The Real Solution to U.S. Debt Crisis

Politics / US Debt Sep 16, 2011 - 12:36 PM GMTBy: MISES

David D'Amato writes: In his famously doleful, dystopian novel, Nineteen Eighty-Four, George Orwell described a world enthralled to what was functionally a "permanent war economy," an "economy existing by and for continuous warfare."

David D'Amato writes: In his famously doleful, dystopian novel, Nineteen Eighty-Four, George Orwell described a world enthralled to what was functionally a "permanent war economy," an "economy existing by and for continuous warfare."

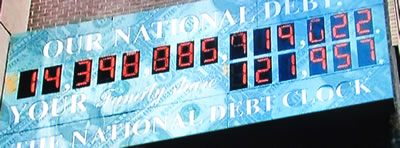

Today, on the heels of a debt ceiling increase calculated to forestall a federal-government default, we both are witnessing and are yoked to the many indispositions of what could be characterized as a permanent debt economy.

The Federal Reserve System, as the radix and arguably most defining component of the American economic paradigm, is fostering a scourge on productive activity that has metastasized through society to a now-catastrophic degree.

The Federal Reserve System, as the radix and arguably most defining component of the American economic paradigm, is fostering a scourge on productive activity that has metastasized through society to a now-catastrophic degree.

As a malignant growth eating away at the foundations of prosperity and freedom, the state, together with its parasitic courtiers, could not survive without the debt and insolvency that Congress's latest actions have endorsed.

Behind the spurious language of compromise and pragmatism, the Washington power elite have damned Americans to what a talk by Mises Institute president Doug French styled "The Culture of Debt and Despair." The state's fraudulent system, grounded on the fool's paradise of an ever-expanding monetary base, is perfectly adapted to engender an indissoluble condition of dependency in the great majority of Americans.

Though mainstream commentators scarcely ever acknowledge it, there is a critical causal relationship between the banking system that prevails in the United States and the ballooning federal debt; the two are intimately linked in both theory and practice, a fact that has been well understood by free-market economists — and particularly the Austrian School — for generations, and that manifests itself today.

As Professor Jörg Guido Hülsmann observes in The Ethics of Money Production, within a fiat-money system, public debt increases "at a much faster rhythm" than even the distended money supply. Pointing to the United States since 1971 as an example, Professor Hülsmann notes that while the money in circulation "increased by the factor 6," the federal government's debt grew by a factor of 20.

This imbalance is not a coincidence. The warped incentives of the cartelized banking environment encourage the precarious imbalances of the state-privileged banker class, existing completely outside of market discipline. The commercial banks collude with the central bank in a symbiotic partnership, one in which the former group gorges itself on government-debt bonds while the bonds furnish easy money at no cost and backed by no value. We cannot hope, then, to address the problem of a snowballing federal debt without first confronting the underlying infirmity bedeviling the economy, the centralized banking framework.

In 1817, the English free marketer and opponent of protectionism, William Cobbett, percipiently recognized the unique connection between government debt and central banking. In Paper Against Gold, he wrote:

[I]t was soon found, that to pay the interest of its Debt, the government needed something other than gold and silver; which, indeed, any one might have foreseen, because the Debt itself necessarily arose from the want of gold and silver within the reach of the government. It was, therefore, supreme folly to suppose, that the government, who had borrowed people's guineas from want, would long have guineas enough to carry on wars and to pay [its creditors] too.

In a cycle through which one illusion is built on and follows from the next, the free market's inherent protections against systemic breakdown are overturned by the state. In a true free market, one of the first and most important hedges against inflationary debasement of currency would be competition between monies themselves, that is, between currency certifiers and minters.

At present, legal-tender laws enshrine a monopoly in the state, one that insulates paper money from competition otherwise capable of stemming the risks associated with the widespread dilution of, for instance, the US dollar. Completely beside the question — subject to ongoing debate — whether the free society demands "free banking" (allowing the practice of fractional reserve) or 100 percent reserve, an open rivalry between currencies has the practical advantage of exposing the lie that defines legal-tender laws.

That lie, overriding the voluntary agreements of market actors, insists that whatever money is aggrandized by the legal-tender law is worth some arbitrarily determined amount of some other money commodity (for example, silver). By sheltering the money type advantaged by the laws, the state promotes a disruption of the free market's natural price signal, a lopsidedness that allows "political leaders … to reap personal profit from the export of the [artificially] undervalued money and from the possibility of reducing debts contracted in [it]."[1]

Far from furthering genuine trust in a particular currency by granting it the imprimatur of the state, legal-tender laws function analogously to state licensure rules. Removing functions such as certification and licensure from the peaceful judgments of the market, and thus erecting a monopoly, effects a result quite opposite from the preservation of quality or reliability.

With alternatives to the state's paper money coercively foreclosed, the prevalence of a particular, favored medium of exchange is the result, not of its trustworthiness or purity, but of the decree of the bureaucratic class that stands to benefit. Just as "bank runs" on a free market would prevent the accumulation of wealth in unstable, overstretched institutions, so too would the currents of wealth in a free society follow the most dependable minting agencies and money substitutes.

That there is, for most Americans, no practical escape from using the dollar only serves to compound the dangerous instabilities of the central-banking model. Private bank notes, essentially bailment documents entitling their holder to a certain amount of, for instance, gold, are outlawed at present.

There is, however, no reason that, in a free, stateless economic landscape, these notes could not fulfill society's need for readily transferable objects of value capable of conveyance in precise amounts. Indeed, we need not assume that such a market in bank notes would lead to the very inflation that has defined fiat currency under central banking.

As Ludwig von Mises argued, "[F]reedom in the issuance of banknotes would have narrowed down the use of banknotes considerably if it had not entirely suppressed it." Further, if such open competition in monetary instruments were allowed, it would itself go a long way in stemming the rising tide of "public" debt.

The correlation between central banking and fiat currency on the one hand and federal-government debt on the other is perhaps oblique on its face.

In Wall Street, Banks, and American Foreign Policy, Murray Rothbard observed that both wings of the banker class — the commercial and investment variants — have a "vested interest in promoting deficits and in forcing taxpayers to redeem government debt." The first group, sheltered from competition by arbitrary regulations and inflating the money supply at will through their lending, is conspicuously desirous (and in need) of the government dole. Investment banks too are specially situated to benefit from mushrooming government debt, financing profligate state spending through the purchase of treasury bonds.

Free of the structural constraints on borrowing established by risk assessments in a free market, the total state can pile up debt without limit through appeals to the newly created money of its central bank. The new dollars, again, are not simply transferred to the growing state in the blatant act of adding them to the treasury, but are shifted to benefit government by the Federal Reserve's "open market" policy. It is through this policy — whereby the supposedly "independent" Fed enters the financial market as buyer — that the debt obligations of the state are purchased (largely from investment banks) in order to underwrite an increasingly pervasive state. We should not, therefore, regard the "moral hazard" built into the structure of the financial economy at every level as an accident.

The plutocrats of the banking class are quite content to profit by lending money pulled from the ether, shielded as they are from the consequences of doing so in a true free market. Open competition among banks, in contrast to the Federal Reserve's cartelized system, would discourage the banks from overextending, from, as Murray Rothbard wrote, "literally creating money out of thin air."

But because there is no cost to the banks to lend "this magical money," which was not accumulated through anyone's saving, the profits accumulated through interest on it come at the expense of those whom Rothbard designated the "inflation-payers." In The Organization of Debt into Currency, Charles Holt Carroll similarly derided bank-credit expansion under the principle that it created "price without value," a indication of the classical labor theory of value that Carroll subscribed to. Of course one does not have to accede to the classicists' theory of value to understand and explain the moral problems with granting a very few the privilege to in essence become alchemists, transforming nothing at all into money. The process has permitted a ruling caste of banking elites, interwoven with and revolving through the state, not only to sponsor unbridled debt but to prosper by counterfeiting — by depriving people of the value of their dollars.

As a result of the United States' inflation-fueled debt crisis, we are now witnesses to a "state of financial dependency unknown to any previous generation."[2] Declining purchasing power under inflation removes any incentive for saving and thus stimulates the accumulation of private debt, a fact that only serves to strengthen the welfare state as it cripples the family and other peaceful social institutions.

As a tool for advancing the interests of the political class, then, inflation under fiat money and central banking is distinctly polytropic; it is capable of rendering a hidden tax that centers the entire economy on a small cartel of strategically positioned bankers, who have no interest but to sponsor — again, with worthless fiat currency — the expansion of government control over our lives. Coincident with the centralization of power within the bowels of the state, business decisions too are increasingly concentrated, enmeshed in the modern-day nobility of the banking sector.

And the reason is simple enough: insofar as saving is at every turn discouraged by the monetary system, businesses become more and more reliant on debt, financing their endeavors with credit flowing from a naturally meddlesome class of lenders. Tethered to the condensed power of the big Wall Street banks, the economy becomes rigid and sclerotic, precluding the nimbleness and innovation that would reign in a genuine free market. Fiat inflation, Hülsmann argues, "creates greater hierarchy and central decision-making power than would exist on the free market."

Not only do the Fed's inflationary policies make unsustainable government debt inevitable, then; they also grant to the big banks command over the entire economic framework. Whereas their influence would be checked by the tides of a free market, they become, within the cartelized economy of the Fed, the pivot point of all commerce. That privilege ultimately costs taxpayers and consumers in the billions, perpetually setting the entire economy on the course of crisis and ruin. The alternative is a market freed from the state's needless regulations and its cancerous central bank, a market that would not forcibly prevent rational responses to economic signals. That alternative is the only real solution to the debt problem.

Within the present system, a balanced budget could only ever mean stifling and overwhelming levels of taxation, which would even further serve to blight the economy. A true remedy to the condition of government debt is the elimination of its underlying incentives and root cause. It's time to free economic life from the burden of the Federal Reserve System, letting individuals' voluntary exchanges decide questions of money and credit.

David D'Amato is a news analyst for the Center for a Stateless Society. He is a lawyer currently working on an LLM in the law of international business. Send him mail. See David S. D'Amato's article archives.![]()

© 2011 Copyright David D'Amato - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.