UK Investments and Pension Funds Feeling the Winter Blues

Personal_Finance / UK Stock Market Dec 17, 2007 - 08:13 PM GMTBy: MoneyFacts

With the end of another year rapidly approaching, now is an ideal time to reflect upon the key financial events of the past twelve months and what 2007 has meant for consumers. For most savers and investors 2007 has proved to be another challenging year.

So how have the different products fared over the last year, and what have been the major developments?

Investments: A roller coaster ride

Investing has certainly not been for the faint hearted during 2007, with world stock markets experiencing high volatility as a result of the problems in the US sub prime mortgage market and the subsequent credit crunch.

With its high weighting in financials, the UK equity market has proved particularly vulnerable to the credit crunch. In mid August the FTSE 100 plummeted as low as 5,858 after suffering a 4.1% fall in just one day. However, it has bounced back strongly since and at the start of December stood at a more comfortable 6,432, a rise of 3.4% for the year.

In contrast to the last few years, where most of the top UK funds delivered impressive double digit returns, this year’s performance has been more disappointing. The average UK All Companies fund has fallen 2.7% over the year to date, whilst the average UK Smaller Companies fund has posted an even bigger loss of 9.6%.

Whilst the UK has been amongst those hit hardest by the credit crunch, Asia has emerged relatively unscathed, with China in particular enjoying a phenomenal 2007. Lipper figures show that the Asia Pacific Excluding Japan sector was the biggest success story of the year, with the average fund posting growth of 27.8%.

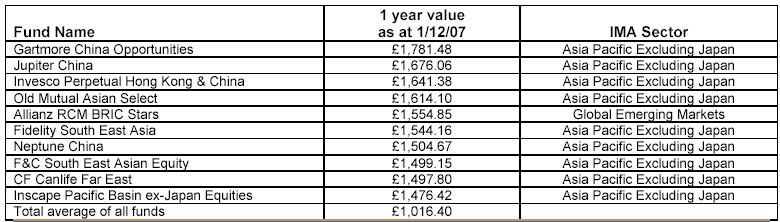

Not surprisingly, as Table 1 reveals, the top ten performing unit trust/OEIC funds over the last 12 months are almost exclusively to be found within the Asia Pacific Excluding Japan sector. Gartmore China Opportunities has produced the strongest performance over the last 12 months, returning £1,781 on an initial £1K investment, followed by Jupiter China (£1,676) and Invesco Perpetual Hong Kong and China (£1,641). Disappointingly, the average unit trust fund posted growth of just 1.6% during the latest 12-month period, down significantly on the 6.1% average growth enjoyed in 2006.

Table 1: Top 10 Unit Trust/OEIC funds over 1 year

Source: Lipper Hindsight. Figures based on £1K lump sum as at 1 December 2007, total return, UK net, initial charges applied

12.12.07

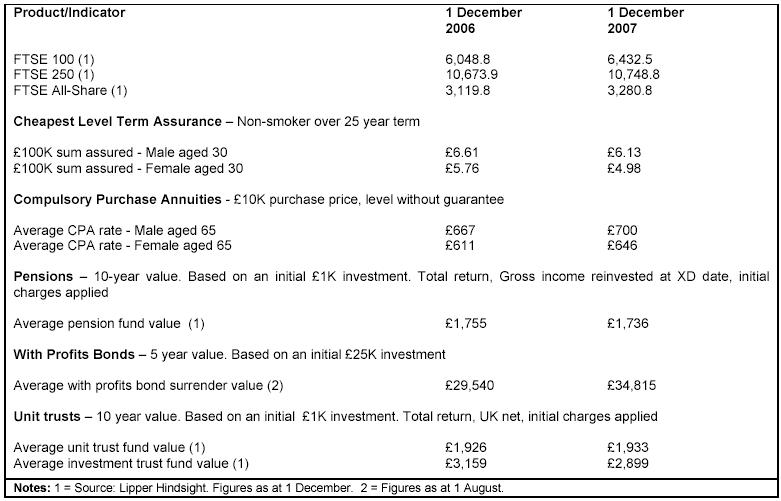

With profits bonds: Out of the rough

With profits investors also received some better news in 2007. After years of waiting patiently, those individuals who kept faith with their with profits bonds through the turbulent investment conditions at the start of the decade are finally reaping the rewards. During the last 12 months, our with profits bond surveys have highlighted how payouts are starting to rise, terminal bonuses are back on the menu whilst menacing market value reductions have all but disappeared. The average five year with profits bond is now returning £34,815 (based on a £25K initial investment) compared with just £29,540 a year ago, an increase of 17.8%.

Pensions: Not out of the woods yet

The credit crunch may have knocked the pensions crisis off newspaper front pages in recent months, but there have still been plenty of talking points within the pensions industry. On the plus side, pension business has continued to boom in the post A-Day landscape, whilst the Government’s new system of personal accounts has started to take shape. However, the volatile stock markets have taken their toll on most pension funds, with the average pension fund posting growth of just 3.59% over the last 12 months compared with 7.2% in 2006.

Annuities: A pleasant surprise

Arguably the biggest surprise of the year has come in the annuity market, where rates halted their historical decline and actually increased. At the time of writing, the average level without guaranteed standard annuity rate for a 65-year-old male has risen by 4.9% over the last 12 months, whilst female rates have increased by 5.7% (see Table 2). Unfortunately, there are signs that annuity rates may have peaked, with a number of reductions beginning to creep in over the last month.

Protection: Price war continues

2007 has proved to be another tough year for the protection market, with providers facing an uphill struggle to rebuild consumer confidence and revive flagging sales. There has also been no let up in the price war that has engulfed the term assurance market in recent years, with the cost of cover falling throughout 2007. The most competitive £100K sum assured level term assurance premium for a non-smoking male aged 30 over a 25 year term has decreased 7% from £6.61 December last year to £6.13 now (see Table 2).

Richard Eagling, Editor of Investment, Life & Pensions Moneyfacts commented: “It may be the season to be jolly, but for many savers and investors, events over the past few months have brought precious little in the way of Christmas cheer. Instead, the prevailing sense of uncertainty created by the ongoing credit crunch and stock market volatility is in danger of serving up a large dose of the winter blues.”

Table 2: The Difference a year makes 2006 versus 2007

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.