Stock Market Coming Off A High

Stock-Markets / Stock Markets 2012 Jan 21, 2012 - 11:48 AM GMTBy: Doug_Wakefield

“There were two conflicting cultures. One rewarded professionalism, honesty, and entrepreneurship. This culture recognized that without individual investors, the markets could not work. The other culture was driven by conflicts of interest, self-dealing, and hype. It put Wall Street’s short-term interest over investor interests. This culture, regrettably, often overshadowed the other.” Take on the Street: What Wall Street and Corporate America Don’t Want You to Know (2002) Former Chairman of the SEC, Arthur Levitt, pg 7

“There were two conflicting cultures. One rewarded professionalism, honesty, and entrepreneurship. This culture recognized that without individual investors, the markets could not work. The other culture was driven by conflicts of interest, self-dealing, and hype. It put Wall Street’s short-term interest over investor interests. This culture, regrettably, often overshadowed the other.” Take on the Street: What Wall Street and Corporate America Don’t Want You to Know (2002) Former Chairman of the SEC, Arthur Levitt, pg 7

Is the world of finance extremely complex? I believe we would all say yes. Are there certain aspects of the world of finance that are really quite simple to understand? Here again, I believe our answer would be yes. Americans have grown to accept the simple ideal that as long as the Dow is climbing, this a positive sign for their own future. Americans have also reacted in the last year or two, to the simple idea that the United States is going the wrong direction, illustrated by the more than $6 trillion in new debt over the last 4 years, a process that took a century to achieve coming into the 2000 top. Clearly, one of these indicators is currently giving off a false signal.

After living through two bubbles, fueled by cheap credit, we are afraid to admit that our entire society is once again caught up in a third credit bubble, and this too, like all before it, will end very, very badly. Our markets have become the place for “financial flippers” (remember the condo flippers) who are addicted to central planning schemes, never considering what it will be like when we come off “the high”. Like a drug addict, we all know there will very painful side effects.

Could the private corporation, the Federal Reserve, the most powerful corporation in the world, have chosen a different path, never allowing the nation to produce trillions in debt that will never be paid back? Could our political leaders have been better stewards of the nation’s finances, rather than men and women seeking to use politics for their own financial gain? Could the public have looked at voting as a way to guard their freedoms, rather than seeking a political leader who would promise to secure financial benefits for them from the state? Painfully, all of these are answered in the affirmative. Instead, we all turned to a private corporation, believing that today’s problems could always be kicked down the road, solely with the use of unlimited amounts of credit to keep our entire society “running smoothly”. Ethics? They were only of value if the credit masters could “fix” the financial problem for the economy, which frankly in the last few months, has move to the problem of the next trading day.

Five months ago, I began a series of articles in an attempt to inform my fellowman that we were coming to not only a juncture in the markets, but also a juncture in history due to our collective actions and that of our leaders. In this article, my third in the Peeling Onions series - the first two released on Sept 12 and Oct 27 ’11 - I would like to examine the evidence that an outright collapse of our financial markets has never been higher, and that this trend grows closer with each passing week. Since I have always felt that facts are more important than opinions when doing my own research, I asked only that you give you God given ability to think critically before drawing your own conclusions.

Section 1 -Do you know of any individual or business that continued to go into ever increasing levels of debt for years and decades that was praised for their shrewd understanding of finance? Then why trust any political solution by a leader who can not grasp the chart below?

Section 2 - For the millions of investors who were crushed under the collapse of markets when the tech bubble collapsed a decade ago, why are so many financial pundits still hyping hot tech stocks, when anyone looking at history can tell you that Thursday, Jan 19 ’12, the NASDAQ 100 has once again hit a ten year high, coming right back to the same levels it has hit 5 times since last February?

Is it possible that if a market soared so quickly over such a short period of time, that it would only be natural to expect it to fall hard as well? Whether the spring of 2000, or the ten trading days after the July 26 ’11 high, when a panic selling environment starts, and they always start at the top of a mania fueled by cheap credit, then millions get hammered all over again.

Section 3 – “But surely the increased values in our equity markets is a good sign. The markets have spoken, and they reflect the collective wisdom of the crowd, right?”

When markets rise, we assume that cash is coming into the markets, pushing values higher. When markets are falling, we assume that cash is leaving the markets, pushing values lower.

Look at the comments from the articles below. Do these reflect a range of investors who have been on a tear to buy stocks?

European Banks Deposit Entire LTRO, and Then Some, with ECB As Deposits Approach € 500 billion, Zero Hedge, Jan 16 ‘12

Back on December 21, the day when the deus ex 3 year LTRO was completed and €489 billion in gross capital was provided to banks at a 1.00% cost, of which €210 billion was net new incremental capital (pro forma for rolling maturities), the ECB deposit facility usage was €265 billion. As of Friday, the ECB announced deposits have grown to just shy of €500 billion, or a new record of €493 billion (which pays banks just 0.25%). In other words, between the LTRO effective date (Dec 21st), and today, an additional €228 billion has been deposited, or more than the entire LTRO! [bold is authors]

TrimTabs: Santschi’s Daily Edge, David Santschi, Executive Vice President TrimTabs Investment Research, Jan 12 ‘12

“The real money these days are going straight under the mattress. In the first 11 months of 2011, investors poured a stunning $889 billion into checking and savings accounts. This amount is more than eight times the $109 billion that flowed into stock and bond mutual funds and exchange traded funds.”

European Hedge Funds Line up Bets on China Downturn, Reuters, Jan 16 ‘12

“European hedge fund managers are betting that China's once red hot economic growth will cool dramatically in 2012, hitting companies, economies and commodity prices that have been fuelled by the world's second largest economy in recent years.

Managers are taking bets ranging from short positions on equity markets or the currency to buying credit protection on companies that export to China. Others are shorting natural resources stocks in other countries that rely on Chinese demand.

‘China is an inflated castle in the air,’ said Pedro de Noronha, managing partner at London-based hedge fund firm Noster Capital.”

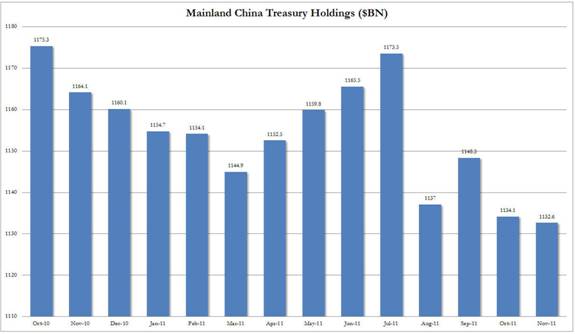

China Brings US Treasury Holdings to One-Year Low, Russia Cuts Treasury Exposure by 50% in One Year, Zero Hedge, Jan 18 ‘12

“Today's TIC data confirmed what Zero Hedge readers have now known for quite some time: namely that foreigners are selling US paper. And while we have used contemporaneous Custody Account data from the Fed to present that in the past 7 weeks foreigners have sold a record amount of bonds, we now get confirmation via TIC that in November the selling continued, especially at the biggest non-Fed holder of US paper, China, which saw its holdings down to $1,132.6 billion, the lowest in the past year. Yet where the selling is just relentless is in Russia, which has quite demonstratively slashed its US Treasury holdings in half in the past year from $176 billion to under $80 billion.”

[Charts above developed by Zero Hedge, Jan 18 ‘12]

So I asked you, if the American retail investor revealed a pattern in 2011 moving funds at record levels into savings and checking, and record outflows from mutual funds, and European banks poured €228 billion back into deposits paying 0.25% at the ECB in less than 30 DAYS after the ECB loaned a record €489 billion to hundreds of banks for 3 years (Dec 21 ’11), the largest infusion of cash and massive debt increase by the ECB in the 13 year history of the Euro, and European hedge fund managers are placing bets that the world’s second largest economy will continue to WEAKEN, as China’s real estate bubble appears to have popped, while the Federal Reserve has not been able to convince China and Russia since last summer to continue buying US Treasuries in order to provide fuel for the current stock market mania, is it possible that what we are watching is really nothing more than a maddening attempt to get past yet one more options week, the week that for years has proved that the concept of “free markets” is a myth and has been for years? Is a combination of jet fueled daily debt, along with high frequency traders, keeping Pavlov’s dogs salivating for QEIII next Wednesday when the FOMC completes their January meeting?

For Americans to have placed their trust, especially since the “recovery” began in early 2009, on so many central planners and their ability to manipulate markets higher with less and less transparency, all the while corrupting the political scene in Washington to a point it is solely an extension of Wall Street’s arm, then like the great manias in history, we will soon awaken to the fact that markets that can not be allowed to decline, will decline rapidly when at some point in the theatre someone yells, “FIRE”, and the crowd once again realizes that they have been set up.

Section 4 - “When will the next major bottom come?”

As Rahm Emanuel so aptly stated in Nov 21 ’08, in an interview with the Wall Street Journal, “You never want a serious crisis to go to waste.” Since most individuals around the world are still totally unaware of the fact that the Special Drawing Rights (you know, your friendly global electronic currency unit) expanded from 21.4 billion to 204 billion in 2009 alone, after staying at the 21.4 billion level for 30 years, it seems extremely gullible to believe that none of the global political and financial players have any ideas about what to do when the current credit bubble blows, and how once again, to move more power into fewer hands.

If you still place your trust in central planners “assisting” financial markets indefinitely, I would suggest you start reading about the Japanese financial markets since the Nikkei topped at the end of 1989. Remember, we are all facing experiences NONE of us has ever faced in our lives. Coming off a high is very painful. However, the longer the denial of the addiction, the harder the withdrawals when they come.

“Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly” Plank #5 of the Communist Manifesto (1848) Karl Marx and Friedrich Engels

If you are interested in our most comprehensive research and trading commentary, consider a subscription to The Investor's Mind: Anticipating Trends through the Lens of History.

Doug Wakefield

President

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2011 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.