long-term trend line will be ENORMOUS pain (LOSSES) for most BOND investors because all other rates (investment grade and junk) KEY off this BENCHMARK. In a search for yield and safety, DESPERATE investors are LOADED with bonds and in at the TOP! Just when will the 30 year bull market in bonds end? SOON...

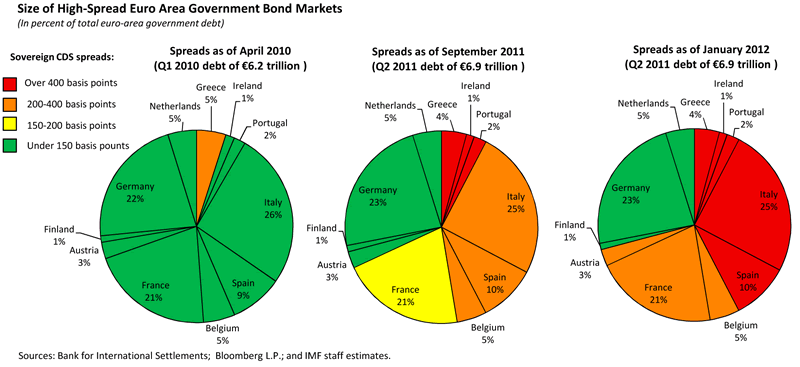

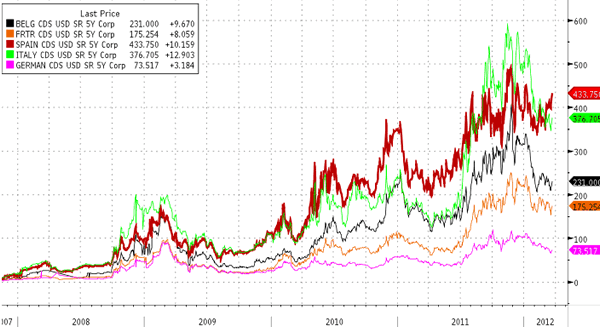

A quick look at Euro zone Bond Market Credit Default Swaps over the last three years is one of a crash in creditworthiness, check outthis chart courtesy of www.bloomberg.com and www.gordontlong.com:

YEARS: One, two and three, CAN you say DOMINOES? Do you store your wealth in the bonds of these countries? INSOLVENCY will ULTIMATELY engulf them all. None have the printing press and Germany has guaranteed it all. She will fall as well. NONE of these countries GROW or create wealth in real terms except Germany. She is the definition of Austrian wealth creation. The NEW Stability and Growth Pact has ALREADY FAILED as Spain has already broken its promises. Portugal and Spain are on their Sovereign, economic and financial system DEATH BEDS. Their CDS's have rallied VERY LITTLE. In fact the next wave (domino) of insolvency is at the doorstep, look at Spanish CDS's TODAY:

Uh oh, Spanish CDS's are back on the rise and why not. It appears the European financial crisis is going to leap frog Portugal and go directly at Spain. If properly MEASURED, it is in a deflationary depression with NO ESCAPE if they stay in the EURO. When it comes to OVERLEVERAGED banking systems and economies, BLOWOUTS in interest rate spreads equal BLOW UPS.

Crashes loom as the short end of the US Treasury Market is being abandoned and primary dealers CHOKE on inventory. When will the long end suffer the same fate? China and Russia HAVE ALREADY left the playing field.

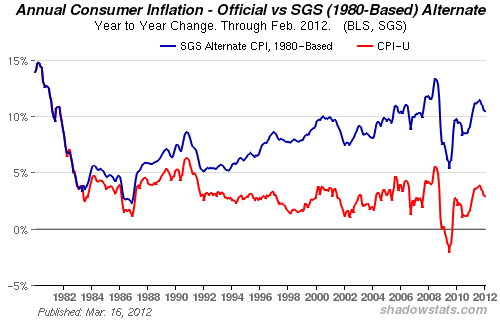

Currently, Euro zone credit markets have been rallying due to long-term repo operations from the ECB. Of course the bond markets at some point must return more in real terms than real inflation, which is currently approximately 10.5% as calculated by John Williams of www.shadowstats.com (I love this site, you should subscribe to get top-quality economic statistics FREE of the ministry of truth and political correctness):

The difference between your yield on your paper currencies or bonds and this inflation measure is your real gain or loss. A US ten-year note yields approximately 2.3% today, inflation is over 10% so your real return is a negative 7.3%. Using the rule of 72, the purchasing power of the ten-year note will be CUT IN HALF when they return your money to you.

This is FINANCIAL REPRESSION. The rest of your purchasing power was transferred to those culprits. This is a RISK-FREE investment according to government and the banksters. You decide if that is true or a government illusion. It is the soft default of the printing press. They are inflating their debts away to fund the welfare state along the way.

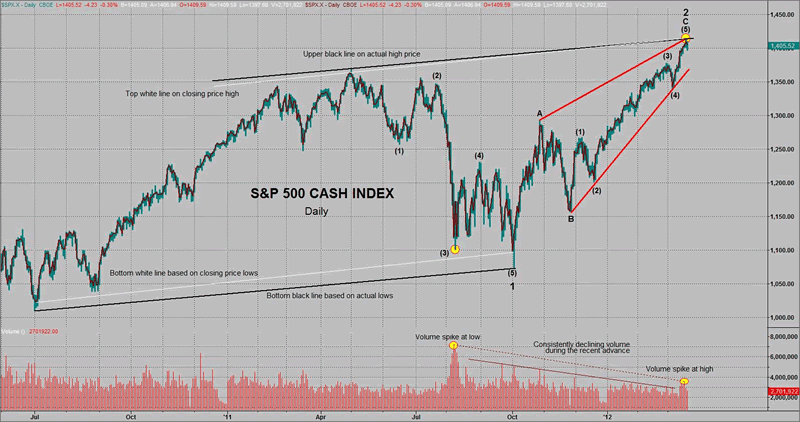

The stock market is breaking out from a yearlong trading range and may be at new highs but has reached this level only God knows how; the volume has disappeared since last October and the PUBLIC has continued to BAIL out of the stock markets. Take a look at this long-term chart courtesy of my friend, Garrett Jones:

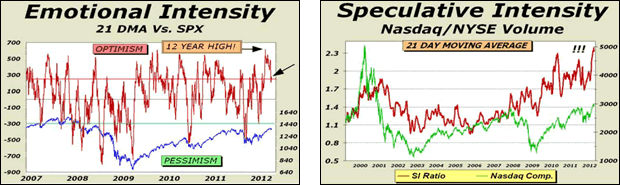

If that is not a top it is close to it; manipulators could send it higher but only a fool would buy here. Most internal measures, especially sentiment and volatility, are HORRID. Check out these charts courtesy of Alan Newman's CROSSCURRENTS (http://www.cross-currents.net , I love his work and recommend it highly):

Do you see the excess positive sentiment above? Can you say Mania? Now lets look again at divergence's..

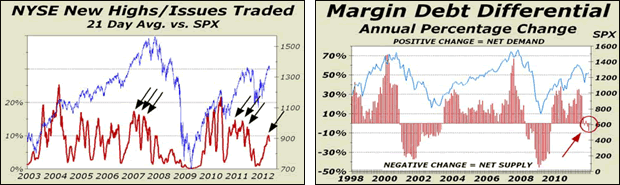

Notice the divergences since the 2010 highs, and look closely when margin debt begins to CONTRACT.

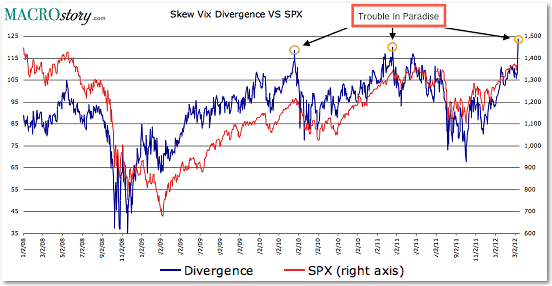

Now let's look at the VIX:

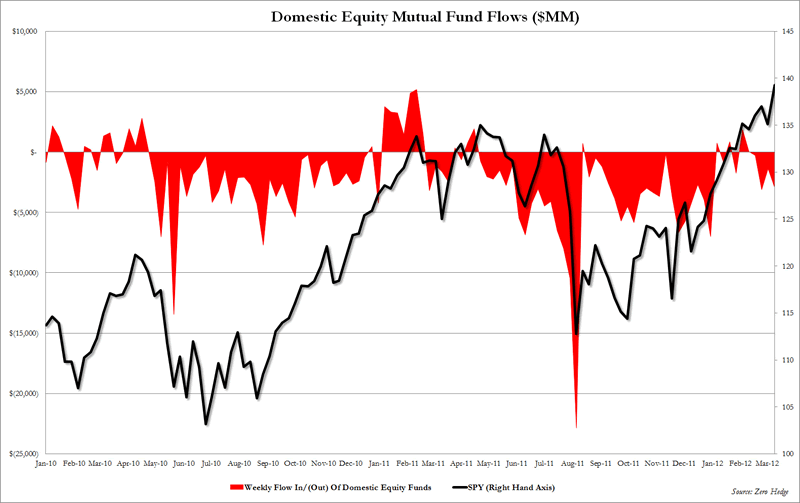

When looking at the VIX just how many rallies begin from these low levels? These Vix studies echo the intensity levels above, all nose bleed positive sentiments. As a contrarian it is buyer beware as seldom is the broad market of investor's right. Now let's look at mutual fund flows versus price action in the S&P 500:

WOW, constant OUTFLOWS for the past two years while price is generally POSITIVE. This is a divergence too great to be explained except one way: PRICE manipulation by banksters working with public servants and central banks. You need to WATCH Charles Biderman of Trimtabs to see some of the inconsistencies under lying this rally.

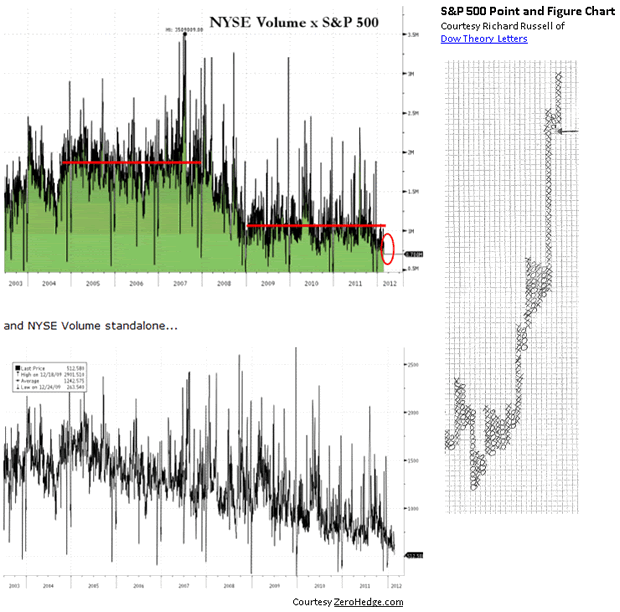

Lying is the correct word for this rally. Finally the volume over the last several years has FALLEN OFF a CLIFF as the public has withdrawn after being VICTIMIZED by bank and investment-house trading desks who use their enormous resources to MANIPULATE market short term. As we can see below, stocks have risen into a high pole. Are you going to buy those highs with virtually no support activity from the lows?

This is an incredible SHRINKAGE in volume versus price and fund flows; a disaster and the unfolding demise of equity markets under ethically-challenged regulators and the big banks that OWN them!

Short term on the positive side, the advance decline line of the NYSE has recently hit new highs and Lowry's is about to generate a BUY signal. OVERALL it is not pretty... Like I said, the internals are HORRID.

I believe stocks are driven higher by just three things: deploying past and present quantitative easing, low rates driving investors into higher-yielding stocks and HFT (high frequency trading) under the guiding hands of the big banks and 33 Liberty Street, also known as The New York Federal Reserve. The authorities, the big investment houses and banksters are DESPERATE to get the public to buy these MASSIVELY overvalued stocks which YIELD nothing. They are offering FOOL'S gold to YOU.

Do you have investments that PROSPER when STOCKS, currencies and BOMB'S, er.... BONDS go UP or DOWN? OR WILL YOU BE HURT? Absolute Return Alternative Investments with the potential to prosper in up and down markets is what I do. If you wish to explore their potential as diversification of your portfolio CLICK HERE and I will give you a call!

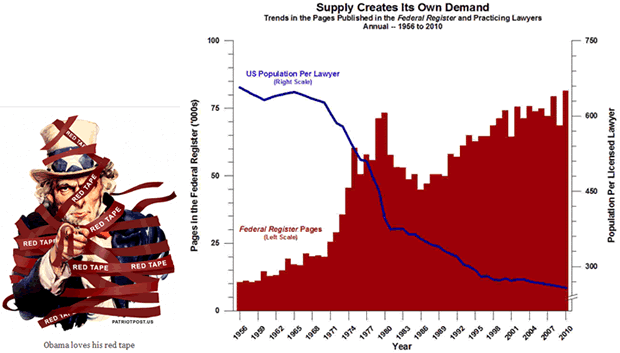

Now take a look at the RED TAPE RISING and why all the money is sitting on the sidelines scared to death and refuses to budge off the sidelines:

This is an illustration of the death of FREEDOM and capitalism and the rise of the centrally-planned economy and totalitarians in Washington. This is what "change you can believe in" means. More MONEY and POWER for the government and less for YOU.

"The Founding Fathers knew a government can't control the economy without controlling people. And they knew when a government sets out to do that, it must use force and coercion to achieve its purpose. So we have come to a time for choosing." ~ Ronald Reagan

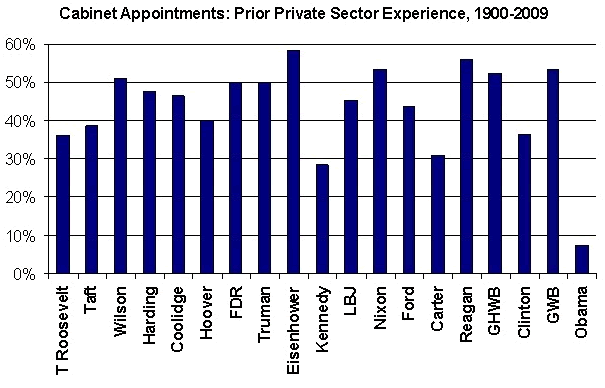

The only period when government was rolled back was REAGAN'S administration; he cut regulations by over one third! The rollback of TAXES and regulation created a growing economy until 2000 (see chart below, look what Carter did, then what the current US administration is doing today, Heavy regulation by would be socialist engineers), at which time the economy quit growing just as it had during the 1970's due to over taxation and regulation.

Reagan's prescription for economic growth worked and it is REQUIRED again for it to restart. Ever since 2000, growth has come from a printing press not the private sector. By the way, REAGAN was an AUSTRIAN economic devotee with ties to Hayak and Von Mises. God Bless you Ronnie and may you rest in Peace!

His successful recipe for growth worked decades of magic, but was reviled by progressives because it sparked growth with its incentives to produce and it was freedom from government and its predatory practices. Rolling back taxes, legislation and regulation are acts of giving freedom back to the public; something verboten in today's political climate of desperate welfare states and public servants.

This is forbidden in Washington because progressives inhabit both sides of the aisle. Of course these words ring true. Red tape is now at ALL TIME HIGHS and written by ACADEMICS and BUREAUCRATS with no knowledge or experience of the private sector they are regulating:

Regulations are a form of NATIONALIZATION of the productive sector. They take control of an enterprises through DECLARATION. As government BUREAUCRATS and Socialist academics work their theories and misuse their power to control the public, thousands and thousands of pages of new rules and regulations are slated for creation to implement the Dodd Frank financial reform and Ob@macare legislation. Those bills are nothing less than tax code, transferring control of larger and larger pieces of the economy to POLITICIANS, CRONY CAPITALISTS, ELITES and BANKSTERS.

In closing, the depression has NEVER ended. The GLOBAL FINANCIAL CRISIS has just been papered over with money PRINTED OUT OF THIN AIR WHICH WILL CONTINUE ENDLESSLY as WEALTH PRODUCTION IS DEAD! Calling government spending and borrowing growth is just a Keynesian ILLUSION. WEALTH and INCOME growth have been OUTLAWED by Socialist welfare states, unaccountable bureaucrats in DC and Brussels and their something-for-nothing constituents. Private personal income tax receipts belie the unemployment numbers (www.trimtabs.com ); there is no growth in personal income and jobs except through government manipulation of the numbers and the headlines. Oh, and let's not forget the MAC truck about to HIT the economy known as NEW TAXES set to start in January 2013: Over $300 BILLION plus. Wealth creation's latest NEW HURDLE which the public servants won't mention in an election year.

I believe stocks are FOOL'S gold with you as their fool, they yield NOTHING and in order to profit, another fool has to take your holdings at a higher price. As for bombs, er....bonds the same is true. When the leverage FAILS it will be bombs away. Do you know how to make money in DECLINING markets?

Recent work by Ray Dalio of Bridgewater (one of the biggest and most successful hedge funds in the world) puts the total bad debt that needs to be purged thru default or inflation (printing money out of thin air) at $20 to 25 TRILLION dollars. This is the accurate number at minimum as he is looking at existing debt. He did not include unfunded entitlements and guarantees on debt (such as student loans, Social Security, Fannie Mae and Freddie Mac, etc.) which are not included in the total. THERE IS NO AVOIDING THIS. Income and wealth creation are DEAD in the developed world if properly measured in REAL terms. Nominally, the Keynesian illusions of GROWTH still exist.

Authors note: This is the greatest opportunity in HISTORY. Volatility is OPPORTUNITY for the prepared investor. As markets price in REALITY rather than Keynesian ILLUSIONS they will move higher and lower. Diversifying your portfolio into Absolute-Return Alternative Investments which have the potential to thrive in up down and sideways markets and can stop the loss of purchasing power by the printing press should be considered. This is what I do, if you have an interest CLICK HERE and I will personally give you a call.

Where's the money coming from to PAY FOR Social Security, Medicare, Medicaid, unfunded federal, state and municipal pensions, collapsing shadow banking? Bankruptcy looms for multiple states where corrupt, progressive public servants have destroyed the economic well-being of their residents and the rewards for PRIVATE sector wealth creation. They are handing their futures to crony capitalists and public sector unions. California, Michigan, Illinois and New York (just to name a few) face brutal restructurings and are operating in functional insolvency.

California's collapse will be SPECTACULARLY breathtaking when it arrives. It is 11% of national GDP but has 1/3rd of all welfare recipients (whose consumption is counted as production in GDP reporting -- obscene and absurd), and just like the federal government, California REFUSES to cut spending or torturing the wealth-creating private sector. So people are voting with their feet and moving to friendlier states. Illinois will be similarly BRUTAL.

Helicopter Ben is attempting to challenge the idea that QE III is not in the wings warming up to take flight soon. He also has taken a BIG SHOT at gold, so he is getting nervous -- he has never done this except in short denials that it is MONEY, and unless the insolvencies suddenly disappear nothing could be further from the truth. For the developed world it is as simple as this: INFLATE or DIE. OFF and ON balance sheet obligations are AT LEAST 500% of misstated (overstated) GDP. Approximately $1.5 trillion must be printed to keep up with the debasement in Europe and Japan, and the countries are BROKE so you can bet on it. Financial repression is PUBLIC policy. Do you know how to escape it and thrive? I do. It's called Applied Austrian Economics.

You can expect inflation in everything you use and deflation in everything you own. When properly, honestly measured, there has been NO recovery. The REWARD for producing has been removed and the hassle by voluminous rules and regulations will make sure you can't even try. It's all Austrian. There is no escape from the final denouement, only the zigs and zags in the economy as the welfare states fight their eventual demise. Don't miss the next edition of TedBits, subscriptions are Free at www.traderview.com and we are soon launching the new website: Tedbits.com: Global Macroeconomic Analysis Through the Austrian Lens.

Thank you for reading TedBits. If you enjoyed it...

For greater insight into the philosophy behind Tedbits, have a look at the Tedbits Overview - To help understand our mission in serving you, the Tedbits Overview gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

Thank you for reading TedBits. If you enjoyed it...

Tedbits will be resuming a regular publication schedule going forward; subscribe for free at www.traderview.com/subscribe . We are also developing a relationship and collaboration with Gordon T Long, a brilliant technician and market analyst. Gordon’s most recent work can be found at: http://lcmgroupe.home.comcast.net/.. and I urge you to visit him.

By Ty Andros

TraderView

Copyright © 2012 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.