Another Round Of Consumer Price Increases On The Way

Economics / Inflation Sep 19, 2011 - 03:26 PM GMTBy: Clif_Droke

The ongoing economic depression has the middle class behind the proverbial eight ball. Not only has it resulted in the deflation of housing values but the stimulus efforts of the last two years have resulted in increased retail prices. This is one of the important signs that the depression has a lot longer to run, for until we see a substantial drop in consumer prices deflation's work isn't done.

The ongoing economic depression has the middle class behind the proverbial eight ball. Not only has it resulted in the deflation of housing values but the stimulus efforts of the last two years have resulted in increased retail prices. This is one of the important signs that the depression has a lot longer to run, for until we see a substantial drop in consumer prices deflation's work isn't done.

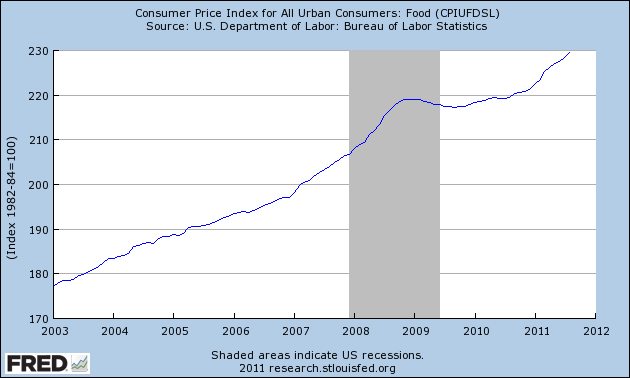

As anyone who has been grocery shopping lately can tell you, prices are high and getting higher all the time. This is a consequence of the Fed's second quantitative easing (QE2) initiative, which directly resulted in a huge increase in commodity prices. After the 2008 credit crisis and recession, food prices were starting to show signs of actually declining for the first time in years. But as the Fed refuses to allow even a hint of deflation in the U.S. economy, QE2 was begun in order to stop this trend of lower prices from getting established. Instead, prices started accelerating higher once again.

The Fed always goes too far in the pursuit of any of its policies and this time has proved to be no exception. Although the Fed's stated motive in implementing QE2 was the revival of the U.S. economy, its obvious from reading between the lines of Bernanke's statements that the Fed has a single minded commitment to fighting the biggest symptom of deflation, namely declining prices, at all costs.

Bernanke is an astute observer of how depression has affected other countries, including this one, and he's determined not to let the U.S. suffer another Great Depression or a Japanese-style deflation. His attempts at fending off deflation, however, will meet considerable resistance from the natural economic long wave rhythm and will ultimately prove counterproductive. Indeed, we're already seeing evidence that the Fed's attempts at fighting off deflation are creating even more problems for millions of Americans.

The Fed's other motivation in purchasing Treasuries (QE) is to keep financial asset prices artificially inflated. While this proved to be beneficial to investors, it has been a burden for consumers who are non-participants in the financial market. Fed Chairman Bernanke should know better - he once wrote a paper which examined the slowness of consumer prices in declining during the Great Depression.

Make no mistake about it, Bernanke is aware that monetary stimulus will only push retail prices higher even as consumer incomes continue to decline. His goal is to keep the lynchpin of the global economy, namely the U.S., from slowing down enough to result in falling retail and commodity prices. This would be a huge blow to the corporate multinationals and a major setback for the complete integration of the world's economies. If the financial health of the middle class must be sacrificed for the purpose of maintaining the status quo of the multinationals, then so be it, reasons Bernanke.

Although QE2 ended in June, the effects of the Fed's loose money policy continue to be felt. Prices at the gasoline pump are still too high and retail food costs refuse to come down. Even the mainstream press has acknowledged the problem of rising prices. In a Sept. 15 article, Christopher Rugaber of the Associated Press wrote, "Consumers are spending more to fill their tanks, feed their families and pay the rent. At the same time, the number of people applying for unemployment benefits has reached the highest level in three months." The article pointed out that "When prices rise, consumers cut back on big purchases, such as appliances, furniture and vacations. Mixed reports on manufacturing Thursday and flat retail sales in August suggest that may already be happening."

Despite resisting the urge to raise prices in recent years in order to prevent a consumer backlash, midsize retailer and restaurant chains are starting to raise prices to consumers. According to a quarterly survey by Barlow Research Associates, 53 percent of companies with annual sales of $10 million to $500 million have lifted prices during the last 12 months, as reported in the Sept. 4 issue of Businesweek. In other words, more price increases are on the way for the consumer despite a weakened economy.

Many economists at the Fed also have a narrow view of inflation, which they believe can be healthy for the economy under the assumption that it encourages people to spend and invest rather than sitting on their cash. There's a reverse side to this coin, however, that economists don't seem to recognize. It's the fact that continuous price increases like the ones we've seen in the last few years can inhibit spending and investment as consumers recoil from paying out too much of their disposable income on necessary items like food and fuel.

At least one economist seems to understand this. Tom Porcelli, chief U.S. economist at RBC Capital Markets, observed, "In an environment where you're now looking at zero job growth, it will be difficult to have much success passing on any additional costs."

One example of how rising prices can create a consumer backlash is found in the recent decision by Netflix to raise the prices of the movies it rents to its customers. The largest U.S. video subscription service in the U.S. announced it will end September with 600,000 fewer U.S. customers than it had in June. This is just the second time in 12 years that Netflix has lost subscribers from one quarter to the next. The decision to raise prices by as much as 60 percent is biting into the company's profits and has resulted in a drubbing of its share price, which has lost almost 50 percent of its value before the company unveiled the higher prices.

One of the most important considerations when evaluating the future direction of the economy is the cyclical path of least resistance. This path is determined by the configuration of the long-term yearly Kress cycles, which in turn influence the direction that prices will follow. Although the Fed tries to fight the long-term cycles through its monetary policies it cannot ultimately prevail in reversing the deflation the long-term cycles will eventually bring. The closer we head to 2014, that fateful year when the dominant 40-year and 60-year components of the 120-year cycle will bottom, the more we'll see of deflation's terrifying appearance.

Consumers will continue to see high retail prices for the balance of 2011 and into the first half of 2012 but by the second half of 2012 the effects of the deflationary long-term cycle should be in evidence. The good news is that this coming deflation will be salutary for the economy and will cleanse it of the problem of high prices that has plagued consumers for years.

Price of Gold

As we enter the final peak phase of the 6-year cycle, the gold price has struggled to stay above its 30-day moving average. Although the interim uptrend is still intact for gold, traders should be watching the nearest pivotal low at the $1,757 level (the Aug. 24 close) in the event that gold shows additional weakness in the next two weeks before the cycle peaks. The 6-year cycle is an equity market cycle, although it does have some residual impact on the gold price. If after the cycle has peaked the European debt situation worsens, investors will likely move very quickly back into the safe haven investment vehicles, which includes gold. Following the peak of the previous 6-year cycle in 2005 gold and the gold ETFs experienced a strong rally in the last couple of months that year and into the following year (see chart below).

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn't matter when so many pundits dispense conflicting advice in the financial media. This amounts to "analysis into paralysis" and results in the typical investor being unable to "pull the trigger" on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

In my latest book, "Gold & Gold Stock Trading Simplified," I remove the mystique behind gold and gold stock trading and reveal a completely simple and reliable system that allows the small-to-mid-size trader to profit from both up and down moves in the mining stock market. It's the same system that I use each day in the Gold & Silver Stock Report - the same system which has consistently generated profits for my subscribers and has kept them on the correct side of the gold and mining stock market for years. You won't find a more straight forward and easy-to-follow system that actually works than the one explained in "Gold & Gold Stock Trading Simplified."

The technical trading system revealed in "Gold & Gold Stock Trading Simplified" by itself is worth its weight in gold. Additionally, the book reveals several useful indicators that will increase your chances of scoring big profits in the mining stock sector. You'll learn when to use reliable leading indicators for predicting when the mining stocks are about o break out. After all, nothing beats being on the right side of a market move before the move gets underway.

The methods revealed in "Gold & Gold Stock Trading Simplified" are the product of several year's worth of writing, research and real time market trading/testing. It also contains the benefit of my 14 years worth of experience as a professional in the precious metals and PM mining share sector. The trading techniques discussed in the book have been carefully calibrated to match today's fast moving and volatile market environment. You won't find a more timely and useful book than this for capturing profits in today's gold and gold stock market.

The book is now available for sale at: http://www.clifdroke.com/books/trading_simplified.html

Order today to receive your autographed copy and a FREE 1-month trial subscription to the Gold & Silver Stock Report newsletter. Published twice each week, the newsletter uses the method described in this book for making profitable trades among the actively traded gold mining shares.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.