U.S. Jobs Bill is Too Late For President Obama

Economics / Employment Sep 12, 2011 - 03:20 AM GMTBy: EconMatters

When President Obama delivered his much anticipated jobs speech on Sep. 8, I was actually driving on one of those highways the President said would benefit from the infrastructure spending included in his proposed $447-billion American Jobs Bill. Listening to the live speech, and judging from the audience reaction, it was a good speech reminiscent JFK-style and was what American public wanted to hear.

When President Obama delivered his much anticipated jobs speech on Sep. 8, I was actually driving on one of those highways the President said would benefit from the infrastructure spending included in his proposed $447-billion American Jobs Bill. Listening to the live speech, and judging from the audience reaction, it was a good speech reminiscent JFK-style and was what American public wanted to hear.

However, the proposed bill is short on implementation detail, and the claim that “Everything in this bill will be paid for. Everything” seems more of a wishful thinking and empty rhetoric as it rests on the assumption that the resulted budget and deficit cuts would not be rolled back by future leaders and policymakers. And that, of course, would not be President Obama’s problem.

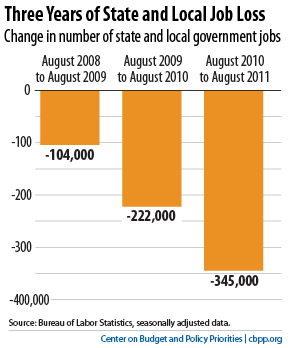

Looking at the proposal on the basis of allocation, there does not appear to be any provision for the public sector, which is shedding jobs at an accelerated rate outpacing the job gains in the private sector due to budget cuts, revenue losses, and the winding down of the stimulus package. U.S.News noted that since the end of the recession, government employment--including federal, state, and local jobs--has fallen by roughly 600,000. Furthermore, there’s no provision for the housing sector which is still hemorrhaging from the financial crisis dragging down the rest of the U.S. economy.

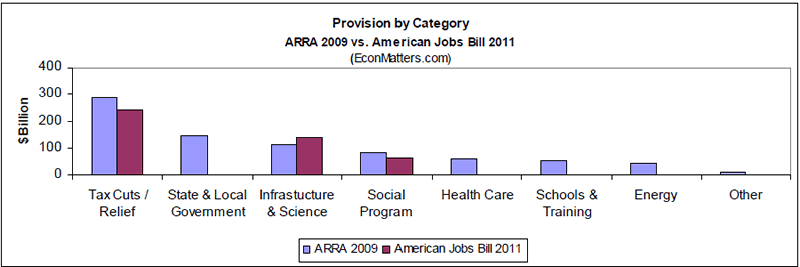

At $447 billion, the proposed Jobs Bill is about half the size of the first stimulus package passed under President Obama – the $787-billion American Recovery & Reinvestment Act of 2009 (ARRA 2009). While both bills have a significant portion allocated to tax cuts/relief, one notable difference is that the Jobs Bill 2011 has devoted a much greater percentage and dollar amount to infrastructure—31% or $140 billion vs. 10% or $81 billion in ARRA 2009. (See Chart)

In the speech, the President made reference to China’s construction spree noting that the U.S. has the capability as well to build out infrastructure on its own. The heart of the matter is that Beijing gets that ….three years earlier than the Obama Administration, which made a decision to go the ‘alternative’ route.

As a result, China has overbuilt in some areas, and its “ghost city” has become somewhat an international laughingstock. But on the other hand, it also suggests China would rather have many ghost cities and empty railways than risking an economic recession. Meanwhile, it is fair to say the under-funding and poor condition of many roads, bridges and ports in the nation could soon turn the U.S. (still the largest economy in the world) into a laughingstock as well.

The ARRA 2009 was heavy on health care, alternative energy, and certain special interest programs. The country now has almost 2 million fewer jobs since 2 1/2 years ago. President Obama and his “brain trust” basically failed by not asking questions like the following in advance:

Does, for example, health care reform, in the middle of an unprecedented recession, really add to net new jobs, without taking jobs away from other sectors?

If the answer is NO to #1, then the second logical question would be: Should we wait till after the economy gets back on its feet?

Could a policy and legislative change of this magnitude rattle business and negatively impact business hiring and investment decisions? If yes, then go back to question #2

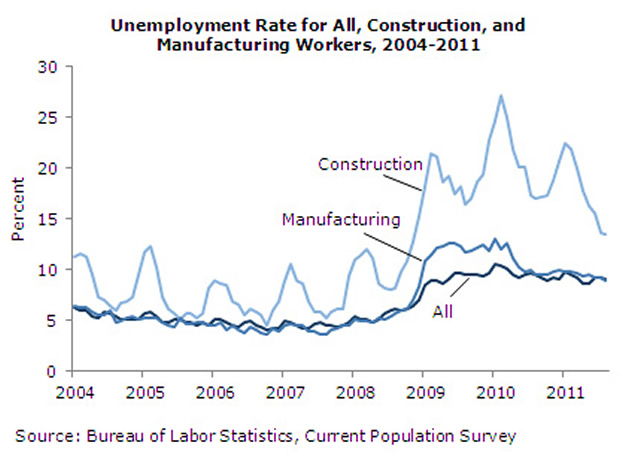

The point is that if the nation has to take on more debt to get the economy going, then at least put the money into established sectors with a large number of workers such as construction and manufacturing that got hit the hardest by recession and job losses. (See Chart Below)

Chart Source: CEPR.net

The ARRA 2009 was literally a no-questions-asked check of $787 billion reflecting the excitement and support of a newly elected (and charismatic) President. The political and fiscal climate then was one such that stars were aligned for President Obama (and the Democratic Party) to go down in the history book as the hero turning the U.S. economy around from the Great Recession…had the resource been properly utilized and implemented.

With the deteriorating domestic housing market, the unemployment rate of the construction industry peaked at 27.1% in February 2010 (See Chart Above), and just lost another net 5,000 jobs in August. One has to wonder what difference it could have made had the ARRA 2009 been allocated the old fashioned (and proven) way—heavy on infrastructure and other business-friendly programs to spur growth.

Large scale infrastructure projects typically take anywhere from 6 to 24 months to go into the actual construction phase. So even if an infrastructure stimulus program is put in place today, the more significant impact on employment most likely will not be seen for another year or two. On the other hand, had the infrastructure program been implemented three years ago, the expected benefit to the labor market would have manifested by now.

Obama challenged the lawmakers to “pass this jobs bill now”. Unfortunately, unlike the time of the ARRA 2009, the GOP is now the majority, and will not be as cooperative, and helpful to President Obama’s re-election. So most likely, the final version of the Jobs Bill could be further watered down. Some analysts said that the Obama camp could call it a victory with 50% of the proposal passed.

By refocusing on infrastructure with this newly proposed jobs bill, the President seems to have admitted as much the mis-direction of the first stimulus package. Nonetheless, since Obama missed the best opportunity three years ago, it is too late for a do-over now.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.