Putting Good U.S. Employment Numbers in Perspective, College Education Isn’t Enough

Economics / Employment Feb 05, 2012 - 06:54 AM GMTBy: John_Mauldin

Everyone knows by now that the US is facing difficult choices. Depending on what assumptions you use, the unfunded liabilities of Social Security and Medicare are between $50 and $80 trillion and rising. It really doesn't matter, as there is no way that much money can be found, given the current system, even under the best of assumptions. Things not only must change, they will change. Either we will make the difficult choices or those changes will be forced by the market. And the longer we put off the difficult choices, the more painful the consequences.

Everyone knows by now that the US is facing difficult choices. Depending on what assumptions you use, the unfunded liabilities of Social Security and Medicare are between $50 and $80 trillion and rising. It really doesn't matter, as there is no way that much money can be found, given the current system, even under the best of assumptions. Things not only must change, they will change. Either we will make the difficult choices or those changes will be forced by the market. And the longer we put off the difficult choices, the more painful the consequences.

This week we begin a series on the choices facing the US, having covered Europe in the first three letters of the year. In order to make the best of a difficult situation, we need to understand the consequences of the choices we make. "Cut spending," say some. "Tax the rich," say others. "Cut out waste and corruption" is always a popular choice. "Do all of the above," intone others.

There are over 3,000 different tax programs that allow for deductions, as Congress has passed out income tax benefits to almost everyone over the past 100 years. In fact, if we cut out all so-called "tax expenditures" (the deductions we get), the budget would be very close to balanced! But there is some group that sees each one of those tax deductions as vital to the future of the republic. Some are quite big, like charity and mortgage-interest deductions, or agricultural subsidies. Others are small and focused on keeping specific industries competitive and even viable. Your municipal bond interest-rate deduction keeps local funding and borrowing costs low. Local government interest rates would rise dramatically if that was repealed. Some, like the earned-income tax credit, are seen as a way to help out those with less income. All have their beneficiaries.

Who Took My Easy Button?

There is a television commercial in the US that offers an "easy button." Simply push it and the product you want will appear.

With regard to the problems facing the country in the next few years, there is no "easy button." There are no easy choices. And the choices we eventually make will have both short-term and long-term consequences. Cutting spending will reduce GDP and tax revenues in the short term, as we see in Europe as countries struggle with "austerity." Raising taxes will also slow the economy for a time and reduce potential private employment over the longer term. If the choices were easy or obvious, even politicians in our admittedly dysfunctional political system could make them.

If the US does not make a choice as to how to get its deficit under control in 2013, the political realities are that it will not happen until 2015, at best, and more likely 2017. By then we will be in a situation that looks like today's Italy at best (if it's 2015) and Greece at worst (if we wait till 2017). Greece is a disaster we all know about. Italy faces a very difficult set of choices that will mean recessions and slow growth, or eventual default. Or Germany has to allow the ECB to target Italian (and then, perforce, Spanish) bond rates to make it possible for Italy to pay back its debts while only suffering a recession, which will not be good for the value of the euro or the inflation level. (And this assumes that Greece and Portugal exit the euro, by the way.)

The US does not want to find itself in a situation where we are faced with the choice between a depression or the Fed monetizing the deficits and debt as we try to find a new balance. Both are disastrous, just in different ways. And not only for the US but for the world. Not dealing with the problem in the near future (in 2013) will necessitate far more draconian cuts in services that we see as essential (healthcare, military, education, and pensions) and far higher taxes than anything we can even contemplate today.

Are things really so dire? I would submit they are. It is simply economic reality. A country cannot run deficits that are 8-10% of GDP forever (and that is the path we are on, under rosy economic assumptions that assume no recessions in the next ten years). In the US, we will soon cross over 100% of federal debt-to-GDP. At some point simply servicing the debt (paying the interest) will eat deep into the budget and decimate what we now think of as critical services and programs that we think of as fundamental rights. When a crisis comes, nothing is off the table. All the sacred cows of today? Some will get led to the altar and sacrificed for the greater good of the others.

In one sense the US is lucky. The basic choice we face can be stated simply: how much health care do we want and how do we want to pay for it? If we want the health-care program in place today, then we either have to raise taxes or cut other programs. Or we have to seriously reform the US medical system and how much we pay for it. Or maybe all of the above. But raising taxes as much as we'd need to would seriously impact employment, both potential and real.

So, as we start on this series, I am going to try to put a human face on the consequences of our choices. Because, in the end, what we are really talking about is jobs and health care. And every solution will have consequences that impact both. So, with that as a preface, let's jump in by starting with the employment numbers that came out today.

Putting a Good Employment Number in Perspective

The non-farm employment report that came out this morning was good. 243,000 jobs, and they were not just in the health-care and food and beverage categories, but across the board. Unemployment dropped to 8.3%.

There were some early comments that the unemployment number was lower because another 1.1 million people dropped out of the work force, no longer looking for work. If you read just the simple number, you might think that. But there were asterisks all over this report, telling us we had to look deeper. A lot deeper.

First, this was the normal month for annual revisions, when the Bureau of Labor Statistics (BLS) makes adjustments to the prior year's data, based on new information. And there were some extensive revisions. So the number in the workforce did not actually drop. Those who thought so "completely missed that this million+ people isn't some new January phenomenon, but a result of the BLS using the 2010 census data to have more accurate data. In other words, the changes in the Household Survey to the various measures had taken place over the years prior to 2010, but for simplicity's sake, the BLS incorporates these changes into one month (which they clearly point out)." (Source: The Big Picture)

Spread out over 10 years, 1 million people is not all that much on a per-month basis. If you just looked at the numbers in the actual release, it would also lead you to believe that somehow last month around 1.2 million working white men and women just disappeared, or that the number of working Hispanics rose by 800,000. There are a lot more of those types of anomalies. But they are also explained by the fact that the BLS incorporated the recent 2010 census data into their formulas. Apparently, the Census Bureau found a lot more Hispanics and Asians in the country than they did in 2000, and that forced the BLS to make adjustments in their estimates, as they did with their numbers of people in the workforce.

All these numbers need to be taken with a large dose of salt, as they are subject to large revisions. This past year the BLS adjusted the employment numbers on a monthly basis, mostly upward, as more jobs were created than they estimated, which is normal for a recovery. In the last recession, they had to go back and adjust the prior numbers downward. It is simply the result of using models and making estimates. The BLS is very straightforward about how they make their models. You can re-create them if you want to. If you go through that process, you get a better understanding of the extent to which the monthly employment number is just an estimate.

For instance, last month, rather notoriously, the BLS found 42,000 new delivery jobs. No real surprise, as Fedex and UPS and other delivery companies hire more workers for the holiday season, and as more and more of us shop online. But those are temporary jobs, and the BLS likes to use seasonal adjustments to smooth out such anomalies. A friend of mine talked with them today, and they said that they recognized the problem and had made adjustments to their models to take into account the new seasonality of holiday hiring. Next December there will be no surprise of 40,000 temporary jobs showing up in the data. And did they back them out in this release? Yes, but in the revised December data.

If you subtracted 42,000 jobs from last month's number the non-farm payroll number would have been close to a loss. What would that have done to the stock market? But if they used the current, revised data, it would have shown 207,000 new jobs, which is a good number and much stronger than the first estimate. In fact, the last three months have averaged 200,000 new jobs a month, when we look at the revisions.

And that is the point. These are the best estimates the BLS can come up with. They are very clear about how they go about making the estimates. If you have a better way, then by all means propose it. (In fact, there are a lot of people who do just that. Clearly, they have more time on their hands than I do!)

But anyone who trades on this number is gambling. It can be revised up or down, even years later. I find the preoccupation of the market with that number amusing.

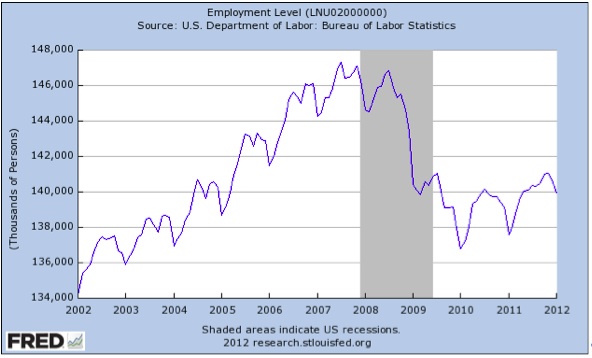

But what is not amusing is the reality that is masked by the joyful response of the stock market to the good news. This was a good employment number, not a great one. It takes about 125,000 new jobs just to keep up with population growth each month. That means we created roughly 120,000 jobs that helped bring down the unemployment number. The US economy has created almost 3 million jobs in the last two years. That means we only need another 7 million to get back to where we were in 2007! Look at the graph of the total numbers of jobs in the country, as of last month. (From the St. Louis Fed FRED database)

So even if we reclassify 1 million workers as Hispanic, Asian, or Black, we are still down 7 million jobs. As I detailed about a year ago, even if we create 250,000 new jobs a month, it will take almost five years to get back to where we were in 2007. That is IF we can avoid a recession in the meantime. Such a growth rate would require whole new industries and new types of work, much like computers and technology in the '80s and '90s. (I think that could happen, but that is a story for another book.)

Is it any wonder that the Conference Board Consumer Sentiment number that came out on Monday dropped precipitously, falling to 61.1 from 64.8 (revised up from 64.5)? The present-situation component led the decline, falling from 46.5 (previously 46.7) to 38.4. The expectations component dropped slightly, from 77 (previously 76.4) to 76.2. "The decline went against expectations of increasing confidence and is a sign of consumers' uncertain views of the economic recovery." This in spite of the fact that today's employment number was so much better than consensus expectations. Things may be getting statistically better, but we don't feel all that content.

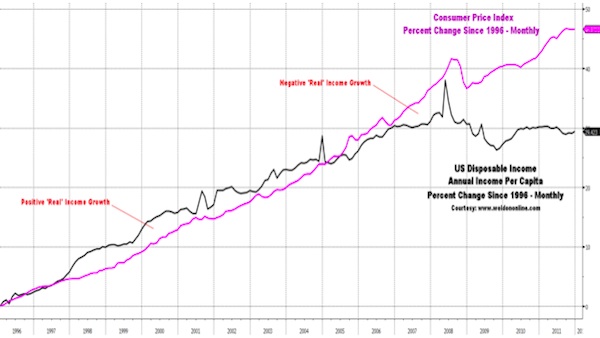

And while we should enjoy the better employment numbers, we need to take a peek at another, less sanguine, number in the BLS report, and that is wages and income. Let's look at this chart from my favorite slicer and dicer of data, Greg Weldon, who makes his return to Thoughts from the Frontline after being absent for too long. A chart from the maestro of statistics will help bring the problem into focus. First, look at how real (after-inflation) disposable personal income has gone flat since 2000, after rising in line with inflation for a very long time. (Go to www.weldononline.com for subscription information.)

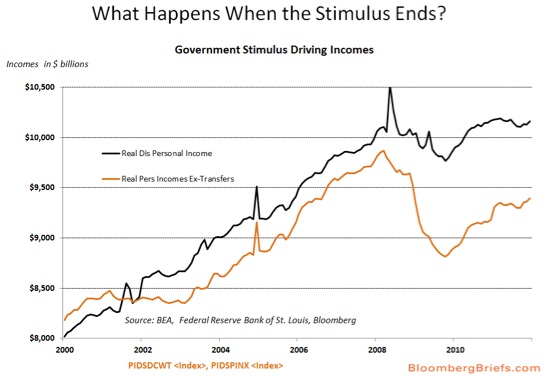

The above suggests there has been little growth in disposable income for five years. But it is worse than that. This next chart, from Rich Yamarone of Bloomberg, who was on a panel with me Wednesday night, shows that government transfer payments have been an increasing share of disposable income since the beginning of 2008. Without that government spending, consumer spending would be much worse than it is. But then so is the federal deficit. There is no free lunch.

It gets worse. Madeline Schnapps of TrimTabs shot me a note about her frustration with the employment numbers. TrimTabs tracks federal withholding taxes to give them an advance estimate of the employment number. In the past, the more taxes that were withheld, the more jobs there were. For the past few months, their data has shown fewer jobs than the BLS estimates. I called her late tonight, and she answered (I know, neither of us has a life outside of numbers). She was still mystified. The last time their data was this different from the BLS numbers was in the last recession, when the BLS estimated too many jobs and later went back to revise their numbers, which were then more in line with TrimTabs tax data.

I suggested that the problem may be that even though more people are working, they are making less money and thus paying less in taxes. But that thought is not apparent in the data. Average hourly wages are not down all that much. But self-employment income is not included in that figure. And many people have been forced into "self-employment," which can mean part-time contract work or consulting, and the drop in income is being missed by the data.

When a College Education Isn't Enough

That leads us to the next bit of data from the BLS, brought to my attention by Philippa Dunne of The Liscio Report ( www.theliscioreport.com). It needs no set-up:

"And in another set of forecasts, on Wednesday, the BLS released its occupational projections through 2020. They make very glum reading. The five job titles with the biggest projected increases in numerical terms: registered nurses, retail salespersons, home health aides, personal care aides, and office clerks. Of those, the first requires no more than an associate's degree; the last, a high-school diploma; and the middle three, less than high school. Of the top 20 occupations, just five require an associate's degree or more. All together, 30% of the projected job openings over the decade will require less than a high-school diploma, and 40%, only a high school diploma. Less than 20% will require a bachelor's or more. Almost three-quarters will require no more than brief on-the-job training, and 85% will require no previous relevant job experience.

"All those politicians and pundits who love to talk about the need to educate the citizenry—along with the proponents of the job-skill mismatch theory of persistent unemployment—should check in with these projections. They paint a picture of a low-wage, low-skill labor force. And though the U.S. is still a destination for world-class scientists and the producer of great innovations, it's hard to imagine how that can be sustained on the base of such an uneducated, unskilled labor force. We can only hope for some upside surprises."

And that squares with the anecdotal evidence I am getting from my kids. Now, let's put a personal face on the employment data. Long-time readers know I have seven kids, five of whom are adopted. Six are out in the labor force – or want to be. I have pushed them to get college degrees, for very good reasons. My oldest son worked part-time for 8 years doing manual labor while going to college to get that degree. He works for one of the large shipping companies, is a union member, and has seen his hours cut the last few years, except around the holidays when gifts are shipped. He has a son and supports his family. And can't make ends meet.

He has been trying to get a new part-time job or another full-time job. Anyone who meets him is instantly attracted to him. Everyone likes Henry. Smart, funny, polite, and hard-working. And black. (Every white man in America should have a black son. It changes your world view. But that's another story.) All-Dallas Area football player in high school and strong as an ox, thus working on the loading docks was a good job when he started out. It paid better than most jobs, as well.

To meet him you would think he could land a good job in a minute, but he can't even get an interview. It used to be that you placed an ad in the paper and people called and then came by the office. You met them and put a face to their application. Up until about 2000 I myself did that.

Then came the internet. Now, every place wants you to fill out an application online. Employers sift through the resumes and find what look to be the top picks and then call them up for an interview. How do you get to the top? Employers want experience in today's job market, where there are four people unemployed for every job opening. Those are the applications that get looked at first. Henry did manual labor while going through school, an honorable and worthy job. But it did not get him any "experience" for an office or retail job. Even with his shiny new college degree, think he can get to the top of the pile of applications? There are lots of college degrees in the pile and they have "relevant" experience. What's a human resources person to do?

About 2000, when we needed someone to work for us and could not draw on anyone we knew, we started to go (at Tiffani's insistence) to this "new" thing called monster.com. You could post a job position and those interested would email a resume. Today, if you post a good job, even with very specific guidelines, you can quickly get several hundred resumes. Overwhelming, actually. I recently hired a new assistant, Mary, who may be one of the better staff I have ever had work for me. I "found" her because one of my other employees suggested her for some specific temporary work that needed to get done, as they had worked together before and she had the special knowledge we needed.

We kept finding work for her to do, and I needed an assistant and realized she was perfect. But would I have found her if I went to the internet? Probably not, as she is not what I thought I was looking for. But how would I have known, just looking at a (virtual) piece of paper?

For fun, I started looking at job postings. Check out this one:

"Customer Service Professionals - ROCK STAR applicants only!

"We are looking for the best of the best; average will not do! - Do you have exceptional problems solving skills? - Can you think outside the box? - Do you impress everyone you meet with your creativity and adaptability? Then we have the position for you! We're looking for dynamic, professional, creative problem solvers for our client in Hillsboro. - This position involves responding to unique….

And what are they willing to pay this Rock Star Applicant? A princely $12-15 per hour. Which may sound like a lot to my Chinese readers, but it's barely enough to support a household with children, even in Texas. And it certainly doesn't leave much in the way of "disposable" income.

When you survey the jobs available online, pay attention to how many people have looked at the job opportunity. If it has been up for a few weeks it may have been viewed many thousands of times. There are four people looking for jobs, for every job opening.

I could go down the list with my other kids. It is a tough world out there right now. Kind of like the '70s, when I was starting out. It took me a long time to get more than a few nickels to rub together. But we made it.

We're All Turning Greek

Upon reflection, I have been somewhat (though not intentionally) cavalier when talking about the European crisis. I write in terms of trade balances and labor-cost disparities. Greek labor has risen 30% more than German labor, so Greece must either leave the euro or see their relative wages drop over time. The same with Portugal and the other peripheral countries.

It all makes such perfect economic sense, at least in theory. But try telling a Greek that he is overpaid by 30% compared to a German. And for the good of the country he needs to take a pay and lifestyle cut. The safe thing to do would be to put it in a memo and not be around when he reads it. Think a politician can get elected on that platform?

And yet, that is not unlike what we are going through in the US. We are seeing wages pulled down as jobs become subject to a larger labor market, not just in China or Mexico but also in the US. It costs about half in terms of employee costs to make a car in the South as it does with union labor in Detroit. Jobs and companies move to take advantage of business climate, costs, and taxes.

We are subject to the same wage disparities that the Greeks are dealing with. Yes, we have lots of capital and amazingly productive workers (as measured by output per hour and cost), but low-skill manufacturing jobs are leaving the country. We have seen a boom in manufacturing of late, but much of the demand is for higher-skill workers. The US manufactures as much as it ever did in terms of output, we just do it with a lot fewer workers.

Sidebar note: Mining (natural resources) and logging in the US employs more than manufacturing. Look it up.

And now let's turn to a few thoughts on health care. Once again, indulge me while I put personal face on the problem.

Who Can Afford Health Care?

On the panel last Wednesday was good friend Mark Yusko of Morgan Creek. He noted that an acquaintance of his, who was worth north of $10 million, had just had four stents put in his arteries. The hospital bill was $288,000. As he was over 65, Medicare paid everything. He paid nothing. Yet he is worth $10 million. I am not judging, by the way. My mother gets veteran benefits and Medicare, as well as Social Security. I will most likely take Medicare and Social Security when the time comes, if it is still there for me, even though I could afford not to. If my income were of the same stripe as Mitt Romney's, you can bet I would pay just 15% of it in taxes. Hold that thought.

On the same panel, Rich Yamarone said he had a stent put in last year. The bill was $90,000, and he was also nothing out of pocket, as insurance paid for it. His employer had paid for that insurance, so he used it. Just as I use my insurance when I need it. Hold that thought.

A good friend of mine recently had hip surgery, for a problem known of in advance by his insurance company. So they are not paying, saying it was pre-existing. And will not pay for the follow-up costs that are now looming, as it looks like he will need a full hip replacement. And he can't afford it. So he lives with steadily growing pain, while an attorney tries to get the insurance company to pony up. Hold that thought.

Two weeks ago my #2 daughter (in birth order – otherwise they are all #1) had some medical work done and mentioned a lump in her throat. The scan came back, and it was not good. The growths on her thyroid were almost as big as the thyroid. I called my doctor (Mike Roizen, Head of Wellness at the Cleveland Clinic) and asked what to do, and he gave us a referral to what he said would be the best doctor in Dallas for this type of thing. We went to see him last Monday, thinking we would schedule a biopsy and hoping we could do it soon.

He said we could do a biopsy, but given the scan we already had, if it were his daughter he would removw the thyroid as soon as possible, whether or not the growth was malignant, and then do the biopsy. He had an opening a week later and she is scheduled for this coming Tuesday. Both he and Roizen agreed, and both told us the odds are quite high that it is benign, although complicated by the fact that Melissa's mother had thyroid cancer some 20 years ago.

Why talk about this with you? Here is the rest of the story. She is the one child I have with no insurance. I knew it and kept hoping she would get a job that included insurance. Now that looks like a bad economic choice.

I gently asked the doctor about costs. It was not as much as I feared, but definitely not cheap. As maybe in the mid-range of tens of thousands of dollars. His fee was the minor part. (I was actually surprised at how low as it was. I make more than that for an hour-long speech, and what skills and training do I have? Just saying.) But then he quietly said that the costs would go up a lot if it was malignant, as just the drugs to kill a thyroid cancer would be $25-30,000. The good news is that if it is a thyroid cancer, there is a proven therapy to beat it. Actually, the exact same treatment (radioactive iodine) as her mother had some 20 years ago.

I didn't bother to call other hospitals to negotiate a better price, or find a less expensive doctor. I simply had them schedule it. This is my daughter. It is her life, not a new car. Time seems to be of the essence. And life has blessed me that I can afford it.

But that's the point. How many people find themselves in that situation and their father can't step in? Or there is no father? You then go to a free clinic or an emergency room and try to get someone to help you, even though it's not an emergency. Or you put it off until it is an emergency, or it's too late.

Talk to your friends in the health-care world. And especially the nurses, who are the real soldiers on the front line. The stories they tell us about how broken our medical system is have shocked even me at times. And it is not just a system that has no money. It is a system that we expect to take care of all the needs that, in my youth, were considered as minor. And that is expected to take care of the homeless and the mentally unstable. Drug users. And a lot of people who do not take care of themselves with a simple, healthy diet and exercise, but expect full service when their bodies rebel, crowding out the service and driving up the costs for those who are in real need.

Medicare fraud? It costs us into the hundreds of billions. Doctors who test for everything because they are afraid of being sued if they miss something, running up costs sky-high? An unbelievable lack of technology in this day and age, because of government rules? Insurance and paperwork? Costs that are the highest in the world by a wide margin, yet no better outcomes?

And all staffed by amazing people who care a lot but are overwhelmed and caught up in a system they want to see changed.

The litany goes on and on. So, is the answer to simply to put hour heads down and accept the higher costs and rising taxes? Or let a bureaucracy control costs and require everyone to buy insurance, even if they can't afford it on the $15 an hour the average worker makes before taxes? Or let a "free" market somehow set the price of health care, working with private insurance and safety nets? All in a world of unlimited demand? Because when you or someone you love is sick or hurt, you want the best care you can get as soon as you can get it.

It seems simple. We need to have more-universal coverage. But there is a limit as to what any nation can afford. We look at countries with universal health care, but it is not something that many of us would be familiar with. Could we really ration health care at the end of life, which is where a large portion of our expense in the US goes? Or give up our right to sue if something goes wrong?

We have promised the Boomer generation more health care than we will be able to afford, without major reforms in what we spend our taxes on. And if we raise taxes enough to even come close to what we need, the shock to our economic body will mean recessions, higher unemployment, and fewer jobs which pay less.

Some point to this country or that and ask, why can't we be like them? They have better healthcare and seem to be able to afford it. But those countries did not move overnight to universal health care. It took time, lots of time, for them to adjust to their current systems.

Could we in the US adjust over time? Of course. But that is like saying the Greeks can adjust over time. In a decade or so things will sort themselves out on the Aegean. In the meantime, it will be an economic disaster. The same would be true for the US.

Raising taxes as much as will be needed to pay for the currently planned programs will take decades of adjustment, and could cause a depression in the meantime. That is just the economic reality. And I am not talking about the Bush tax cuts. Repealing those does not even get us 10% of the way to paying for the current programs, as well as the other "services," like Social Security, the military, education, parks, and the BLS. (Well, at least I would miss the BLS data, even if my kids might not.)

Not to make hard choices on the deficit, taxes, and health care is to choose to allow the market, via interest rates, to force us into even harder choices. And that's not in some distant future but in the next all-too-few years.

There are no easy choices. As we will see, raising taxes has consequences in the short and medium term. The transition to where 30%, then 40%, of the economy will be taxes will be wrenching. If we can believe the polls, dialing back health care will not be popular. Raising taxes is no less popular. We want more health care, and we want someone else to pay for it. But there is no one else. It is just "we the people."

And what we do will define our job market for decades. There are no easy choices. We all marshal the "facts" as we see them to support our personal choices on jobs and health care, but it is far more complicated than most anyone wants to admit. There will be costs for whatever choices we make, even if we decide to do nothing at this time.

And with that thought I will end here, although there is much more that can be said.

It's 6 AM and time to hit the send button – somehow, I have been up all night. I will close the letter for the first time in years without a personal end note, as I have already been "personal" enough. Have a great week.

Your thinking about health care more than he wants to analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.