The Danger of Having a Weak Economy with a Strong Stock Market

Stock-Markets / Stock Markets 2012 Jan 31, 2012 - 04:11 AM GMTBy: Sam_Chee_Kong

For the past two to three decades, there has been a radical structural transformation of the American economy from being a production economy to a service economy with consumer driving 60% of its GDP. Due to the so called Globalization, much of America’s manufacturing facilities have been transferred overseas and hence with its jobs as well. Since the beginning of the 21st century America has lost more than 50,000 manufacturing facilities either due to uncompetitive closure or being shifted overseas. As a result more than 5 million jobs have been lost along the way.

For the past two to three decades, there has been a radical structural transformation of the American economy from being a production economy to a service economy with consumer driving 60% of its GDP. Due to the so called Globalization, much of America’s manufacturing facilities have been transferred overseas and hence with its jobs as well. Since the beginning of the 21st century America has lost more than 50,000 manufacturing facilities either due to uncompetitive closure or being shifted overseas. As a result more than 5 million jobs have been lost along the way.

This has also resulted in a loss of more than 10% of the middle class jobs where during the early 2000s there are more than 72 million middle class jobs. Now there are less than 65 million middle class jobs.

Problems of Keynesianism

Similar problems are also surfacing in most of the economies around the world, which follow policies that are dictated along the lines of Keynesianism. When their economies are in trouble with deficits, Keynesians believe in ever expanding the economy through private consumption and public spending and any slowdown will result in a contraction of the economy. Apart from the above fiscal measures, one of the monetary tools available to Keynesians is the manipulation of the interest rates.

Keynesians believed that by lowering the interest rates it will help revitalize the economy through the extension of cheap loans to companies. Due to cheap loans companies will expand plants and hire more workers and this in turn will put pressure on raw materials and labor cost. As a result, it will cause an upward movement in the cost of both labor and raw materials. Eventually, this will lead to an increase in the price of finish goods when aggregate demand exceeds production or what we call ‘Inflation’.

To keep up with the cost of living consumers will have to spend more of their income on goods and services and hence less on savings. This is actually what happens during the early part of this century where savings became negative. As we know any country without savings will find it extremely difficult to build up its capital. Without capital a country will not be able to reinvest and hence will have to turn to external sources to finance its consumerism and expenditures in its government’s day to day operations.

Diverting attention

When external sources of funds are scarcer or insufficient to finance its deficits spending, it will eventually need to rely on its last resort which is Money Printing or Quantitative Easing. Due to the nature of Keynesianism, the flow of money cannot be stopped, it has to keep flowing in the economy or else its economic activity will grind to a halt. This is how the current state of affairs of the American economy, like a drug addict forever needing an increasing dose of drug to keep him going.

Due to this, it also helped contribute to America’s problems which include $15 trillion in funded and $135 trillion in unfunded debts, budget deficits of more than $1.3 trillion in 2011 fiscal year, more than 8.5% unemployment rate, 46 million Americans on food stamp, the U.S Debt/GDP had already surpass the 100% mark, 23 million American workers are either unemployed or underemployed and the lists can go on and on ad infinitum.

To divert the public attention from the problems in its economy, the government had to do something visible and that is to support a strong stock market. Thus, this is their smoke and mirror act. This not only helped to deceive the public that a strong stock market is difficult to crash but also gives an impression that the economy is doing well. This eventually leads to an overvalued stock market. Because uninformed folks will always think that a strong stock market is driven by a strong economy. But when the day of reckoning arrives, it will be too late for those folks to escape.

Market Overvaluation

Will the history of market overvaluation lead to a crash again? In 1996, Alan Greenspan, the then Chairman of the Federal Reserve warned the public about the ‘irrational exuberance’ in the stock market. No one heeded his warning. True to form the market went up from about 6400 in November 1996 to more than 12000 in March 2000.

However, in March 10th 2000, when the Nasdaq Composite Index reached an all time intraday high of 5132, it nosedived and continued to fall in the following two years. By Oct 10th 2002, it hit the bottom with an intraday low of 1106 which is about an 80% retracement. Even after 12 years as of today it only managed to close at 2816 which is about 55% of its original value.

During the dotcom fever nobody cared about earnings anymore, any company that has a dotcom attached to it will instantly be the darling of the stock market. Then, the public were stampeding to buy those dotcom stocks that were without earnings like there is no tomorrow.

It is as if they have found a money minting machine or the holy grail of investment. Hard work, savings and prudence in spending their money is no longer valid. Working from 9am to 5pm is a thing of the past because money is now too easy to be earned, just by clicking a few buttons and voila out comes the money from the perpetual money fountain. It seems like they have reached a new peak in money making from the stock market.

Massive Money Supply Growth

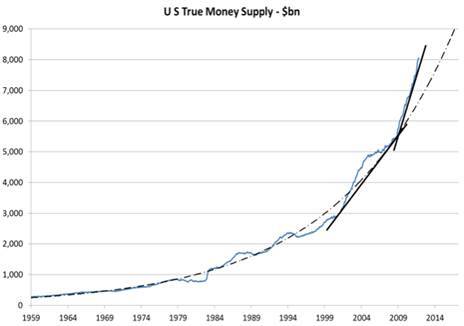

During the end of 1999 and early 2000, there have been a massive monetary expansion which amounted to trillions of dollars or about 50% of the money supply at that time. This is because the Federal Reserve feared a collapse in the Y2K bubble and hence had to inject massive liquidity into the system to avoid a crash. The following chart shows the extent of the increase in money supply since 1999 till 2011. Take a look at how steep is the curve during its parabolic run up. As we know anything that Goes up Parabolic cannot be sustainable, sooner or later will find its way down and FAST. It is like the lyrics of the old Brook Benton song ‘what goes up must come down…’ and so it did.

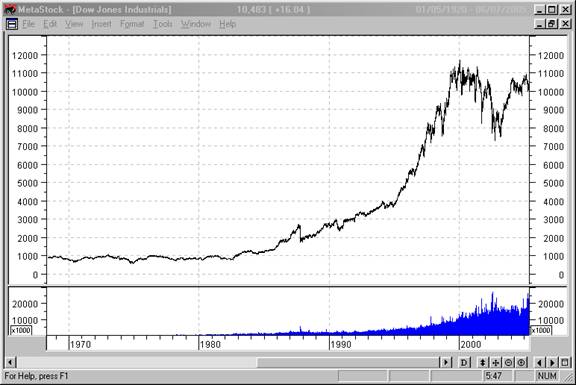

As a result of such a massive growth in the money supply where most of it flowed into the stock market, resulted in one of the biggest bull run in the U.S history. Stocks that have no earnings are drive up to more than 10-20 times their original value. This can be shown in the following chart of the Nasdaq Composite Index where it takes less than a year to double up from 2200 to more than 5048 in March 2000.

Recent developments in the movement of stock markets suggest that there is currently a decoupling effect on the performance of the stock market to the economy. It seems like the more bad news the economy churns out the better the performance of the stock markets. It had reached to a point where the study of the fundamentals of companies doesn’t matter anymore. As they said ‘a rising tide raises all boats’.

Stock Market Overvaluation

Since its inception in 1896, it took the Dow about 100 years to reach the 3000 point mark in 1988. Remarkably, as from the above chart during its recent run up, it only took the Dow two years to double that value (6000 points) from 6498 in March 2009 to 12876 in March 2011. It suggests that the rise in the market is not due to increasing corporate earnings as we know but rather due to overvaluation.

More over between 2009 and 2011 the Dow’s Price Earnings ratio (P/E) ratio averages about 14.5. A P/E of 14.5 indicates that an investor is willing to pay $14.50 for every $1 the Dow generates or put it another way an investor will need 14.5 years to achieve a 100% return on his capital. As you can see from the above chart, the Dow instead of needing 14.5 years to achieve a 100% return with a mark to earnings valuation, the Dow achieved it in 2 years. Alan Greenspan once said ‘the market is no longer what it once was, an investment reflection of a free market’. He further added that investing in the stock market is equivalent to buying a ‘lottery’ especially in internet stocks.

Why the need of an Overvalued Stock Market?

An overvalued stock market will be the ultimate goal of every market participants. Everyone from the individual stock investor to the fund managers and government needed an overvalued stock market. Let us examine each and every one of them individually.

- From an individual investor point of view, it is certainly not in the best interest for them to have an under-performing stock market. If the stock market persistently under performs other assets, then investors will pull out their investments from the stock market and invest in say money markets if they offer higher rates of return. So in order to prevent investors from pulling out of the market, the insiders and big money will always try to create an overvalued market.

- Politicians need an overvalued stock market to gain popularity especially when election is around the corner. When the stock market is strong, no one will benefit more than the politicians. This is because when everyone is making money from the market, no one seems to care how the politicians run the economy even if they run it to the ground. The present government will surely be voted into office again even if there are corrupted to the core. The people who are able to influence the public are too occupied with making money and hence they will have less interest in who is running the country and who is being done to it. All they care is whether the market will continue going upwards.

- Mutual funds managers and brokers also want an overvalued stock market because their earnings are based on commissions. Mutual fund manager’s income is based directly on the percentage of the funds valuation. The higher the valuation the more income they will receive. Mutual fund managers need an ever increasing market to keep selling their products to unsuspecting investors by telling them that the market will keep going up and making new highs.

Stock Broking firms too through their brokers always engaged in the so called ‘hyped-up selling’ of shares to their uninformed clients, telling them that every dip is an opportunity to accumulate more shares. This will nonetheless increase their earnings by doing more trades and hence more commissions.

- Corporations also need an overvaluation of the stock market. The reason being most of the executives wealth are tied to their stock holdings in the company either through Employee Stock Option Scheme (ESOS) and Stock splits. So it is not in their interest to have a beat down stock market.

Corporate head honchos don’t make most of their money by increasing the sales of their company year on year or by churning out new products every now and then. They make most of their money by increasing or ‘Pump Priming’ the value of their company stocks. When their stock valuation reached obscene levels they will cash out in no time and often leaving uninformed shareholders in the lurch

How they create Overvaluation?

One, the stock market has become a victim of market manipulation of Wall Street bankers and brokerages. They get companies to coordinate with the brokers to promote their companies and often offer incentives for them to do the marketing. Brokers will encourage you and others to invest in their stocks without caring whether they fit your requirements. All the brokers care is their commissions and free trips when their sales quotas are met.

They will engage in what they called ‘over selling’ which will drive prices of stocks many times over their valuation based on their earnings.

Two, the Plunge Protection Team or the President’s Working Group on Financial Markets (PWG) which comprises mostly of hedge fund managers. Its mission is to ‘develop and publicly release best practices so that market participants may enhance investor protection and systemic risk safeguards consistent with PWG principles and guidelines’. The committees are mostly from the hedge funds industry and they are,

1 Eric Mindich, Chair, Eton Park Capital Management

2 Anne Casscells. AETOS Capital, LLC

3 James S. Chanos, Kynikos Associates LP

4 Anne Dinning, D. E. Shaw & Co., L.P.

5 Jonathon S. Jacobson, Highfields Capital Management

6 Marc Lasry,Avenue Capital Group

7 Edward A. Mulé, Silver Point Capital

8 Daniel S. Och, Och-Ziff Capital Management

9 Daniel H. Stern, Reservoir Capital Group

10 William Von Mueffling, Cantillon Capital

11 Michael Vranos, Ellington Management Group LLC

Getting people from the funds industry to head the Plunge Protection Team is like getting a fox to look after the chicken coop. Just wondered who are they going to bailout first (themselves or millions of folks out there) when the next crisis strikes.

In actual fact the main purpose of the Plunge Protection Team is to stabilize or rescue the financial markets when it is poised for a huge takedown or crash. They will stabilize the market so that investors will not get too worried or fear that the market is going to crash.

A good example is during May 6th 2010 when the market experience a ‘flash crash’ when the Dow experienced a drop of almost 1000 points within minutes. Quite a number of stocks had their market capitalization wipe out by almost 90% due to the absence of buyers. Within the next few hours the market regains back most of its losses and thanks to the Plunge Protection Team.

Another mission of the Plunge Protection Team is to keep driving the index higher at the end of the trading day. Nowadays it’s normal to see huge volatility in the markets with daily trading range of up to 2-3 %, especially during the first and last 30 minutes of trading. It is especially so during the final minutes of trading and out of nowhere there will be a sudden surge in buying activities in index linked stocks. The end result will be a sharp rebound or increase in the Index value.

They (PPT) can manipulate the market both ways. Since they can drive the market up, what makes you think they can’t manipulate the market on its way down. They can’t be driving the market all the way up to the stratosphere without any retracement. When they are done with their selling, they need to drive the market down so that they can buy back at a discounted price again and cover their short positions. Together with the media, they will soon release bad news about the economy and negative company earnings and of course paint a bleak picture of things to come.

They will keep driving prices lower until all the weak holders sell out. When things are quiet and people lost interest in the market, it’s time again for stock market promotional campaigns. The media will again fill with good news and encouraging signs of the economy turning around. Investors will again join in the bandwagon and the cycle will be repeated. Again it’s time for catchy phrases like ‘Green Shoots’, ‘This time is different’, ’New housing startups turned the corner’, ‘the market will turnaround by next week’ and ‘encouraging signs from non farm payroll’.

Plunge Protection Team is a Global thing

The manipulation of the stock market by the Plunge Protection Team is not only limited to NYSE, it is a global phenomenal. In Jan 2011, the Bangladesh Stock Exchange suffered one of its biggest crash with a dropped of 8.9% and as a result trading was suspended. On Sunday, the Exchange had already lost another 6.7%, since it was battered for the past few weeks.

People are seen rioting in the streets and police had to be called in to disperse the crowds. Miraculously, the next day the exchange posted one of its biggest gains in its history by recording a 15% rise in its opening. Circuit breakers triggered during the 8.9% dropped but failed when the market shoots up 15% on opening? Isn’t this another move by the Bangladeshi Plunge Protection Team?

In May last year, Bloomberg reported that stock exchange in the Kingdom of Saudi Arabia rose for the first time in three weeks after its Finance Minister Al Assaf, said that the rise in oil prices will boost the ‘strong condition’ of the kingdom and it is in ‘excellent shape’. This is in response to weeks of decline due to the fear of unrest in Libya might be spreading to the kingdom.

He further reiterated that ‘stock prices in the kingdom are very attractive and the Saudi Public Pension Agency bought shares last week’. To further boost the confidence in the stock market, he told Bloomberg that, ‘I also seized the opportunity and bought shares, I am a long term investor and the moves by government agencies signal continued confidence’. An excellent job by the Saudi Arabian Plunge Protection Team ?

Didn’t anyone tell him that the term ‘holding long term’ had long been erased from the vocabulary of Investment in today’s markets?

Will Market Overvaluation lead to a Crack-up boom?

What is a crack up boom?

Ludwig Von Mises, in his ‘The Theory of Money and Credit’, stated that ‘the boom can last only as long as the credit expansion progresses at an ever increasing pace. The boom will not last forever even there is an ever expansion of credit because it will encounter barriers or rather the Law of Diminishing Returns along the way. Eventually, it will lead to a boom crack-up and the breakdown of the entire financial system’.

Due to the ever increasing expansion of credit in an economy, the excessive money supply will somehow cause inflationary pressure on the goods and services given that the latter are unable to expand correspondingly. Moreover, in order to compensate for the increase in the money supply something has to give in and it will be the debasement of the currency. According to the Theory of Rational Expectations, when people realized that there is an ever increasing supply of money, they will form an expectation that the purchasing power of the currency will fall.

The end result will be an increase in the prices of goods and services because people will spend their money as fast as possible so that the value of their money will not be further deteriorated. The credit expansion will lead to a fall in demand for the currency due to its flight to goods and services and eventually the price of goods and services will be too expensive for the people to afford. In other words, they are facing Hyperinflation and eventually will bring down the whole financial system.

However, it is sad to see most of the uninformed folks are still ‘Partying on the Deck of the Titanic’. By strengthening the stock market, authorities are able to create a smokescreen over the real economy and also give a false impression that the economy is strong and doing well. As a result, nobody wants to make money in the traditional ‘brick and mortar’ business model anymore, they are now convinced that money can easily be made in the ‘New Era’ of day trading in the stock market by pressing a few buttons.

When making money seems effortless and pain free, who needs a full time job anymore. However such symptoms points to one thing that have been existed for the past centuries and that is ‘Market Mania’. For the market to reach such a stage it has to be driven by rampant greed, something for nothing, the feeling of invincibility to losses and the feeling of getting hold of the holy grail of investing. History is awash with examples, especially during the Dutch Tulip mania in the 17th century and the British South Sea Bubble in 18th century.

We may be lucky to dodge the Y2K bullet and the 2008 Mini Crash, but due to the massive injections of money into the economy by the Fed that enabled it to avoid a much more severe contraction in the economy. Make no mistake, sooner or later the market come back to its senses and when the day of reckoning arrives there will be a lot of pain and blood in the streets. Just take a look at the following chart. Can you detect anything wrong with the chart?

Look at the volume at the bottom. Since the year 2000 until now, the volume of stocks traded are more than 100 times the volume traded since Wall Street open for business !! Most of the Volume are done when the Dow is trading above 8000 points. Guess who are the folks that hold stocks above this level? If you are an astute trader, you will know that the amount of Shares Accumulated will equal the Amount Distributed when the market crashes. So, as for the Long Term the DOW is doomed. By the time the market corrects the insiders and the big money would have already left the scene and the holders will be the millions of uninformed folks.

Another issue that needs to be taken into consideration is that under normal conditions in a major correction, the Duration of the coming Bear Market will normally equal to the Duration of the previous Bull Run. If you use the Time Series to study the market, you will notice that the duration of a bull market almost exact the duration of the coming bear market.

In this case the market started its ascend during the mid 1990s till today (which is about 15 years) and hence when the next crash comes, be prepared for at least another 15 years of Bear Market before we reach the level in what we called a ‘Full Retracement’ which is at about 3000 points.

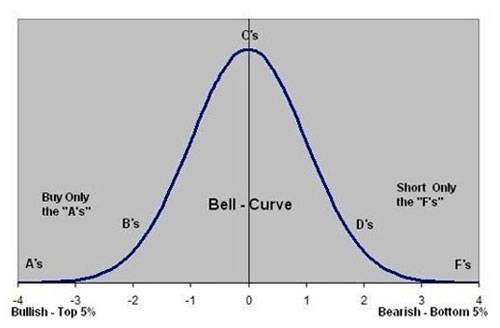

The above situations can best be described with the following bell curve. The bell curve is the best description of a normal market cycle. A normal market cycle usually starts from point A to C and end in point F. From point A to C, it represents the bull market while from point C to F represents the bear market.

Two points to take note,

1) As you notice, the duration for the bull run which is measured from point A to C is almost exactly the same as from point C to F which is the duration of the ensuing bear run. Eventually when the cycle completes, the market will end up in point F which is also at the same level as A before the run. This is what we called a ‘Full Retracement’. On its way down, the market will gyrates up and down or rebound and retrace until it finally reaches point F.

2) Similarly, the amount of shares accumulated on the way up from point A to C will also be almost evenly ( 5% margin of error) distributed on the way down from point C to F.

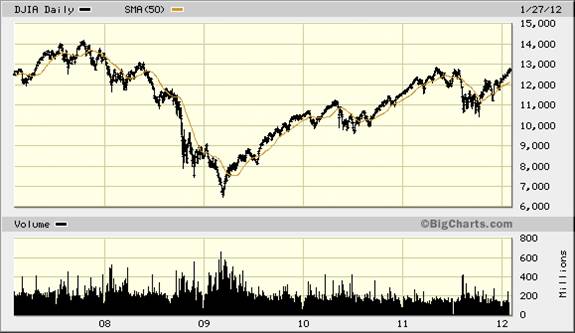

No doubt the market is going to make a new high in the next few months but the risk associates with building a portfolio under such conditions outweighs the rewards. As for the intermediate term (next 12-18 months), I will foresee there is a possibility the DOW breaking the previous all time intraday high of 14,164 which is set in July 2007 as shown on the following chart..

However, before it can set a new high, the immediate short term (next 1-6 months) target will be the 52 week high which is set in May 2nd 2011 at 12,876. Barring any unforeseen circumstances, the DOW should be able to break through the 12,876 in the next three months. This is because the trend line is ascending in a fairly decent angle and most of the technical indicators are not overbought. After the 52 week high is taken out, the DOW should move to its next target which is the all time intraday high of 14,164.

Betting in the stock market is all about understanding risk and rewards, nothing more and nothing less. This is because during a major correction ‘receding tides will lower all stocks’. Just for a discourse, during the crash of 2008, can anyone name me a stock that managed to go against the tide and set a new 52 week high?

Even blue chips like Microsoft, Apple, Coca Cola and many others were not spared and they too were not able to withstand the waves of selling.

The only difference between a more fundamentally sound company and the rest is that during the recovery phase, they will be the first ones to recuperate their losses because market insiders and big money will be going after them.

It is sad to say that the current state of affairs of a weak economy with a strong stock market is being replicated throughout the world.

In order to beat the market insiders and big money we need to understand the risk/reward ratio at any moment. If the current risk/reward ratio is against us then we just have to wait for another time and opportunity when the market offers better odds.

The theme for investing in 2012 will be ‘Cautious Optimism’ meaning we should be optimistic in the Short and Intermediate term but at the same time be cautious about being too optimistic.

This is because currently the markets are being confronted with too much headwinds and tailwinds so as to say while at the meantime the charts are pointing towards a bullish biased. It will do us no justice if our portfolios are too much cash biased because we will not be able to take advantage if the market is going to break new high in the coming months.

Similarly, as for the Mutual and Institutional fund managers, they will need to convince investors that the investment targets stated in the Investment Policy Statement is on target before they begin another round of ‘loading up’ their clients with new investments.

We have to be Cautious because we do not know what will be the next catalyst in the coming Financial market Meltdown. It is always better to be safe than sorry. The following might be one of the catalysts for all we know.

- The breakdown of either the Euro or the Eurozone.

- Price of Oil going back to $146 per barrel.

- Another Black Swan event. To qualify for a Black Swan event an outcome will have to satisfy two criteria and that is High Impact and Low Probability. There is a new group of countries that are designated as ‘Frontier Markets’. This new group of countries are similar to the current emerging market countries like Singapore, Taiwan, Indonesia, Malaysia and so forth when they are 20 years ago. Countries that fits into the ‘Frontiers Markets’ include most of the African countries like Kenya, Zimbabwe, Nigeria and South East Asian countries namely Vietnam, Burma and Cambodia .

These are high risk markets and most of their stock markets lack regulations and controls. For example in Vietnam, both publicly listed and non listed private companies are traded in both the Saigon and Hanoi Stock Exchanges. Yes, shares of privately held companies are allowed to be traded in the Stock Exchange. It is not uncommon to see a run up of 60-100% within a trading day on prices of unlisted companies due to the lack of regulations. A crash in one of the markets might set off a chain reaction of events that might unstable the global markets.

by Sam Chee Kong

cheekongsam@yahoo.com

© 2012 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.