Beating the Credit Cycle - The Battle Between Debt & Recession

Economics / US Debt Dec 08, 2007 - 08:56 AM GMTBy: Adrian_Ash

"...The Fed & the White House will do whatever it takes. But will that be enough to defeat recession for ever and ever...?"

"...The Fed & the White House will do whatever it takes. But will that be enough to defeat recession for ever and ever...?"

SO THERE IS TO BE no let up or truce in the war between debt and recession. The cannon-fodder of consumer credit – the battle-weary consumers themselves – must push ahead with the Christmas offensive. The United States , standing shoulder to shoulder with its partners in Britain , will stay in the trenches until the job is completed.

All boom, no bust! Gordon Brown – now the UK prime minister – has no promised no less for more than 10 years. And this is no time to quit the field now.

But beating the credit cycle won't be easy, even if it proves possible. Indeed, this war of attrition will take just as long as the never-ending war against terror.

"Some borrowers took out loans they knew they could not afford," said President Bush on Thursday, before he slipped into the present tense and tried to wind back the clock.

"To compound the problem, many mortgages are packaged into securities and sold to investors around the world.

"So when concerns about sub-prime loans begin to mount – began to mount – uncertainty spread to the broader financial markets."

Out in the field, the commander-in-chief knows he's lost the high ground, but that "uncertainty" was never a threat. Adjustable-rate home-loans made it clear, right from the get go, what would happen in 2007 to 2008 and beyond.

They "usually begin with 7% to 9% rates that [then] reset to between 11% and 13%," as Bloomberg explains. But that was precisely the problem.

For can you imagine it? An interest rate that moves up, and not down...?

"What we are talking about is having these loans modified, so they continue for a longer period of time at the starter rate," said John Reich, director of the Office of Thrift Supervision, of the Hope Now initiative earlier this week.

Will flat rates be enough to keep the big guns pounding the enemy? After 25 years of ever-cheapening credit, the bond market certainly wants rates to go down – not least after bond yields reached a half-decade high at the start of this summer.

Piling into short-dated bonds, in fact, Wall Street has priced in recession already. Three-month bond yields have slumped by more than 200 basis points since mid-June, the fastest rate of decline since May 2001.

Two-year bond yields have slumped by 219 points inside six months – a 15-year record –going from 5.10% to below 3.00% in short order.

2001 marked the shortest and shallowest US recession on record. At least 1992 got to dent housing and jobs, unwinding debt and forcing households to save and not borrow.

It must never happen again!

"Uncertainty about the effects of the credit crunch, together with rising oil and food prices, seems to be affecting feelings about jobs and the future economic situation," said Fionnaula Earley, chief economist at Nationwide – the UK 's biggest mortgage lender – on Wednesday this week.

"With that in mind, it is natural that consumers would think about tightening their belts this Christmas and this is reflected in the weaker spending index."

But this "natural" response – cutting back spending after a record decade of credit growth – can't be permitted. "At least two cuts" to UK interest rates were now needed, Earley told the Telegraph "to take the "pressure off [household] finances."

The Bank of England delivered one cut on Thursday, pretending that inflation will slow just because consumer demand is receding. Put another way, and on the other side of the Pond, "policymakers appear fully engaged in stanching the financial turmoil and ensuring that the economy avoids recession," says Mark Zandi of Economy.com for Moody's.

"The Federal Reserve has aggressively lowered interest rates in recent weeks and Congress and the administration are working to aid the hard-pressed mortgage market. More help will be needed, but policymakers appear ready to provide whatever is necessary."

Can whatever it takes keep recession pinned down for ever and ever? There's only been one winner so far in this war waged by debt – and Gold Prices look set to keep winning as consumer debt push ahead as the economy slows.

The global boom in all asset prices that now seems to be tipping over the top came thanks to one major bear market – the bear market in the value of money.

Government-led and central bank-sanctioned, it has cut the value of US Dollars by two-thirds versus a Gold Bullion Investment. It's pushed the British Pound Sterling to new all-time record lows, and cut even the Euro in half when measured in gold.

Call it liquidity if you must, a flood now washing the ink out of central bank promises to pay. The bubble also pushed oil, base metal and food prices sharply higher – but even if they somehow slip back as the US economy slows, the outlook for Gold Prices might still hold good in 2008.

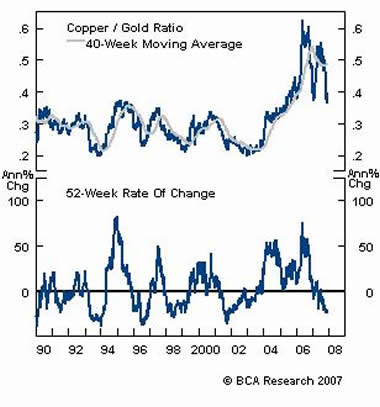

Dr. Copper – the metal with a PhD in forecasting economic growth or recession – has broken down even as Gold Prices have continued to surge, notes the Bank Credit Analyst .

Comparing the two metals over the last 17 years, "the Copper-Gold Ratio plunged when central banks fell behind the deflation curve," the BCA says. The ratio then surged "when rates were normalized or policymakers were struggling to cool growth."

"The current breakdown in the Copper-Gold Ratio suggests that more liquidity is needed to reflate the global financial system and keep the economic expansion on track," the BCA adds. And more liquidity means more money, of course.

So wheel out the big guns of debt! Last time the US defeated recession, real interest rates dropped below zero; the Gold Market doubled in the following three years.

If the Fed cuts again down to 3.5% (Bill Gross's forecast at Pimco) or right down to 1% (the Greenspan Fed's answer to the 2001 dip), just how far might gold go – even without rising inflation?

"Monetary policy in the three main areas [the US , Europe and Japan ] should remain on hold," reckons Jorgen Elmeskov, chief economist at the Organization for Economic Co-Operation and Development (OECD). Indeed, if inflation picks up – and it just hit 3.0% in Europe , despite the surging Eurozone currency – he thinks it would be "necessary to pay a price in terms of lower activity in the short-term" to keep the cost of living in check.

The European Central Bank broke ranks this week, doing just what the OECD said and keeping Eurozone rates on hold. But the Fed and Bank of England ?

Neither are charged with growing the economy. Both are supposed to avoid destroying their currencies and letting inflation run wild. But as Clive Briault, a managing director of the Financial Services Authority – the UK 's investment watchdog – said this week, "there is a very real prospect that conditions will worsen further, raising some important risks for consumers.

"If their financial plans depend on cheap and abundant credit, the absence of those conditions is likely to cause significant consumer stress."

Stress meaning a slowdown, and slowdown might now mean recession. It cannot be allowed, whatever the costs.

What might that cost be to cash savers without gold?

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Free Report: 5 Myths of the Gold Market

City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2007

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Adrian Ash Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.