Currency Trading Update, Yen is the Pick to Short

Currencies / Japanese Yen Feb 14, 2011 - 04:33 AM GMTBy: Justin_John

YEN and Nikkei Trade: Where is YEN going?

YEN and Nikkei Trade: Where is YEN going?

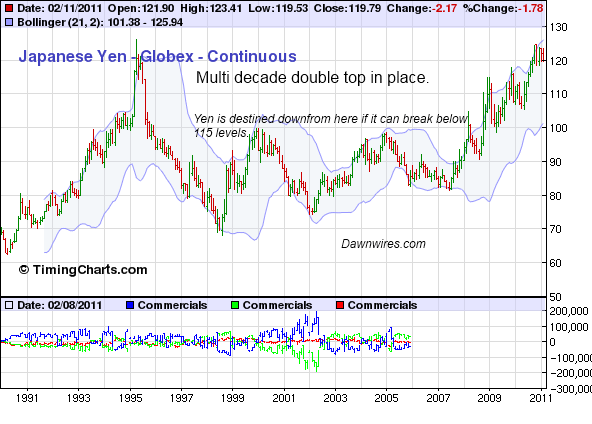

Yen is at 120 levels which represent a multi decade high. There are very few things out there which are hitting a multi decade tops. Yen was 120 levels in 1995 after which it took a wild swing down to hit a bottom at 1998. After nearly 9 years of consolidation, YEN broke out and ran away to 120 levels in the last 4 years. It has been an extraordinary run, one which has confused many. Bill Gross has been on record saying that Japan is worthless piece of crap. Yen needs to be shorted against every high yielding currency.

The arguments against YEN has been pretty much obvious, isnt it? That may just have been thr problem with YEN short trade not working.

Debt levels at 196% of GDP, highest for any country in the world.

The only country to be officially in deflation for 18 years depending on what you call deflation. If deflation means price stability or marginal fall (inc real estate), then sure Japan has been in deflation.

Debt yields at 0-0.5% even on long term debt reflecting safety and deflation concerns.

A central bank who is always ready to act if YEN acts up.

Yet with all those arguments, we have the currency strengthening for over 4 years now. Why? Well traders may just have been looking at wrong parameters to judge YEN. The arguments for YEn are while hidden are pretty obvious to hedge funds who have been stacking it up for over 2 years to benefit 50% returns in the last 12 months. Some of them still have not taken profits which forces you to think whether YEN short is good idea or not. SO why has YEN strengthened:

Strong Technicals aided by an extremely crowded short trade purported by hedge funds who have continuously spoken against owning YEN including PIMCO. Rating agencies have not done good either by down grading Japanese economy.

Japan has a trade surplus which is only beaten by China. Japanese make some awesome products which are still in demand irrespective of its price. Its exports to US has only grown in the last 24 months while with China it has bypassed multi year highs.

China bought YEN bonds in July 2010 allowing for YEN appreciation. Chinese took YEN bonds to faciliate and earn from the exports that Japan made to China. It was a beautiful hedge trade for the Chinese. When China enters the market, not too many shorts can stand against it not even BoJ. BoJ intervened in the market in 2010 to depreciated YEN. $25 Billion wasted for 150 pips all of which was gone in 2 weeks time as YEN cam back to 83 levels before plummeting to 80 levels to a dollar by Nov 2010.

Japan may just be showing signs of coming of deflation. As impossible as that may sound even with the latest GDP numbers indicating capex expansion and consumer growth

DB writes that recovery in Japan is sure.

Surprisingly, despite the 0.7% QoQ fall in real private consumption in 4Q (Oct-Dec) 2010, consumer durables did rise 3.1% QoQ, equivalent to a 0.55%point contribution to private consumption. The majority of the fall in consumption came from non-durables goods (-3.6%QoQ fall, or -0.86%point contribution to private consumption). This suggests that the expansion in private consumption in 3Q (Jul- Sep) was attributable to the last-minute purchases of autos (with the peak month in August) and that the negative payback in autos in 4Q (Oct-Dec) has been more than fully offset by an even larger last-minute purchases of flat-screen TVs (with the peak month in November). While some may anticipate another round of lastminute flat-screen TV purchases in March 2011 when the eco-point program terminates, we believe the majority of the front-loading ended by November 2010. We should note the possibility that the negative payback in the flat-screen TVs in 1Q 2011 could be larger than that in the autos, which could bring private consumption down further. That said, we are well aware of the brighter prospect of the global economic expansion gathering momentum. Our US economics team has revised up their real GDP growth for 2011 to 4.3%. As such, we believe 1Q 2011 is likely to point to more concrete signs of an export-led recovery for Japan, despite another contraction in private consumption.

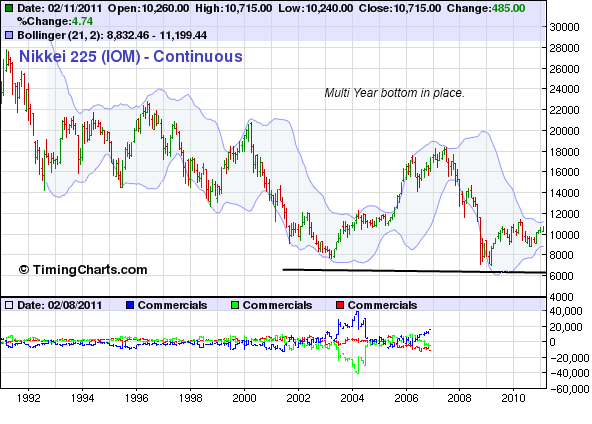

Given the positive GDP numbers in Japan, we are now moving to bullish view of Nikkei which may be setting itself for a major multi decade bottom which coincides with the view on YEN.

Nikkei charts:

Aligning those charts with YEN, we are in for a massive double pair trade which could make many of you millionaires with very little downside. Long Nikkei and short YEN to EUR is the trade to go for 2011.

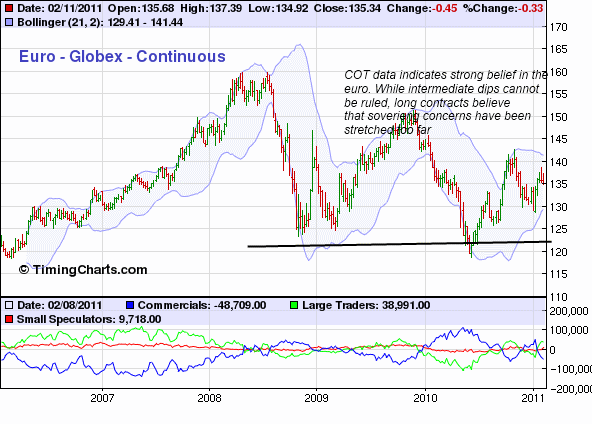

Mad Hedge Fund Trader, John Thomas believes one of his pick trade for 2011 is the short YEN trade. We go one step further and short the YEN against an equally hated currency, EUR. We believe EU Yields will ultimately pull EURO out 1.30′s range to the dollar and hence also pull it to the YEN to the 135 levels in 2011.

We also do a quick update on yield differences between German 10 year bunds and Japanese 10 year JGBs which has a strong and direct correlation to EUR/JPY over the medium term.

EUR/JPY will catch with yields at some point but in the short term one needs to see further signs to place a bet here. Nikkei needs to break out while we need some statement from BoJ about maintaining it dovish stance even with recovery strengthening. We will be on the look out but 115 on eur/jpy is the holy grail of going long on EUR/JPY for a target of 135 in 2011.

Given the downside, one may just be forced to wonder is this is wonder trade of Hugh Hendry, which has a downside of mere 2% while an upside of 75%?

EURO: Yield vs Soverign concerns

EURO has been on a mystery rise from the lows of May 2010 on a continuous rise which has been ably supported by 2 Year yields springing to 1.4% from a docile 0.8% in Oct 2010. Inflation concerns have returned to haunt the ever hawkish ECB which for the moment though has dismissed the concerns as short term effects. Bond markets are not ready to believe that and hence yields have once again risen to 1.45%. Rise above 1.5% will be fatal for low yield currencies like YEN as EUR/JPY could spring to 118 levels in a few hours time given the YEN leveraged trade that exists in the market today.

Strong COT long contracts and high yields have allwoed EURO to stay strong even with negativity relating to soverign concerns surrounding it.

ECB buying bonds have put in a sure floor within the EURO shorts.

China apparent relationship with EU has forged new strength for EURO longs.

And yet there are risks and dark spots which continue to stop people from taking an outright position. That is why we believe, that EURO is on a bull run given the skeptical environment around it.

Source: http://dawnwires.com/uncategorized/...

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2010 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.