Will The U.S. Stock Market Decouple From Europe?

Stock-Markets / Stock Markets 2012 Jan 18, 2012 - 11:13 AM GMTBy: Chris_Ciovacco

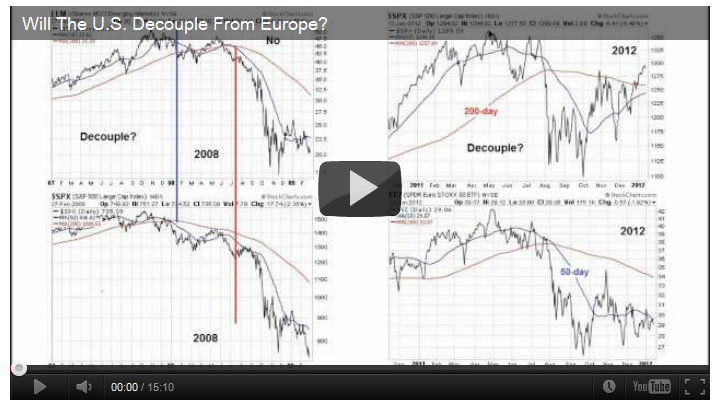

The term decouple is often used on Wall Street to explain something that is difficult to wrap your arms around. In late 2007/early 2008 we were told the emerging markets would decouple from the mortgage mess based in the United States. In the video below, we explore:

The term decouple is often used on Wall Street to explain something that is difficult to wrap your arms around. In late 2007/early 2008 we were told the emerging markets would decouple from the mortgage mess based in the United States. In the video below, we explore:

- Important S&P 500 levels to watch on the upside and downside.

- How the decoupling theory played out in 2008.

- The technical state of global markets.

- Monthly Demark counts.

To reach another trend exhaustion signal today on the daily chart of the S&P 500, we need a close greater than or equal to 1,296.82, which is the January 12 high. As we said last week, we would prefer to see the market close higher in the very short-term.

Some excerpts from a CNBC article on decoupling:

The story goes that the market is “decoupling,” – that is, shaking off euro-land panic and instead focusing on the nascent U.S. economic recovery. In this scenario, stocks and the dollar can glide higher together while American investors remain blissfully unaware of the debt storm abroad.

Just don’t try selling it to Bob Janjuah, the flame-throwing co-head of global macro research at Nomura Securities, who believes decoupling is a myth that will be exposed sooner rather than later.

“Yet again, and certainly for the third year in a row, we are being told that the U.S. is over the worst and that a sustainable recovery is here,” Janjuah told clients. “We are expected to believe another ‘decoupling’ fairytale, only this time around neither Asia/EM (emerging markets) nor the Eurozone really matter to the U.S. economy.”

Inaction by leaders both in Europe and the U.S. to attack dual debt crises will hit investors later in the year, he said. In particular, he attacks the “neo-communist experiment in the West that relies on more debt and printing money in order to maintain the status quo.”

As we noted in a December video, the levels of debt around the globe have reached unsustainable levels, which will most likely put pressure on global economic growth. Despite numerous problems in Europe, investors seem to be hopping on the decoupling bandwagon. The ratio of bullish sentiment to bearish sentiment prompted Jason Haver to pen Two-Year Study of Investor Sentiment Points to a Top; some excerpts:

The latest American Association of Individual Investors (AAII) sentiment survey numbers were released yesterday, and amazingly, were virtually unchanged from the week prior. For the second week in a row, bearish investors remain at 17%, still near decade-long lows. This struck me as a rare situation, so I decided to investigate further.

I set out to uncover how the market reacted when there were two or more consecutive weeks of bearish investor percentages this low, using bears below 19% as the control figure (thus allowing for roughly 20% standard deviation in the data figures). After combing through 562 weeks of AAII data by hand, I discovered that since the 2000 market peak, there have only been 12 other occurrences of this scenario. Interestingly, the current back-to-back reading of less than 19% bearish is the first occurrence we’ve seen in almost six years. So indeed, this is a rare set up.

-

Copyright (C) 2012 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.