The Global Stocks Bull Market

Stock-Markets / Global Stock Markets Apr 23, 2011 - 02:44 AM GMTBy: Tony_Caldaro

Wild week for most equity markets worldwide. Entering monday’s US opening foreign markets were lower, and then made a bigger drop when S&P downgraded US debt to negative watch. No comment. The US market gapped down at the opening to new pullback lows. By 11:00, however, the selling was over and the market rallied into the end of the week. For the week the SPX/DOW were +1.3%, and the NDX/NAZ were +2.3%. Asian markets gained 0.6%, European markets added 0.7%, the Commodity equity group rose 0.8%, and the DJ World index rallied 1.7%. Bonds were +0.1%, Crude gained 2.1%, Gold made new all time highs +1.2%, and the USD lost 1.1%.

Wild week for most equity markets worldwide. Entering monday’s US opening foreign markets were lower, and then made a bigger drop when S&P downgraded US debt to negative watch. No comment. The US market gapped down at the opening to new pullback lows. By 11:00, however, the selling was over and the market rallied into the end of the week. For the week the SPX/DOW were +1.3%, and the NDX/NAZ were +2.3%. Asian markets gained 0.6%, European markets added 0.7%, the Commodity equity group rose 0.8%, and the DJ World index rallied 1.7%. Bonds were +0.1%, Crude gained 2.1%, Gold made new all time highs +1.2%, and the USD lost 1.1%.

The economic calendar was quite light. Positives outgained negatives by 7:4. On the negative side: the NAHB/FHFA housing indices declined, along with the Philly FED and the M1-multiplier. On the positive side: housing starts, building permits, existing home sales all improved, along with, weekly jobless claims, leading indicators, the WLEI, and the monetary base made a new all time high. This week we have a tue/wed FOMC meeting and Q1 GDP.

LONG TERM: bull market

In global markets bull and bear equity stock markets rarely occur in isolation. Growth in some countries is usually not enough to drive equity prices higher in those countries unless there is a worldwide growing optimism. In example, China and India’s economies continued to grow throughout the 2007 to 2009 worldwide bear market. Their economic growth certainly did not prevent major declines in their stock markets. Therefore, for one to take a bullish or bearish stance in one equity market generally requires the observation of the same activity in many equity markets worldwide.

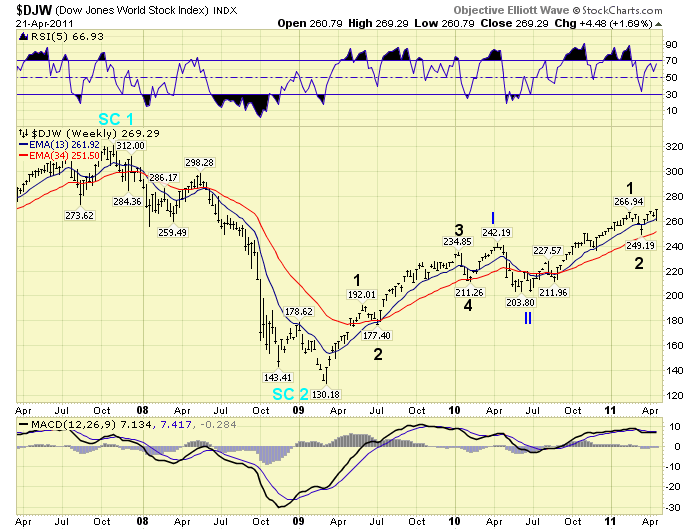

The Dow Jones World index provides a view of the entire global equity market by tracking the highest capitalization stocks in the world. Observe the bear market from 2007 – 2009. Then the current bull market from the March 2009 low at 130 in the index. Recently Major wave 3 of Primary III kicked off, and this index is now making new bull market highs.

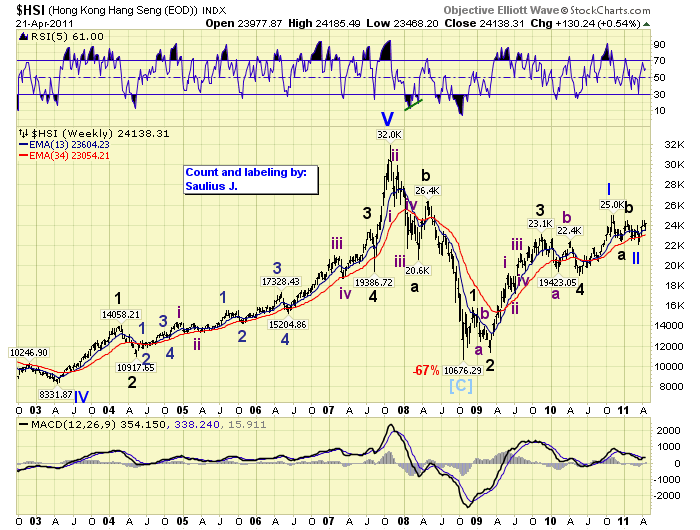

In our daily review of the overnight market activity we refer to Asia, Europe, and then the US. We track several markets in each region and many indices in the US. However, our bellwether indices for each region are the following. In Asia, Hong Kong’s HSI:

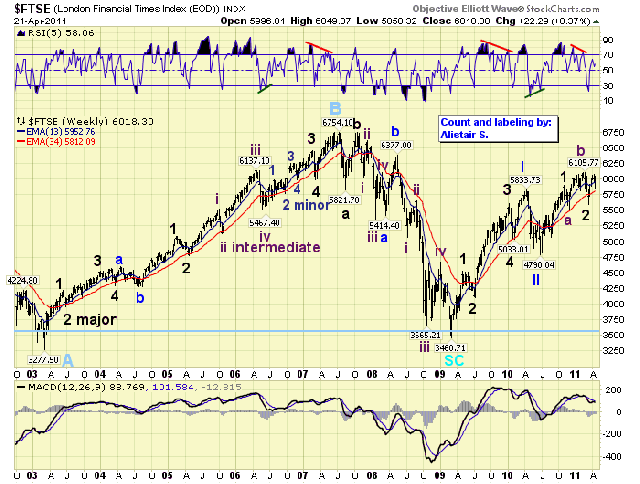

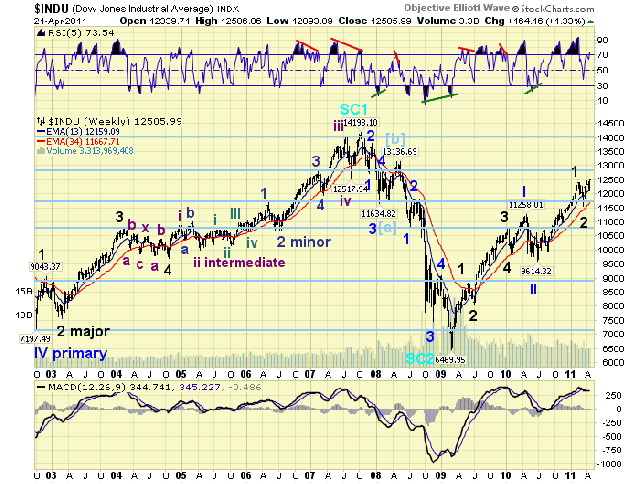

In Europe England’s FTSE, and in the US the DOW.

Notice the wave patterns of all three of these bellwether indices were decidedly bearish during the bear market, and are decidedly bullish now. The DOW, in fact, has the same exact wave structure as the DJW. Bull and bear equity markets rarely occur in isolation.

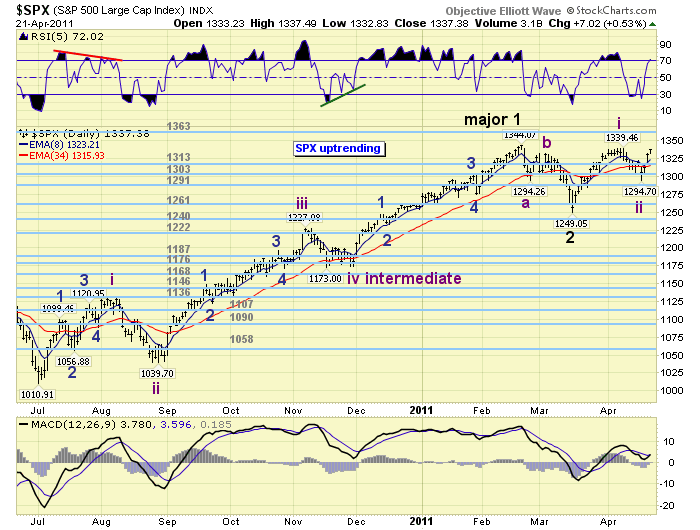

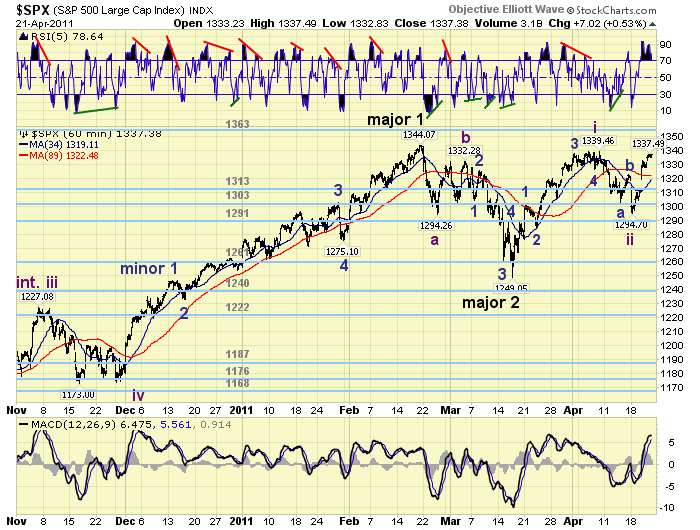

MEDIUM TERM: uptrend high SPX 1339

Remaining with our global theme. In our weekend update, and sometimes during the week, we note the trend confirmations in the various worldwide indices we track. A few indices may take the lead during one trend, while others lead during another. Generally, it’s the overall trend movement that we track. Currently 11 of the 15 world indices we track are in confirmed uptrends. This is bullish worldwide.

The current uptrend started at the Major wave 2 low of SPX 1249 in March. This uptrend, Major wave 3, should unfold in five Intermediate waves. Intermediate wave one ended at SPX 1339 in early April, and Intermediate wave two appears to have completed this past monday at SPX 1295. Nearly a perfect 50% retracement. Intermediate wave three should be underway now. Overall, we’re expecting this uptrend to end in June between SPX 1440 and 1462. The SPX closed at 1337 this week.

SHORT TERM

Support for the SPX remains at 1313 and then 1303, with resistance at 1363 and then 1372. Short term momentum ended the week quite overbought. Last weekend it appeared that Intermediate wave two had completed at SPX 1302 and the market was rallying. On monday the entire rally was wiped out on a gap down, the SPX made a new pullback low at 1295, and then the market rallied again. The final pattern looks a bit more complex, but still an ABC down from SPX 1339. Nevertheless, the action off monday’s low has been quite constructive with two gap up openings and a 42 spx point, (3.2%), rally in just three trading days. Short term support is at SPX 1324 and then the 1313 and 1303 pivots. Resistance is at 1339/1344 and then the 1363 and 1372 pivots. Expecting new bull market highs next week. Best to your trading!

FOREIGN MARKETS

Asian markets were mostly higher on the week for a net gain of 0.6%. Only Japan’s NIKK has not confirmed an uptrend.

European markets were all higher on the week for a net gain of 0.7%. The Swiss SMI and the STOX 50 remain unconfirmed as well.

The Commodity equity group were all higher on the week for a net gain of 0.8%. Brazil’s BVSP confirmed a downtrend during the recent pullback.

The DJ World index remains uptrending and gained 1.7% on the week.

COMMODITIES

Bonds remain in their 3+ year trading range and were +0.1% on the week. Since 2008 10YR yields have remained between 2.04% and 4.32%. We do not see this changing for several more years.

Crude gained 2.1% on the week as its uptrend continues.

Gold gained 1.2% for the week, hitting $1500, as its uptrend continues. Silver’s (+8.4%) weekly chart looks parabolic, but it’s daily chart look fine.

The USD made a new yearly low losing 1.1% on the week and dropping below 74.0 DXY. Next support is at 71.31.

NEXT WEEK

Busy week ahead. Monday at 10:00 New homes sales. Then on tuesday Case-Shiller, Consumer confidence and the FED starts its two day FOMC meeting. On wednesday Durable goods orders, then the FOMC statement in the afternoon. Then on thursday Q1 GDP, weekly Jobless claims and Pending home sales. On friday, Personal income/spending, PCE prices, the Chicago PMI and Consumer sentiment. The FED has two speeches scheduled after the FOMC meeting. On thursday FED governor Duke gives a speech at a FED conference in Va. Then on friday FED chairman Bernanke gives a speech at the same conference. Best to your holiday weekend and week.

CHARTS: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID1606987

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.