The U.S. Debt Ceiling Charade, $114.5 Trillion of Debt and Liabilities

Politics / US Debt Jul 27, 2011 - 05:18 AM GMTBy: Jeff_Berwick

What a circus the debate over the raising of the US Government debt ceiling has become. It's fun to watch everyone involved wriggling around trying to ignore the blue whale in the room.

What a circus the debate over the raising of the US Government debt ceiling has become. It's fun to watch everyone involved wriggling around trying to ignore the blue whale in the room.

It used to be an elephant... perhaps around 1986. But now, after a decade of wars and trillion dollar deficits, the US Government debt has become like the largest mammal in the history of the world - the blue whale - and is perhaps so large now that it might be in everyone's best interest just to ignore it or their heads may explode from realizing the enormity of the problem.

Beyond Salvageable

The official debt of the US Government is $14 trillion but they've spent more than $60 trillion that was supposed to be "saved" in things like the Social Security trust fund for decades now, meaning the total debt and liabilities of the US Government is now over $75 trillion - an amount that works out to over $1 million per family of four.

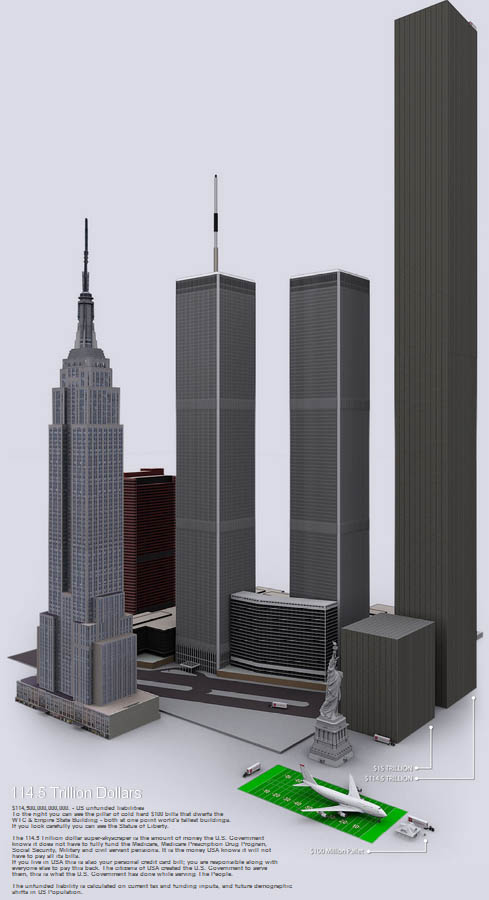

One of the most perfectly titled websites, WTFNoWay.com, has published a visualization of US Government debt that is worth checking out. They calculate total debt and liabilities of $114.5 trillion (slightly above our estimate of $75 trillion) and show what that looks like in terms of $100 bills.

That stack on the right is what the total debt of the US Government looks like in terms of $100 bills. Yet, there is no talk of reducing it anytime in the near future - only on how much to increase it by.

Barack's Two Choices

Barack Obama, puppet to the global financiers and other private interests, commandeered the airwaves of the US the other night to state that the options are simple. He gave the US public two options:

"If you want a balanced approach to reducing the deficit, let your member of Congress know," he said. "If you believe we can solve this problem through compromise, send that message."

Is that all this is about? A balanced approach or a compromise? It seems so simple now. Thanks, Obama-tron or those who write what you recite.

He doesn't mention the other two options. Both of which are much less nebulous and are better for the US public in general in the long run.

One is to keep the debt ceiling where it is and immediately cut the US Government deficit by a tremendous amount to a level where it is not in deficit. God forbid, only spend as much as you steal? That's just crazy.

The other option is to default. Admit that the US Government is so indebted that it is mathematically impossible to pay off the debts and liabilities and to default and renege on those debts.

But, those two options were ignored.

Instead he asked for the "help of the people". He asked people to call in with their ideas as though perhaps some housewife from Nebraska might come up with something they missed at the last second!

And call in they did. Congressional switchboards were swamped with calls. There can only be one thing you can say with certainty about the tens of thousands who called - they are highly delusional!

Do they suppose that perhaps a quick call to some congressional intern with their ideas might get heard? Or that there is some easy solution to this gigantic mess that only they could provide?

Instead, democracy was reduced to its ultimate and inevitable state: groveling. Many people called in to beg their overlords to give them the money through various subsidies or tax breaks. Or take it away from someone else who is not them. At this point in democracy the government is just a big Santa Claus with a gun. You ask him for stuff and cower in submission when he says no.

In reality, however, no matter what sayeth the man on the street the politicians will keep doing what they are doing and wrangle and do deals far from the prying eyes of the public and sell-off anything they can to fatten the pockets of themselves or their benefactors. They have no skin in the game and are there just to take what they can.

The Show Will Go On

Even though they are getting down to the supposed final days of this dispute it is still highly unlikely that the politicos will not raise the debt ceiling. The reason is simple. A raising of the debt ceiling allows business as usual to continue in Washington - at least for the time being. Not raising the debt ceiling means having to do things politicians don't like: be accountable, make cuts to the size of government and have less money in the trough with which to steal, bribe and finagle.

That's why not raising the debt ceiling at all, or lowering it, was never one of the choices offered. And why gold hits new highs every day.

Subscribe to TDV today (90 day moneyback guarantee) to access our Special Report on How to Own Gold as well as get complete access to our newsletter and portfolio selections.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2011 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.