U.S. Household Debt - Deleveraging Posts New Record

Economics / US Debt Dec 13, 2011 - 03:35 AM GMTBy: Asha_Bangalore

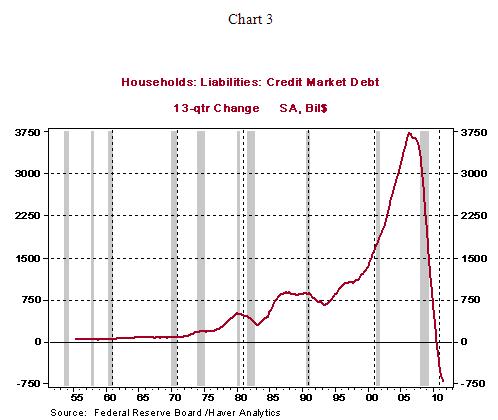

Household debt soared prior to the onset of the financial crisis to establish a peak at $13.9 trillion in second quarter of 2008 (see Chart 2). During the thirteen quarters since the peak, household debt has declined $688 billion (see Chart 3) to set a new record for the post-war period.

The focus on reducing debt has held back the growth of consumer spending in the United States. The important question is how long the deleveraging process is likely to continue. Our best guess is that improvement in hiring will raise consumer confidence to take on additional debt and improve housing market conditions to result in fewer foreclosures. The Fed's policy statement following the December 13 FOMC meeting will offer information about the Fed's new assessment of the economy.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.