Debt, It's a Rollover... or is it?

Interest-Rates / US Debt Jan 06, 2012 - 06:22 AM GMTBy: William_Bancroft

Will Bancroft looks at the debt loads weighing down economies and sees a year of tightrope walking for the authorities and the banking system. The financial markets wait with baited breathe for a resolution to the debt problems, but are there any fixes available?

Will Bancroft looks at the debt loads weighing down economies and sees a year of tightrope walking for the authorities and the banking system. The financial markets wait with baited breathe for a resolution to the debt problems, but are there any fixes available?

As we enter 2012 there is one issue that probably sits at the forefront of our minds: can the overly indebted parts of the financial system keep financing themselves?

The markets opened the year with some optimism after their festive slumber. We feel typecast as the killjoys, but let’s see how long this optimism lasts.

Sovereigns and institutions need to issue, or reissue and ‘roll over’ vast sums of debt.

The focus remains on Europe which has nearly €800bn of sovereign debt to sell to the market this year according to the FT. Goldman Sachs thinks it’s more like €1trn.

Mind you, the United States is not much healthier. Why do you think the Fed is so keen to extend unlimited swap lines across the Atlantic?

Within Europe, Italy has nearly €250bn to issue, France €200bn, prudent old Germany has €180bn and Spain around €80bn.

In 2011 these nations managed to finance themselves, even if there was often large participation in their respective debt markets by the European Central Bank (ECB). Essentially not enough external investors from around the world thought it was smart to lend money to the PIIGS et al any more.

Where are the bond vigilantes?

The problem with carrying huge debt loads is that you are fine until you are not. When the interest rate environment is calm you can just about manage, but when the bond markets smell risk and continued irresponsibility they punish you.

A small increase in the rates you have to pay for the privilege of borrowing has an enormous effect on your ability to remain solvent due your monstrous leverage. Leverage and debt bring vulnerability.

It wouldn’t take much of a shift in market thinking to produce a buyers’ strike and send rates skywards.

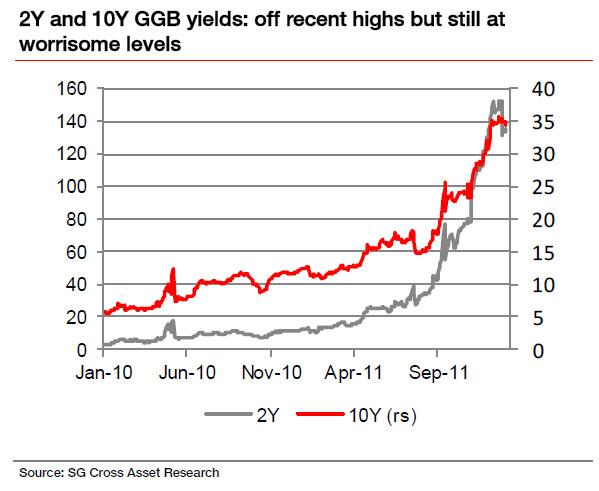

Just look at the changes in Greece’s borrowing costs for two year and ten year bonds.

The bucket carrying ECB could finally be faced with an aggressive print or devastating collapse scenario.

Two dirty options for the financial authorities

Which scenario would the ECB choose?

We’d guess the one involving the printing press. It’s the easiest way out, and politicians seldom take tough choices. A Jean Claude Juncker quote explains it well.

We all know what to do, but we don’t know how to get re-elected once we have done it

Politicians prefer inflation as it makes people feel richer.

Inflation doesn’t actually make anyone richer; it’s a silent and pernicious tax which erodes your purchasing power and hard earned savings. This is less than ideal given that capitalism is dependent on savings and the efficient allocation of them.

What’s holding it all together?

In Europe it’s the ECB which is propping up the banks and the sovereigns.

The continued surge in emergency borrowing by European financial institutions is remarkable.

The ECB’s alphabet soup comprising its rescue tool kit is led by the ‘Long-term Refinancing Operations’ (LTRO). This is where the ECB lends the banks money at below market rates for three years in return for low quality assets (often sovereign or other financial debt) the banks don’t want to keep on their own balance sheet.

It’s like a game of pass the parcel, except the parcel is still full of rubbish assets that need to be written down or written off.

If the parcel is dropped and a mess is made, taxpayer funds will likely be called upon once more to clean it up – whether we pay for it through more obvious bailouts or through less obvious inflation from the authorities’ money printing.

Kicking the can down the road

How much further can this financial can be kicked?

No-one can say exactly, but we have a long year to get through. As Ted Lord, Head of European covered debt at Barclays Capital, comments:

2012 it will be the year of refinancing, for the banking sector and sovereign sectors.

The creditors of the world need to keep playing ball. The BRICs and anyone else fortunate or prudent enough to be running a surplus need to keep believing the indebted West can get its house in order.

The problem is that to spend less and produce more politicians have to make tough choices with sickly debt burdened economies and ‘entitled’ voters. And, we’ve already heard Mr Juncker explain the politicians’ dilemma.

A problem of agency

Turkeys don’t vote for Christmas; voters don’t vote to cut their entitlements; and politicians don’t vote for things their electorates don’t want.

As Société Générale reports in a recent research note: “market participants remain in a wait-and-see stance”.

The markets are like a theatre crowd on edge before a potentially chilling climax. Investors wait with baited breathe for the next moves from the key players, and with a close eye on perceived ways to protect themselves.

This crisis has been rumbling on for five years now, and still we are more worried about the return of our capital than the returns on our capital.

The fact is no solution has been offered that will cure the mess. Voters, politicians, and large parts of the banking system don’t want to face the truth.

Why investment markets crash

One of our favourite academics is Didier Sornette, whose book ‘Why stock markets crash’ is, in our minds, a must read financial tomb.

Mr Sornette argues that the financial markets are systems of deep complexity, which over time periods can organise themselves into states of ‘self-organised criticality’.

A state of self-organised criticality is what precedes a crash. Once this state is achieved the system is vulnerable to minor events triggering far greater results. Think of the last straw being added to a great pile breaking the camel’s back.

We find Mr Sornette’s theory quite descriptive of the state the financial system arrived at prior to the Credit Crunch.

The financial system in 2012 can be perceived as a mountain laden with continued heavy snow fall (debt!), and waiting for the inevitable avalanche caused by the addition of one more tiny snowflake.

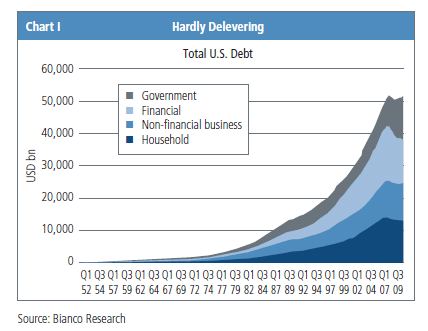

The system is still trying to deleverage after 5 years of meddling and muddling by the authorities, and a number of decades of debt accumulation.

The trader’s adage ‘don’t fight the Fed’ is not redundant, but the authorities cannot hold back the market’s desire to cleanse itself of debt and start afresh.

Worried about a financial avalanche? Learn how to buy gold in minutes…

Regards and good investing,

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2012 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.