U.S. Labor Market Small But Noteworthy Improvement

Economics / Employment Nov 11, 2011 - 03:37 AM GMTBy: Asha_Bangalore

At the town hall meeting in Fort Bliss today, Chairman Bernanke stressed that the Fed is “focused intently” on job creation. He also mentioned that the United States will be affected adversely if there is a blow-up in Europe and added that the Fed stands ready to provide policy accommodation as necessary to minimize the damage.

At the town hall meeting in Fort Bliss today, Chairman Bernanke stressed that the Fed is “focused intently” on job creation. He also mentioned that the United States will be affected adversely if there is a blow-up in Europe and added that the Fed stands ready to provide policy accommodation as necessary to minimize the damage.

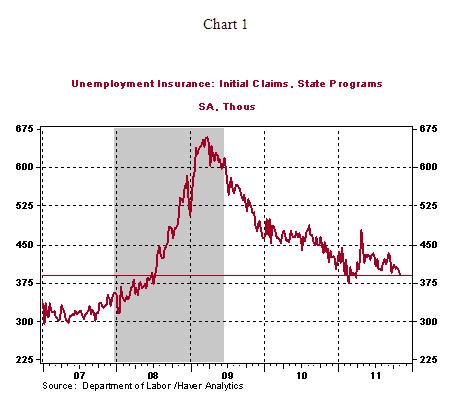

Speaking about the labor market, initial jobless claims fell 10,000 to 390,000 during the week ended November 5, the lowest reading since April 2011 (see Chart 1).

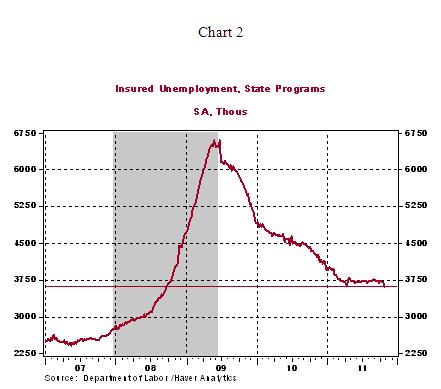

Continuing claims, which lag initial jobless claims by one week, declined 92,000 to 3.615 million, the fewest number of jobless claims filed since October 2008 (see Chart 2).

These numbers are encouraging, while additional improvement will be necessary to confirm that labor market conditions are improving. The number of applicants under the special emergency and extended benefits program (these numbers lag initial jobless claims by two weeks) moved up slightly to 3.53 million from 3.48 million in the week ended October 15. In sum, there were 7.236 million people obtained unemployment insurance during the week ended October 22 (Continuing claims plus those under special programs).

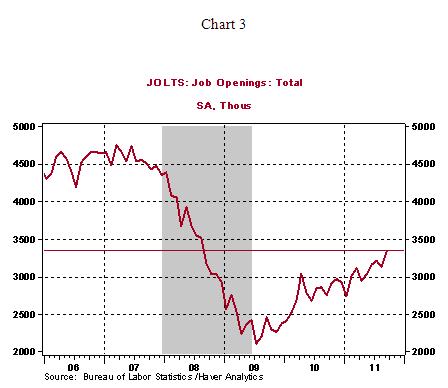

Earlier in the week, another economic report showed that the number of job openings in September were at the highest level in the past three years (see Chart 3). These numbers suggest small but important positive developments in the labor market.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.