It's Time to Invest in Coal

Commodities / Coal Jun 22, 2011 - 03:30 PM GMTBy: Marin_Katusa

Marin Katusa, Casey Research Energy Team writes: Coal prices are surging ahead even as most other commodities pull back, spurred on by expectations that metallurgical and thermal coal production will again fail to meet rising global demand this year. The result? Record profits for major coal producers like Xstrata, a surge in acquisitions from coal-hungry India, Chinese electricity shortages, and a raging carbon tax debate in Australia amid record investments in that country's coal-heavy mining sector.

Marin Katusa, Casey Research Energy Team writes: Coal prices are surging ahead even as most other commodities pull back, spurred on by expectations that metallurgical and thermal coal production will again fail to meet rising global demand this year. The result? Record profits for major coal producers like Xstrata, a surge in acquisitions from coal-hungry India, Chinese electricity shortages, and a raging carbon tax debate in Australia amid record investments in that country's coal-heavy mining sector.

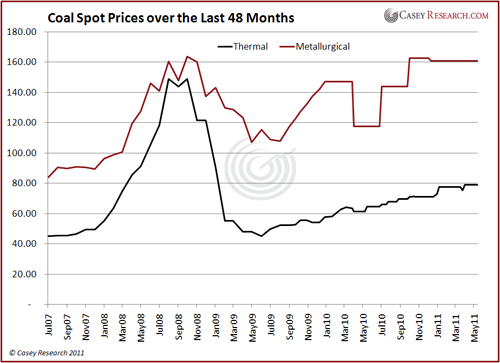

The price spikes in the second half of 2008, which were completely unsustainable and disappeared rapidly in the recession, distort the picture. So instead, imagine the above graph without those peaks. What you get is an almost sustained ascent in the spot prices of thermal and metallurgical coal over the last four years. Metallurgical coal, which is used to make steel and is also known as coking coal, has almost doubled in price, climbing from just above US$80 per ton in mid-2007 to more than US$160 per ton today. Thermal coal, which is burned to generate electricity, has risen from the US$45 per ton range to almost US$80 per ton.

There are a couple of countries that really take notice when coal prices start to rock. Australia is the world's biggest coal exporter and relies on thermal coal for 80% of its electricity. China mines more coal than any other country in the world but still imports more to support its power and steel-making needs – the country mines and burns more than three billion tons of the black stuff annually. And India – where the economy is growing at 8% annually – is facing multimillion ton coal shortages even as it works to halve a 14% peak power deficit within two years.

Let's start with Australia, a country embroiled in a debate over newly introduced carbon taxes. Those taxes are set to come online in mid-2012, ahead of a cap-and-trade system that could begin as early as 2015. Proponents say the tax is necessary to force a coal-reliant country to move toward cleaner energies. However, the tax has drawn widespread criticism from the nation's huge coal industry. Australia supplies 19% of the world's thermal coal and 59% of its coking coal; these industries are worth A$18 million and A$40 million, respectively (2009 numbers). With coal prices expected to keep rising for the next few years at least, Australian coal miners had big expansion plans. Instead, if the carbon tax goes ahead, the industry says it will have to close mines, meaning major tax and job losses for the nation. Opponents of the tax also say it will make Australia's own energy more expensive and less reliable.

Another argument against the tax is that reducing Australia's coal output could in fact increase global carbon emissions, because power stations in China and India would simply use dirtier coal to fill the gap. Australia's thermal coal is perhaps the best in the world, with high energy content and few impurities. Thermal coal from Indonesia has only 70% of the energy value of Australian thermal coal, which means that much more coal would have to be mined, processed, and shipped.

In the context of this very current, heated debate – the Australian coalition government is set to meet this weekend to hammer out the details of the tax – a new report from the Australian Bureau of Agricultural and Resource Economics and Sciences shows that planned investments in the country's mining sector have soared to a record A$173.5 billion. The figure represents development plans for 94 projects, including 35 mineral projects, 35 energy projects, 20 infrastructure projects, and four processing projects. The Bureau estimates A$55.5 billion in mining-industry expenditures in the current year alone.

A fair chunk of these investments will come from coal companies, which have money to spend because the current coal prices are providing record profits. Xstrata, the world's largest exporter of thermal coal, is expected to report an 83% gain in net income this year, according to a Bloomberg compilation of analysts' expectations. Another good example comes from Arch Coal (N.ACI), which recently tendered a $3.4 billion offer for International Coal Group (N.ICO) aimed at creating Australia's second largest metallurgical coal producer.

China is another major coal producer, but there the issue is coal shortages. The country's economy is steaming ahead at a 10% growth rate, and that kind of development requires a lot of steel. This year alone, China is facing a shortfall of 56 million tonnes of metallurgical coal – the country is expected to produce 513 million tonnes, but consumption will reach 569 million tonnes. The Asian giant imported 47 million tonnes in 2010, helped by a 278% increase in imports from Mongolia. And even though domestic coking coal production is expected to increase by 80 million tonnes per year by 2015, China's latest estimates predict a 100-million-tonne annual shortfall in coking coal by 2015.

It is not just coking coal that China needs. Shortfalls in thermal coal supplies are the main culprit in an expected 30-million kW summer power deficit. And the problem is exacerbated by the fact that the country's electricity pricing system has not kept up with coal price increases. Plants sell electricity to the State Grid Corp. of China (SGCC) at a set price, and SGCC then resells to consumers. But the set price has not kept pace with coal prices. As such, coal-fired generators lose money for every ton of coal they burn, which is not exactly an incentive to produce more power. Over the past three years, China's top five state-owned power generating plants have lost some 60 billion yuan, while SGCC posted a 40-billion-yuan profit last year alone.

China is expecting to face its worst power shortage in years this summer. Widespread droughts, which have decimated the country's hydropower capacities, are not helping. As many as 20 provinces and territories have already been put on power rationing, including the country's industrial heartland. Some 44 major industries in Zhejiang (a manufacturing hub near Shanghai) have been told to limit consumption or face prohibitive tariffs. The story is much the same in Guangdong, south China's manufacturing hub. And producing more coal is not an option – the government has acknowledged that China is near its peak coal production capacity.

To continue on a familiar theme, India is also facing an acute coal shortage. In April, for example, the nation imported 32 million tonnes of thermal coal against a total requirement of 36.9 million tonnes. At the end of March, 26 of India's thermal power stations reported having only critical stocks of coal, including ten stations with fewer than four days' worth of fuel. On Monday, the prime minister convened an emergency meeting to discuss the coal shortages, which are expected to total 112 million tonnes over the next 12 months.

India has been working to address the coal void for some time now. Indian firms have been scouring the globe for coal assets, and the effort has secured several major deals: Indian conglomerate Adani is set to buy the 25-million-tonne-per-year coal export terminal as Abbot Point in Queensland, only a year after buying the Galilee coal project in Australia for $2.7 billion; Indian trader Knowledge Infrastructure signed a joint venture deal with Indonesian miner PT OSO International to develop thermal coal mines in Kalimantan; and three Indian firms are among those shortlisted to buy Australian coal explorer Bandanna Energy, a deal expected to top $1 billion.

Coal India, which produces 80% of the country's coal, is not going to be left out of the shopping spree. A few months ago, the company set aside $1.2 billion for overseas buys, specifically in Australia, Indonesia, and the U.S. And it has the money – net income for the first quarter totaled $931 million and full-year profits were up 13%. Shares in Coal India started trading Nov. 4 after the government raised $3.2 billion by selling a 10% stake, in the country's largest public offering to date.

The story could go on, discussing other coal-needy countries like Japan, South Korea, Germany, and so on, but perhaps the point has been made. Global production is maxed out with respect to existing infrastructure, so increases from here can only occur as quickly as new mines, rail lines, and ports can be built. Coal prices have been climbing steadily, based on real supply constraints, and most industry watchers agree that they will hold their ground or continue to climb for the next few years.

Those countries with coal should count their blessings.

[Whether the subject is coal, oil and gas, nuclear, or alternative energy resources, Marin Katusa and the rest of the Casey Research energy team dig deep to find the best power plays to invest in. Test-drive Casey Energy Opportunities for just $39/yr. today and find the best energy investments for prudent investors. Learn more here .]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.