Asian Stock Markets Expected to Trend Lower Into November

Stock-Markets / Global Stock Markets Oct 21, 2007 - 10:05 PM GMTBy: Nadeem_Walayat

I am taking a break from the regular look at the US and UK Stock Markets by evaluating the immediate term outlook for the major asian markets. All of the asian markets have rebounded from the August lows, some more strongly than others. The anticipated October seasonal weakness across the global stock markets continues. The seasonal weakness looks set to impact the asian markets into early November with clear signs of sell signals on many markets. Fridays plunge on Wall Street is also expected to nudge those waiting for a sell trigger into the red zone on Monday.

I am taking a break from the regular look at the US and UK Stock Markets by evaluating the immediate term outlook for the major asian markets. All of the asian markets have rebounded from the August lows, some more strongly than others. The anticipated October seasonal weakness across the global stock markets continues. The seasonal weakness looks set to impact the asian markets into early November with clear signs of sell signals on many markets. Fridays plunge on Wall Street is also expected to nudge those waiting for a sell trigger into the red zone on Monday.

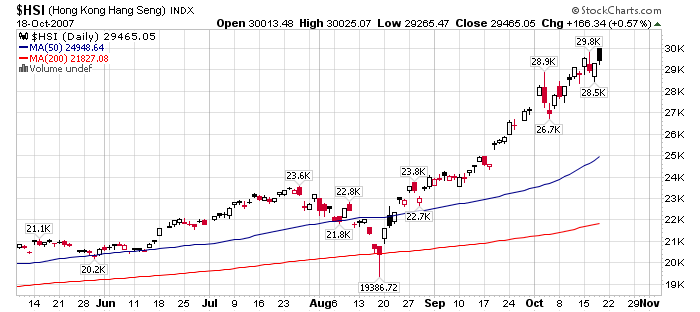

Hong Kong - Hang Seng Index

The Hong Kong market continues to be supported by the flood of chinese money due to recent investment rule changes for retail investors. This is expected over the coming year to result in a trend towards equalization of valuations between the Chinese and Hong Kong Markets which suggests that Hong Kong will continue to perform strongly and be supported during general market declines.

The Hong Kong index is overbought in the immediate term, but so far there has been no price trigger to suggest an imminent downward trend, which suggests a consolidating trend, with immediate support at 28,500, however an assault on this would be expected to break to target stronger support at 26,700.

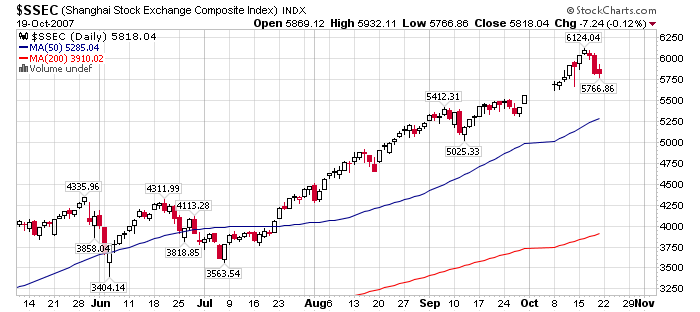

China - Shanghai Index

China's stock market is a bubble waiting to burst. Plain and Simple ! When is it going to burst ? The recent peak was 6124 with the market down just recently to 5766. Is this the bubble finally bursting ? Its like asking when the Nasdaq Tek bubble would burst. What is clear the market is showing near-term weakness. Targeting a downtrend to between 5000 and 5400.

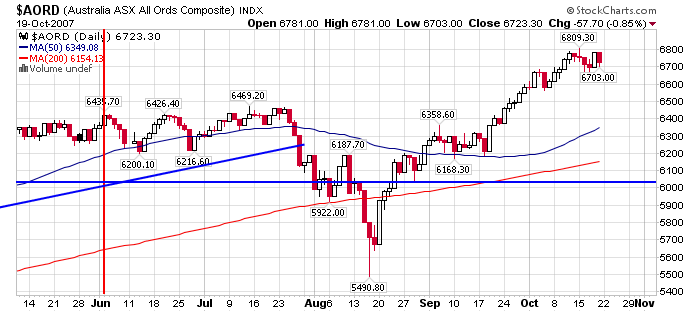

Australia ASX All Ordinaries

The Australian market peaked at 6809 and is targeting a downtrend to between 6550 and 6500. The nearest confirming price trigger is 6703.

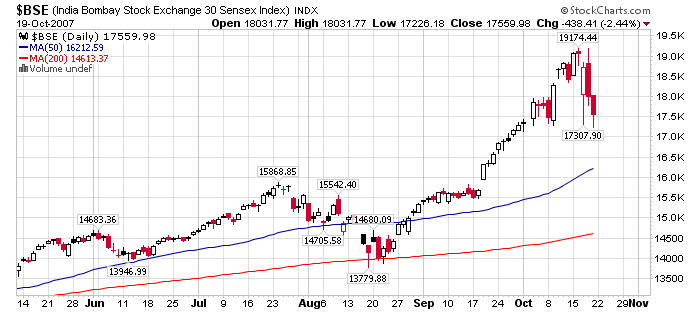

India - Bombay Stock Exchange Index

The Indian market had a sharp sell off on announcement of the possible introduction of capital controls. It looks like the Indians did not learn from Thailand's earlier experience during late 2006 announcements which resulted in similar large sell offs. The Indian market also looks set to correct lower over the coming few weeks, targeting a move to between 15,750 and 16000. Which would represent a strong 18% retracement from the high.

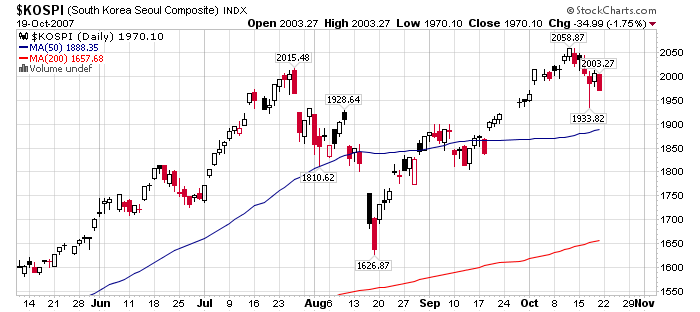

South Korea - KOSPI Index

The KOSPI has struggled to break the previous peak of 2015, and after doing so fell back below the peak. This suggests weakness, and therefore the KOSPI could suffer a much sharper decline going forward, which could see the KOSPI decline back down towards 1750, a good 12% lower.

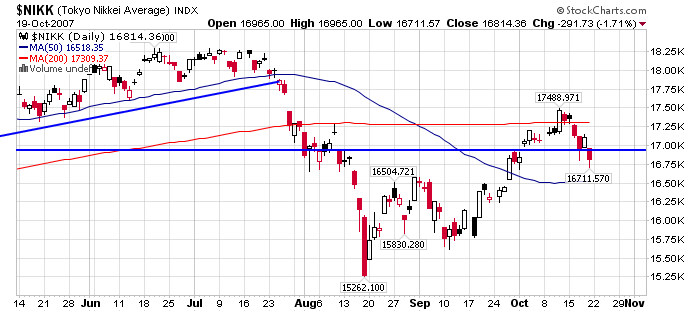

Japan - Nikkei 225

Japan is clearly the weakest of all major Asian stock markets, the recent rally to 17488 failed to recover the August losses due to the credit crunch. The action since clearly resembles a B wave corrective rally and thus suggests a stronger impulse wave lower. The risk is that the Nikkei will break 15,262. However the initial target is for a downtrend to 15,800, which would represent a 10% drop from the recent high. But it is definitely not looking good for the Nikkei's longer term prospects due to the proximity to the 15262 low.

Conclusion

With the exception of Hong Kong, All asian markets have already given sell signals. Friday's sharp fall on Wall street Friday will likely trigger a fall in Hong Kong to bring that market inline. All of the markets look set to trend lower into early November with the risk that Japan's market could break major support that could result in a more severe decline further out that is not reflected in the stock charts of other asian markets at this time. Also still waiting for the chinese bubble to burst, maybe this time ?

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of analysing and trading the financial markets and is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.