WSJ Under Reports New Jersey Pensions Deficit as $54 Billion, Actual is $174 Billion

Interest-Rates / US Debt Dec 24, 2010 - 10:13 AM GMTBy: Mike_Shedlock

The Wall Street Journal reports New Jersey Pension Gap Hits $54 Billion.

The Wall Street Journal reports New Jersey Pension Gap Hits $54 Billion.

New Jersey’s pension gap grew to $53.9 billion in the last fiscal year, up from $45.8 billion, thanks to market losses and a lack of state funding, according to figures released Thursday.

Gov. Chris Christie’s administration said the gap, which reflected the state’s investment positions as of June 30, highlighted the need for proposed cuts to current public workers’ pensions. The $53.9 billion figure reflects the difference between the retirement benefits the state has promised to roughly 780,000 state and local workers over the next few decades and the amount on hand to pay those benefits.

In addition, an accounting practice called “smoothing” allows the state to factor market gains and losses over several years — meaning pension funds, on paper, are still feeling the effect of the 2008 market crash.

Christie, a Republican, wants to reverse a 9% pension bump workers received in 2001 under a Republican administration. Unions argue their members have an irrevocable right to benefits they have earned. The governor has challenged the unions to meet him in court.

Actual Deficit Much Higher

There are at least two problems with that $54 billion number.

1. It allows smoothing

2. Plan assumptions expect average annual returns of 8.25%.

I highly doubt pensions return 8.25% total (let alone annual) over the next 5 years.

10-year treasury yields are a mere 3.4%. To get higher returns, requires higher risk. History shows how well that idea has worked out for the last 10 years. There is no reason to assume the next 10 years will be any different.

In fact, given stretched valuations and overly optimist earnings estimates, there is every reason to suspect the next 5 years will be worse.

New Jersey Pension Funding

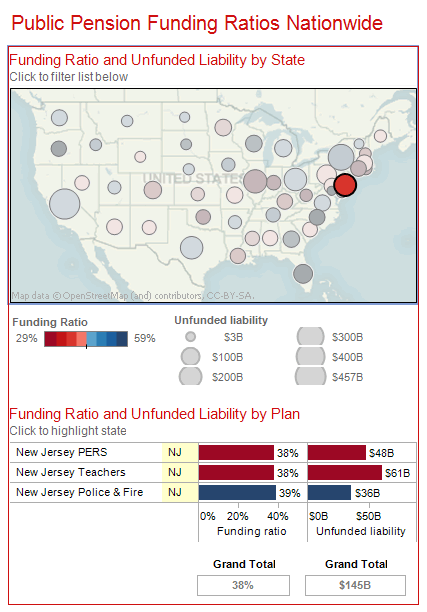

Here is a look at New Jersey pension funding from Interactive Map of Public Pension Plans; How Badly Underfunded are the Plans in Your State?

New Jersey Subtotals

PERS - $48 Billion

Teachers - $61 Billion

Police and Fire - $36 Billion

Those subtotals net to a combined $145 billion. They are from March 2010 so there has likely been some improvement since then. However, those totals do not include all of the state pension plans nor any deficits in city or county pension plans.

The interactive map and those subtotals are based on data from Calculating the Market Price of Public Sector Pension Liabilities, by Andrew Biggs at the American Enterprise Institute.

The American Enterprise Institute report is quite detailed. However, it only includes 3 of 7 New Jersey defined benefit pension plans.

New Jersey Defined Benefit Plans

- Teacher's Pension Annuity Fund (TPAF)

- Public Employees Retirement Fund (PERS),

- Police and Firemen's Retirement System (PFRS)

- State Police Retirement System (SPRS)

- Judicial Retirement System (JRS)

There are two existing defined benefit plans closed to current workers, the Consolidated Police and Firemen's Pension Fund (CPFPF), and the Prison Officer's Pension Fund (POPF).

Thus, New Jersey's liability is hugely understated, even at $145 billion.

Crisis in Public Sector Pension Plans

Please consider Crisis in Public Sector Pension Plans by George Mason University.

Pension plans operated by state governments on behalf of their employees are underfunded by an estimated $452 billion according to official reports, with total liabilities of $2.8 trillion and total assets of $2.3 trillion in 2008. However, many economists argue that even these daunting liabilities are understated. Current public sector accounting methods allow plans to assume they can earn high investment returns without any risk. Using methods that are required for private sector pensions, which value pension liabilities according to likelihood of payment rather than the return expected on pension assets, total liabilities amount to $5.2 trillion and the unfunded liability rises to $3 trillion. The ability of governments to pay for the retirement benefits promised to public sector workers runs up against the reality of limited resources.

The state reports that its pension systems are underfunded by $44.7 billion, when liabilities are discounted at the 8.25 percent annual return that New Jersey predicts it can achieve on funds' investment portfolios.

However, when plan liabilities are calculated in a manner consistent with private sector accounting requirements, methods that economists almost universally agree are more appropriate, New Jersey's unfunded benefit obligation rises to $173.9 billion. This amount is equivalent to 44 percent of the state's current GDP8 and 328 percent of its current explicit government debt. This calculation applies a discount rate of 3.5 percent (the yield on Treasury bonds with a maturity of 15 years) to reflect the nearly risk-free nature of accrued benefits for workers. It is estimated if state pension assets average a return of 8 percent, New Jersey will run out of funds to meet its pension obligations in 2019. If asset returns are lower than 8 percent, they will run out of funds sooner. State actuaries estimate that under certain assumptions, New Jersey's pension plans will run out of assets to make benefit payments beginning in 2013.

Governor Chris Christie signed legislation on March 22, 2010 to reduce the size of the unfunded liability. These measures include capping payments for unused sick days, banning part-time workers from receiving pensions, and requiring government workers to contribute 1.5 percent of their salaries toward health care. Legislation also adjusted the formula used to calculate benefits, returning to the pre-2001 formula where benefits equalled 1.7 percent of final salary times number of years of service, versus 1.8 percent of final salary in the TPAF and PERS plans. Also, members of these plans would have their retirement allowance calculated based on the final five years of service, instead of the final three. However, these changes to benefits would apply only to newly-hired public employees. Current workers, even those who recently entered the job rolls, would be able to continue under the current benefit formula for the rest of their careers.

These measures will help at the margins but do little or nothing to address the size of the liability that has already been accrued. The rate of accrual of benefits will have to be reduced further, and employees will have to contribute more to their plans. The state must recognize that adding more workers to a system that is underfunded by $173 billion by market standards, representing over 40 percent of New Jersey's GDP, is not a tenable option.

The report cites Calculating the Market Price of Public Sector Pension Liabilities, the same study used to create the interactive map.

Report Recommendations

- Reduce benefits for newly-hired public employees

- All newly hired employees should be shifted to a defined contribution pension model based upon the plan already offered to New Jersey's university employees

- Current reforms lowering pension replacement rates should be continued and, if possible, extended to current employees. All vested benefits should be honored, but the rate at which future benefits are earned should be reduced.

- Current employees who are not yet vested in their benefits might be shifted along with newly hired employees to a defined contribution plan. This step could produce savings to existing DB plans while moving more quickly to a sustainable pension model for public employees.

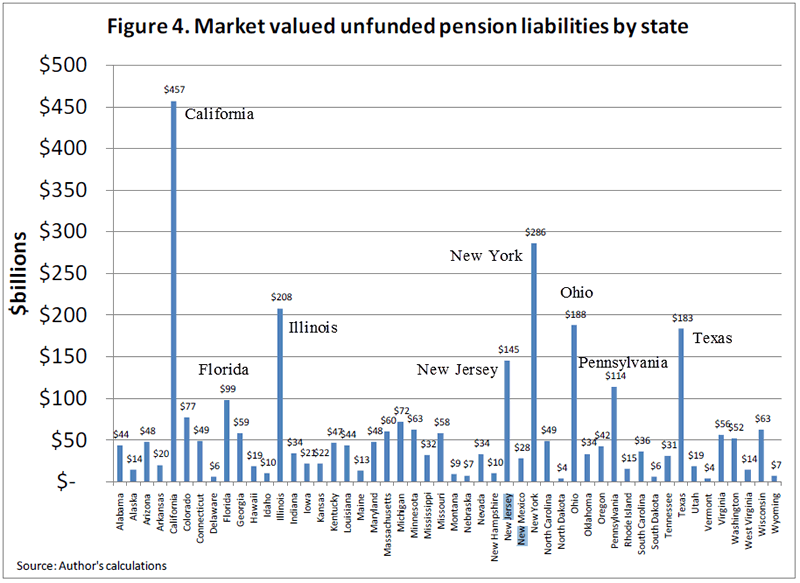

Here is a look at liabilities state by state.

Unfunded Liabilities by State

California is the worst state in absolute terms. In per capita terms, Illinois appears to be in the worst shape. However that statement does not factor in all of New Jersey's pension plans. Then again, the Biggs report does not include all of Illinois' public pension plans either. The mess everywhere is far bigger than it looks.

Pension Apartheid Doesn't Work

Unions are screaming about an Irrevocable Right to Benefits. Leo Kolivakis at Pension Pulse sums up the situation nicely.

State governments have little choice but to raise the retirement age, cut benefits, and partially or fully remove inflation protection of public sector pensions. They should also revise their rosy investment assumptions for state plans.

This may seem unfair and unreasonable to public sector workers, but to quote a strategist who I spoke with yesterday, "deleveraging sucks". You can't have pensions apartheid between the private and public sector. And there are no "irrevocable rights to benefits". Just look at the mess Greece and Ireland are in right now. When the money runs out, cuts are guaranteed.Yes indeed. Not only do Greece and Ireland prove it, but so does Prichard, Alabama the first city in the country to default on pensions. Please see Alabama Town Defaults on Pensions, Breaks State Law; Renewed Calls For San Diego Bankruptcy; "Prichard is the Future" for details.

Click Here To Scroll Thru My Recent Post ListBy Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.