Stock Market Seasonal and Cyclic Forecast for 2008

Stock-Markets / US Stock Markets Dec 31, 2007 - 12:35 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-Term Trend - The 12-yr cycle is approaching its mid-point and some of its dominant components have topped and may be restraining the bullish effect of the 4.5-yr. This could lead to another period of consolidation in 2008 with an eventual bull market top in 2009-2010.

SPX: Intermediate Trend - The intermediate-term trend which had been in a correction since the index reached 1576 has now resumed its up move, but the corrective pattern could be extended if a new high is not achieved soon.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which determines the course of longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview

The SPX -- along with other equity indices -- has been in a consolidation pattern since it made its alltime high of 1576 on 10/11. By certain seasonal and cyclical criteria, this corrective phase has an opportunity to end at this time and the index to proceed to new highs.

The 3-week period from mid-December to the first week in January is statistically one of the most bullish of the year. On December 18 we saw the beginning of a good rally, but it was interrupted last week by the bottoming of the 20-wk cycle which should ideally bottom on January 31st. The rally will then have a chance to extend itself for a few more weeks. If this does not happen, it is likely that the correction will be extended at least into April-May of 2008, in conjunction with the bottoming of another intermediate term cycle.

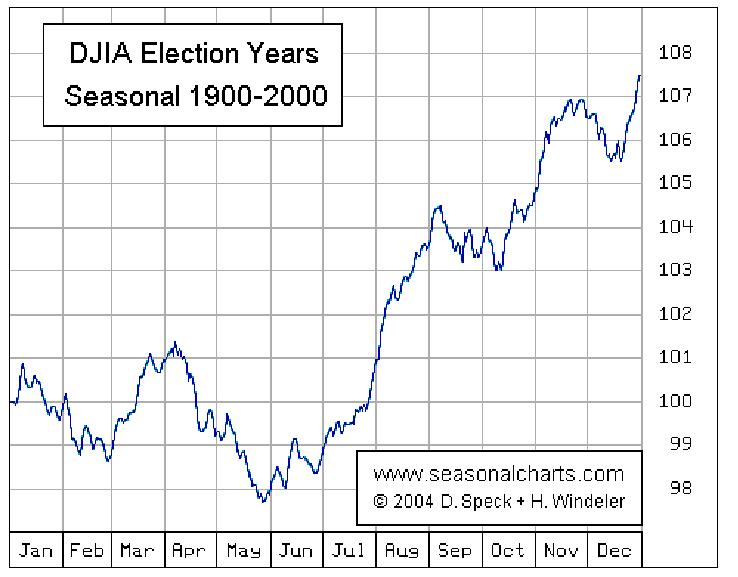

I recently came across this chart which adds to this probability. It depicts the DJIA seasonal tendency for election years.

Beyond this seasonal pattern, the 8th year of the Decennial pattern tends to be a bullish year, but the cyclical configuration into late Summer or Fall may cause it to be less so this coming year.

What's Ahead?

Momentum:

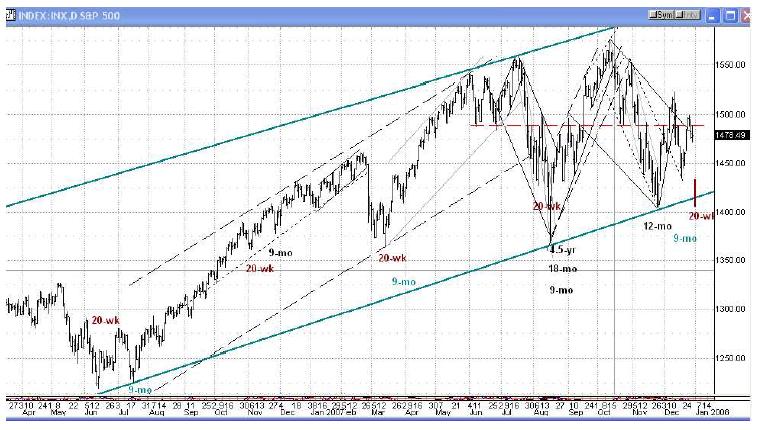

As the chart below demonstrates, the long-term momentum of the SPX was arrested in October when it made an all-time high of 1576. Since then, it has remained in its long-term up-channel, testing the top and lower trend lines twice and bouncing off. The chart shows the cycles which were associated with the declines and reversals. In the past week, the bottoming 20-wk cycle has caused a small retracement. When it makes its low in the next couple of days, it is expected to reverse the short-term trend and will have a chance to push the SPX decisively above the 1490-1500 level which has been a source of resistance (dashed red line).

Resistance has also come from the down trend line from the top of 1576. Twice it was challenged, and twice prices were pushed back below it.

With the cluster of cycles which have and are making their lows in this time period, the index has another opportunity to rise toward the top of its long-term channel.

Cycles

You will notice that I have re-adjusted the low of the 9-mo cycle forward by about 3 weeks. I think that this makes more sense since the December low conforms more closely to its normal phasing. In the past, I have explained that there are two visible 9-mo patterns which affect the market. The 9- mo cycle to which many analysts refer just made its low at the end of the year. The other one is a subdivision of the Hurst cycle series and is due 9-mo from the August 4.5-yr low, or around April-May 2008.

There are several cycles which should provide the market with buoyancy at this time, including the 20-wk cycle which is about to make its low. If they don't generate a good extension of the rally, it is possible that the election year pattern depicted above will repeat once again, especially since the 9-mo Hurst cycle is due in the time frame associated with a low point.

We also have to consider that the 6-yr half-span of the 12-yr cycle which bottomed in October 2002 is in a down phase into the later part of next year and its further subdivision, the 2-yr cycle, is also dominant. It is possible that these could override the normal 8th year bullish tendency or push back the low of the correction into the later part of 2008.

Projections

In the last newsletter, I stated: "There are two Fibonacci projections for the current decline: The short-term one is to about 1460. If that level is broken, it is conceivable that prices could move back down to about 1440 or slightly lower."

In fact, the recent decline in the SPX found a floor at 1436 and rallied. The base which was established at the 1436 level consists of two distinct phases. The first had a maximum count of about 1500 which was nearly met at 1498 before the retracement into the 20-wk cycle low, and the entire base gives us a reasonable target of about 1535. There is also a Fibonacci projection to about 1550 that could come into play if enough upside momentum is established. These are the levels which should be reached after the cycle has reversed and where additional consolidation would be expected.

Failure to reach those levels would be a sign of weakness.

Breadth

Examining the relationship of breadth to price is one of the most important means of determining market health. One way to analyze the intermediate-term breadth pattern is with the help of the McClellan Summation Index of the NYSE McClellan oscillator. The following is a reproduction of the summation index for the past 3 years (courtesy of StockCharts). Note that it has tended to fluctuate in a range from overbought to oversold. It is currently oversold by recent bull market standards, but it could reach far deeper levels of negativity in a bear market.

The pattern started to diverge negatively from the price in the early part of the year when it failed to make new highs along with the stock market. In May, it was still overbought, but showed increased divergence as the market was moving higher. It dropped to its deepest oversold level in 3 years when the market made its 4.5-yr cycle low in August. The rally to 1576 in the SPX (an all-time high) failed to bring the SI anywhere close to its former highs and was a warning that breadth was increasingly diverging from price.

The low in December was higher than the August low, concurring with the price pattern. But since then, while the SPX rallied to 1523, the rally in the SI has not kept up with price and continues to diverge negatively.

The only conclusion we can derive from this analysis is that until we see the Summation Index perform at least as well as the price index, the market correction will be likely to continue.

The short-term pattern of the advance/decline is a little more bullish. On Friday, while the SPX made a slightly new low in its decline from 1498, the A/D failed to confirm that low, indicating that the decline could be very near to running its course.

Market Leaders & Sentiment

Here, the various indicators are still a mixed-bag. GE is by far the worst acting leading indicator, having dropped to its long-term uptrend line and rebounding little. On the other hand, the NDX continues to perform rather well relative to the SPX, both on an intermediate and short-term basis.

Of the two widely followed investors' sentiment indices, the AAII index is bullish and making a pattern which is comparable to the 2002 lows, while the Investors Intelligence index is on the bearish side. We could reconcile the two by mentioning that, according to some analysts, the AAII index tends to be more of a short-term indicator. This would fit with the current cyclical configuration of the market which is short-term bullish.

The ISEE put/call ratio index has moved from bullish to neutral in the past few days. As of November, insider trading was predominantly bullish.

Summary

Corrective patterns are ambiguous in nature and the current one is no exception. It could evolve into a new uptrend, could prove to be a topping pattern, or just continue to extend the correction for a longer period of time.

Except for the short-term which is bullish, cycles are not much help in determining the intermediate direction of the market. One could make a case either way based on the current cyclic configuration. The one indicator which will be the most helpful in clarifying the future trend is probably the NYSE McClellan Summation Index. Overall, it has been in a negative divergence relationship to the SPX for several months. If this continues, it will most likely bring about further price consolidation or even deterioration. If it steadies itself, we could see a resumption of the bullish trend.

A market advisory service should be evaluated on the basis of its forecasting accuracy. This service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles and coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

The following are examples of unsolicited subscriber comments:

What is most impressive about your service is that you provide constant communication with your subscribers. I would highly recommend your service to traders. D.A.

Andre, You did it again! Like reading the book before watching the movie! B.F.

I would like to thank you so much for all your updates / newsletters. as i am mostly a short-term trader, your work has been so helpful to me as i know exactly when to get in and out of positions. i am so glad i decided to subscribe to turning points. that was one of the best things i did ! please rest assured i shall continue being with turning points for a long while to come. thanks once again ! D.P.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.