United States Defaulted Long Ago, Approaching Final Collapse of our Credit Expansion Boom

Interest-Rates / US Debt Jul 30, 2011 - 07:18 AM GMTBy: James_Quinn

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The final collapse of our credit expansion boom approaches. We have a choice over the next week. We could voluntarily abandon further credit expansion by voting for a Balanced Budget Amendment to the Constitution or we can raise the debt ceiling, pretend to cut spending far in the future, and allow our currency system to experience a catastrophic final collapse.

We’ll take what’s behind door #2 Johnny. The vested interests in Washington DC and Wall Street only care about power and wealth. They will never abandon credit expansion. It’s their drug. They must have it. They are addicted to it. They will keep injecting it into our system until they overdose America.

The mainstream media acts as if not raising the debt ceiling by next Tuesday will result in America defaulting. This is a crock. America chose to proceed on a path to default decades ago. We are just finally reaching our destination. Below are the choices we made as a people and a country to default on our obligations and eventually destroy our country:

- The enactment of the 16th Amendment to the Constitution in 1913 allowing the government to impose a tax on your income, thereby opening Pandora’s Box to a 60,000 page tax code and allowing politicians to sell their votes to the highest bidder.

- The signing into law of the Federal Reserve Act by Woodrow Wilson in 1913, transferring control of our currency system to Wall Street banks. The man made inflation created by the Federal Reserve has reduced the purchasing power of the USD by 97% since 1913 and has allowed politicians to promise $100 trillion of benefits to Americans, that can never be delivered.

- The Social Security Act signed into law by Franklin Delano Roosevelt in 1935, supposedly to help widows and orphans, morphed into a giant ponzi scheme used by politicians to make Americans think it was a retirement plan and the money was in a lockbox. The scam continues, but ponzi schemes always collapse.

- Fannie Mae was created in 1938 as a government agency and Freddie Mac was created in 1970 as a quasi-government agency. By promoting home ownership and subsidizing loans to people who should have never gotten loans these agencies caused hundreds of billions in mal-investment. As tools of politicians, they were used to push social agendas. The result will be in excess of $300 billion in losses to the American taxpayer.

- The Korean War set a precedent where the President did not need to seek Congress to declare war as required under the Constitution. This has allowed the President the freedom to fight undeclared wars around the world for decades, while spending trillions, with no approval from Congress.

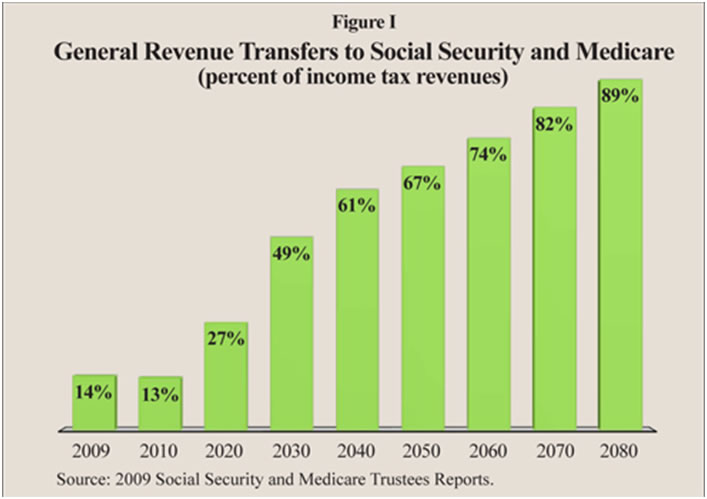

- LBJ’s Great Society programs such as Medicare and Medicaid were sold to Americans as cost saving programs that would improve healthcare for all Americans. We now spend 17% of our GDP on healthcare and these two programs have an unfunded liability of almost $100 trillion.

- Nixon closing the gold window in 1971 removed all restraint on the Federal Reserve, banks and politicians. With a fiat currency backed by nothing but promises, it was only a matter of time before the greed and corruption of bankers and politicians overcame any self imposed fiscal responsibility. The result has been the National Debt going from $400 billion in 1971 to $14.4 trillion today, a 3,600% increase in 40 years. Meanwhile, GDP only increased 1,350% over this same time frame.

- The embrace of consumer debt by the Baby Boom generation beginning in 1980 created an atmosphere of living for today and not worrying about the future. This attitude has left 50% of all the households in the country with a net worth of $70,000 or below.

- The repeal of the Glass Steagall Act in 1999 unleashed the hounds of hell upon America, as the soulless blood sucking vampires on Wall Street proceeded to rape and pillage the American economy with their financial derivatives of mass destruction and marketing of debt to the clueless masses. The housing bust and impoverishment of the middle class can be laid at the feet of these evil greedy bastards.

- Bush’s unpaid for wars of choice, his reckless tax cuts, and his foolish expansion of a bankrupt Medicare program in the midst of two wars turbo charged the country on its path to default.

- By bailing out Wall Street on the backs of the middle class in 2008/2009, the politicians in this country showed their hand. They will protect their fellow power brokers and contributors and throw the American people under the bus. Wall Street controls Congress.

- The Keynesian schemes rolled out by Obama and his minions have just added trillions of debt while depressing the economic system and doing nothing to help the average person. The Fed created inflation has inflamed revolution through out the world and further impoverished the middle class who need to eat and fill up their cars.

- In the midst of a Depression Obama chose to create a brand new healthcare bureaucracy, add 30 million people into the government controlled system, and commit the US taxpayer to trillions of future healthcare costs.

As you can see, next Tuesday means nothing. The debt ceiling means nothing. We chose to default as a nation many years ago. The destination was certain, only the timing was in question. Time to step on the gas.

“Credit expansion is not a nostrum to make people happy. The boom it engenders must inevitably lead to a debacle and unhappiness.” – Ludwig von Mises

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2011 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.