U.S. Unemployment Drops as Employment Reports Widespread Gains, Allows Fed Breathing Space

Economics / Employment Jan 07, 2012 - 07:04 AM GMTBy: Asha_Bangalore

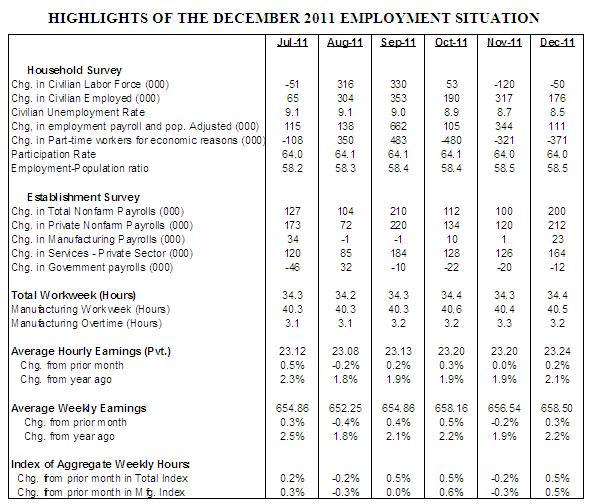

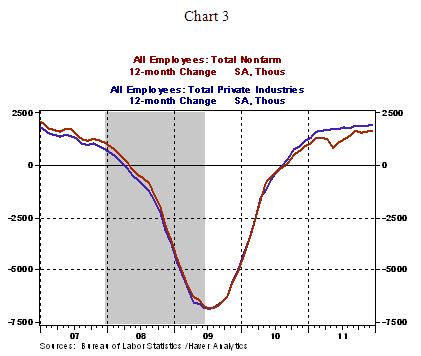

Civilian Unemployment Rate: 8.5% in December, down from 8.7% in November. Cycle high jobless rate for the recent recession is 10.0% in October 2009.

Civilian Unemployment Rate: 8.5% in December, down from 8.7% in November. Cycle high jobless rate for the recent recession is 10.0% in October 2009.

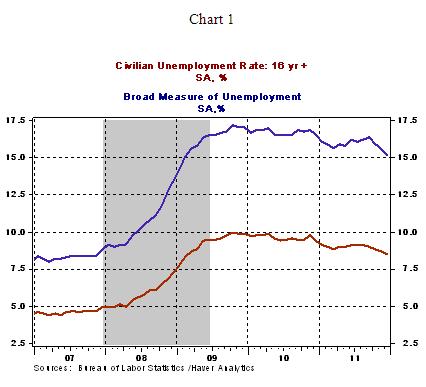

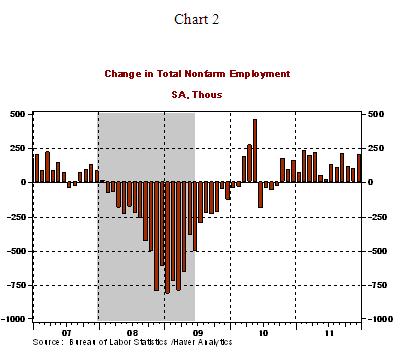

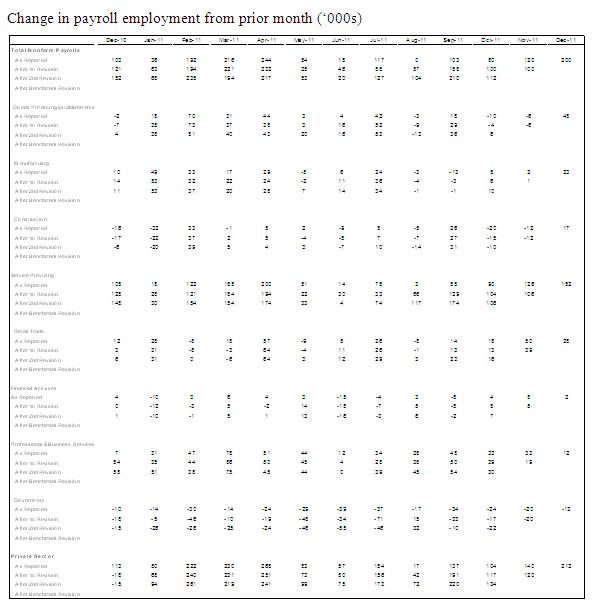

Payroll Employment: +200,000 jobs in December vs. +100,000 in November. Private sector jobs increased 212,000 after a gain of 120,000 in November. A net loss of 8,000 jobs followed after revisions to payroll estimates of October and November.

Private Sector Hourly Earnings: $23.24 in December vs. $23.20 in November; 2.1% y-o-y increase in December vs. 1.9% gain in November.

Household Survey – The civilian unemployment rate edged down to 8.5% in December from a revised 8.7% reading in the prior month. The unemployment rate has declined almost one percentage point from the year ago mark of 9.4%. The broad measure of unemployment, which is a sum of the officially unemployed plus those working part-time because they cannot find full-time jobs and those who want to work but have not looked for a job in the past year, fell to 15.2% in December from 15.6% in November; it is down sharply from a 16.6% reading in December 2010. The number of people working part-time because they cannot find full-time employment dropped to 8.428 million in December from 9.205 million a year ago.

Establishment Survey – Nonfarm payrolls increased 200,000 in December, following a revised gain of 100,000 in November. There was a net loss of 8,000 jobs after revisions to earlier estimates of payroll employment in October and November.

During the twelve months ended December a total of 1.64 million jobs has been created vs. a gain of 940,000 jobs in all of 2010. Private sector employment has advanced by 1.92 million over the past twelve months, while government employment fell 280,000 during the same period.

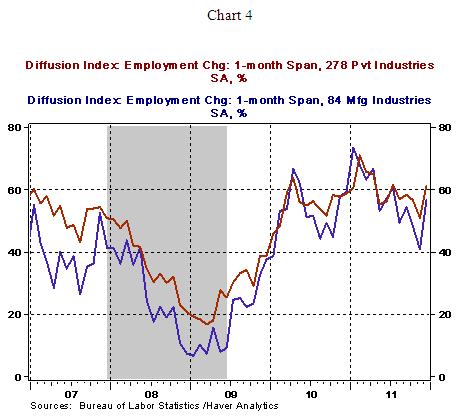

The diffusion indexes for private sector employment (61.2%) and factory employment (56.8%) indicate that hiring gains were widespread in December and the strongest since April 2011 (see Chart 4).

Highlights of changes in payrolls during December 2011:

Construction: +17,000 vs. -12,000 in November

Manufacturing: +23,000 vs. +1,000 in November

Private sector service employment: +164,000 vs. +126,000 in November

Retail employment: +39,000 vs. +28,000 in November

Professional and business services: +12,000 vs. +19,000 in November

Temporary help: -7,500 vs. +11,200 in November

Financial activities: +2,000 vs. +5,000 in November

Health care: +22,600 vs. +16,000 in November

Government: -12,000 vs. -20,000 in November

The 0.5% jump in manufacturing man-hours index in December bodes positively for industrial production. Hourly earnings rose 0.2% to $23.24 in December, putting the year-to-year increase at 2.1%. The gain in employment and earnings points to a more than moderate increase in personal income during December. The 0.5% increase in the total man-hours index in December puts the quarterly annualized increase at 3.2%, which is consistent with our 3.4% increase in real GDP during the fourth quarter of 2011.

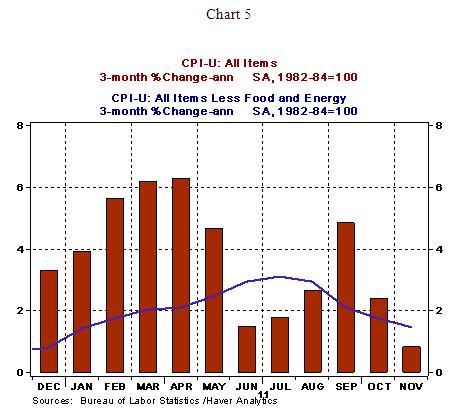

Conclusion – The positive tone of the string of economic data in the first week of the month – ISM manufacturing survey (53.9 vs. 52.7 in November), auto sales (13.48 million in Q4 vs. 12.48 million in Q3, albeit a small decline was recorded in December), and the December employment numbers -- suggest that the Fed has the luxury to watch and wait. In addition, the moderating trend of inflation (see Chart 5) gives the Fed latitude to ease monetary policy if economic activity shows signs of fading in the months ahead.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisio

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.