If Economy is Recovering, Why Are U.S. Cities Going Bankrupt?

Interest-Rates / US Debt Mar 09, 2012 - 01:16 PM GMTBy: EWI

As pundits chatter about an economic recovery, 80 miles east of San Francisco you'll find a city (pop. 292,000) facing bankruptcy:

As pundits chatter about an economic recovery, 80 miles east of San Francisco you'll find a city (pop. 292,000) facing bankruptcy:

Stockton is on the verge of becoming the largest city in the United States to declare bankruptcy...

San Francisco Chronicle (3/4)

Bloomberg reports (2/25) that it costs the city $175,000 just to get a consulting firm's fiscal evaluation. Management Partners issued a report which said:

...the city took on a large amount of debt in anticipation of ongoing growth that now exceeds the city's ability to pay. Compensation packages exceeded sustainable levels and the city assumed a significant liability for improved retiree health coverage without sufficient recurring revenues to cover growing costs...

Stockton also has one of the nation's highest home foreclosure rates and has been called "Foreclosureville USA."

And Moody's just downgraded Stockton's rating to Ba2, which is two levels below investment grade.

In the same Bloomberg article, the California State Treasurer said "The reputational stain can bleed onto other local issuers and the state, and that can hurt taxpayers in the bond market."

Yet in recent months investors have been enamored with municipal bonds. Our December Financial Forecast said:

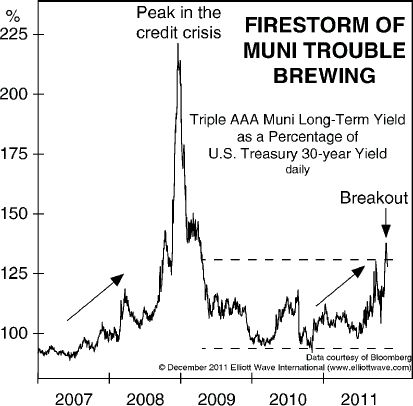

No matter how thick the storm clouds over state and city finances become, the belief in a bullet-proof municipal bond market just seems to grow. As the [chart below] shows, the ratio of AAA municipal bond yields to comparably-dated U.S. Treasury yields rose...in August.

...investors still believe munis are safe, but we'll stick with our bearish forecast...the evidence continues to mount that a change for the worse is underway. Deflation will only accentuate the impact of waning revenue streams, underfunded pension liabilities and bloated labor costs.

Financial Forecast, Dec. 2011

Other municipalities facing recent bankruptcy include:

- Jefferson County, Alabama (home of Birmingham)

- Central Falls, Rhode Island

- Boise County, Idaho

Jefferson County, Alabama is the biggest U.S. municipality to face bankruptcy; Stockton is the biggest city.

In fact, as of December there were eleven municipal bankruptcies in 2011. Many other cities face extreme financial woes.

Economic recovery?

Look under the hood so you can see what kind of condition our economic engine is really in. Prepare for what's ahead.

EWI's NEW free report, The Economic Rot Beneath, reveals important economic numbers that you are not currently reading in the mainstream headlines � but you should be. For instance, did you know stocks priced in real money (gold) are down 87%? Or that U.S. manufacturing jobs are half of what they were in 1979? Or that housing starts per capita are back to 1922 levels? Learn what's really going on in the U.S. economy. Download your free report now. |

This article was syndicated by Elliott Wave International and was originally published under the headline If the Economy's "Recovering," Why is the Largest-Ever U.S. City Bankruptcy on the Horizon?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.