Investor Flight to Safety is Negative for Small Cap Stocks

Stock-Markets / US Stock Markets Dec 11, 2007 - 01:48 AM GMTBy: Donald_W_Dony

The trickle down affect of the U.S. subprime debacle is more far reaching than most investors may suspect. The obvious surface reaction is the negative outcome in the financial and housing sectors. Stocks in these areas have seen their values plunge in recent months. In addition, the Fed is prepared to cut rates to help stabilize the markets and in doing so, pulls whatever frail amount of support that exists from under the U.S. dollar. This move, in turn, provides increasing upward pressure to gold. But the area that is equally important and often missed in the subprime fiasco is the reaction or need for safety from investors.

The trickle down affect of the U.S. subprime debacle is more far reaching than most investors may suspect. The obvious surface reaction is the negative outcome in the financial and housing sectors. Stocks in these areas have seen their values plunge in recent months. In addition, the Fed is prepared to cut rates to help stabilize the markets and in doing so, pulls whatever frail amount of support that exists from under the U.S. dollar. This move, in turn, provides increasing upward pressure to gold. But the area that is equally important and often missed in the subprime fiasco is the reaction or need for safety from investors.

The flight to safety can best be viewed in Chart 1. This relative strength examination between the S&P small cap index and the Consumer staples sector reflects the long-term performance between these two opposite groups. A rising line indicates a greater relative performance from the small cap market and a falling line shows that the Consumer staples sector has higher growth. This comparative gauge reflects on growth-to-safety perception with investors.

It also has proven to be a good gauge on the overall strength and outlook of the market. Since July 2007, growth oriented small caps have been the better performer of the two groups. However, as the subprime crises began to unfold, investors withdraw their funds out of more speculative small cap companies and shifted to higher safety with purchases of defensive consumer staples. As of early December, the mood of investors has intensified with a continued removal of capital out of the small cap sector.

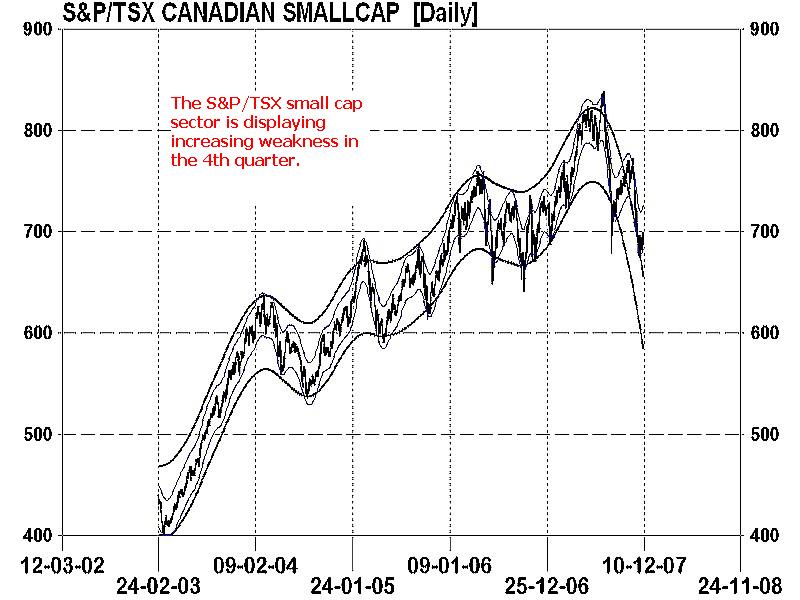

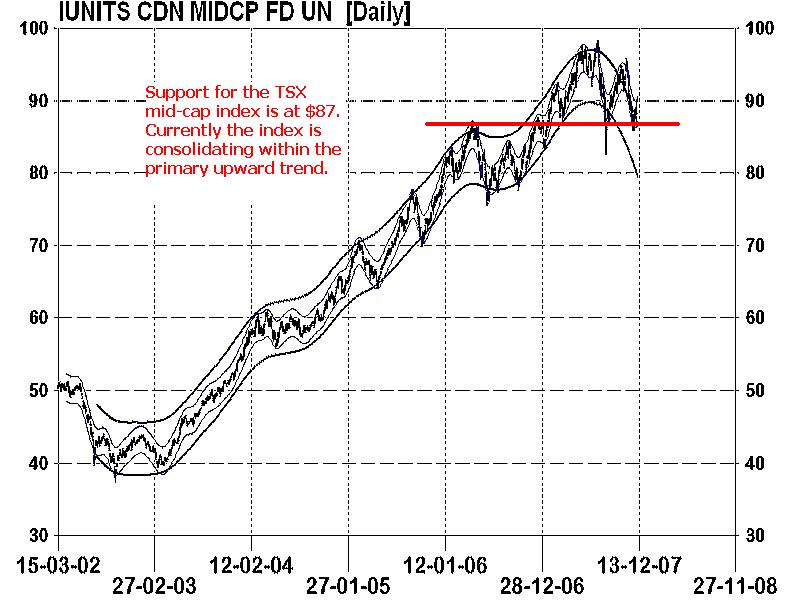

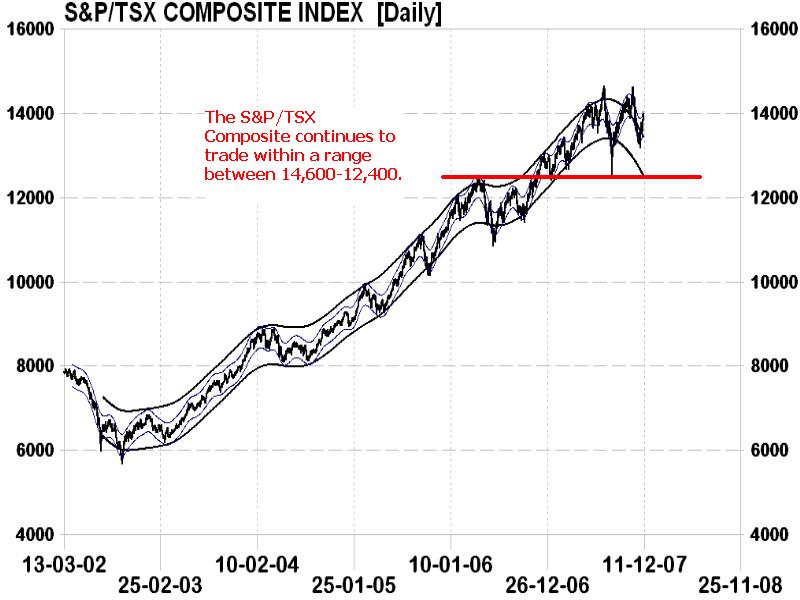

The next three charts are a comparison of the TSX small caps index through to the larger cap S&P/TSX Composite. The evidence shows the progressive weakness and volatility coming from the mid-caps and small cap sectors as compared to the larger companies within the S&P/TSX Composite. The TSX small cap index is the only index of the three groups to have broken key support continues to roll over.

Bottom line: Investors are moving away from the more speculative small cap indexes in favour of safety. This shift in relative strength from growth to defensive often occurs at or near market tops.

Investment approach: The shift of funds out of the higher risk small cap arena and into the safety of staples and consumer non-cyclicals points to the underlining concerns about the economy and stock markets that many investors currently have. Investors should therefore consider overweighting on the strength of the market (ie defensive sectors) and underweighting small cap stocks in their portfolios.

Additional research on the economy, North American and global markets is in the latest December newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.