U.S. States Slowly Slipping Into Bankruptcy and Beyond

Interest-Rates / US Debt Jul 07, 2011 - 03:30 AM GMTBy: Adam_Brochert

Everyone is focused on Europe and their debt problems. The peripheral countries (i.e. PIIGS) of Europe are now being asked to sell off national assets to keep the bankers fat and happy. What a system, huh? Meanwhile, several larger states in the United States (e.g., Illinois, California) are quietly slipping into bankruptcy and beyond. Will they be bailed out? The odds are strongly in favor of federal help for states in dire financial straights. After all, an election year is coming and who ever heard of a government not willing to give away other people's money/future purchasing power to get a few more votes for the incumbents?

Everyone is focused on Europe and their debt problems. The peripheral countries (i.e. PIIGS) of Europe are now being asked to sell off national assets to keep the bankers fat and happy. What a system, huh? Meanwhile, several larger states in the United States (e.g., Illinois, California) are quietly slipping into bankruptcy and beyond. Will they be bailed out? The odds are strongly in favor of federal help for states in dire financial straights. After all, an election year is coming and who ever heard of a government not willing to give away other people's money/future purchasing power to get a few more votes for the incumbents?

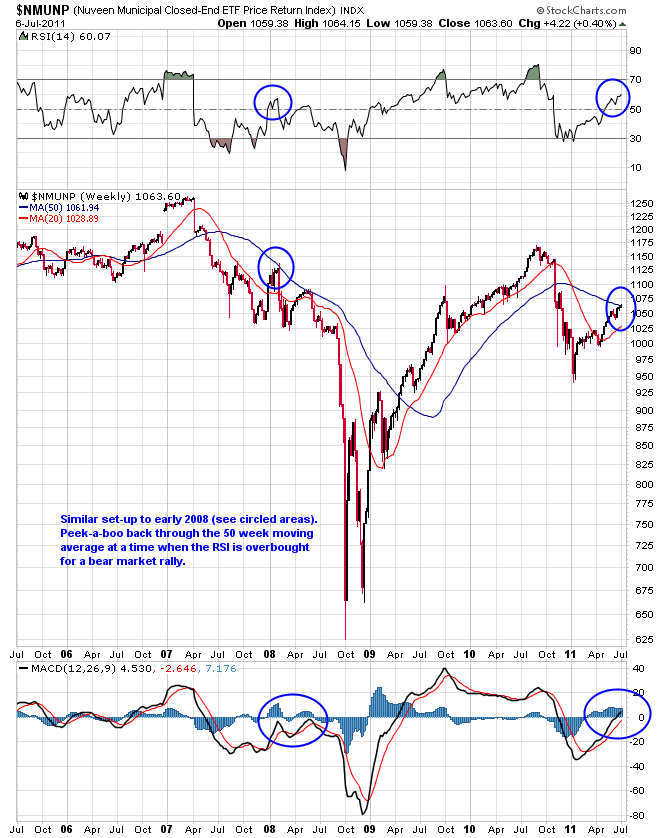

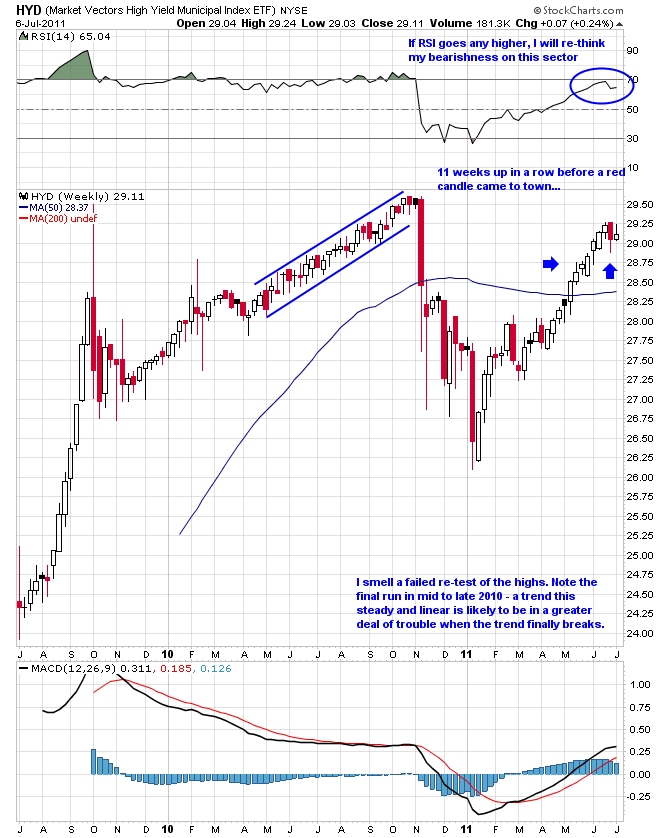

I doubt we'll see any bailouts until we get a few fireworks in the U.S. municipal bond markets, however. I have been watching this lipstick-covered pig-of-a-market for some time. Though shorting this market is difficult, municipal bonds are still a bellwether to be watched. I think the top in the muni bond market is just about in - we may have a percent or two more to go, but now is the time to be exiting this sector with haste if one is long (unique individual opportunities aside).

Here is a 6 year weekly log-scale chart of the Nuveen Municipal ETF Price Return Index ($NMUNP) thru today's close:

As is typical in debt markets, the weaker debt tends to deteriorate first. I belive the first cracks in muni debt market are starting to show in the high yield sector. Here is a 2 year weekly chart of the HYD ETF ("Market Vectors High Yield Municipal Index"):

I don't play in the muni debt markets. Government debt is not attractive to me for many reasons - I'm a Gold bull in the midst of a private sector secular credit contraction/economic depression, after all. I think major dough will be thrown at the muni debt markets and state governments because an election is coming up in 2012 and because the U.S. will continue to print money until the federal debt markets revolt. With a 10 year bond yield of around 3%, I'd say we're quite a long way from the bond vigilantes imposing discipline upon the federal apparatchiks of the United States.

In fact, when the so-called federal reserve (not federal and has no reserves) throws money at the muni market upon the request of the U.S. Treasury, this may be just the catalyst Gold needs to start moving above $1550 on its way to $2000/oz and beyond. Forget the headlines. They tell you exactly what the market has already priced in and this is not worth knowing. The charts are the only chance the little guy has of getting insider information. If you don't know how to read charts and are trying to trade these markets based on what you read on Bloomberg or see on CNBC, consider subscribing to my low-cost trading service

Click here for a description of the service and to see samples of recent subscriber materials.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.